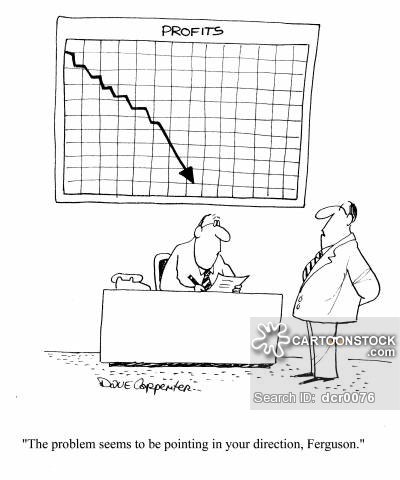

Sodding greedy clusterfucks at Ruby River Capital LLC (U.S.-based owner of GNL Québec Inc.) and Osler in Calgary, you’re way out of line with your $20 Billion in lost profits demand.

Frac’ing loses money. It loses lots of money, notably for stupid investors. It’s not Canadians’ fault (or the BAPE or gov’ts) that investors and Liquid unNatural-frac’d Gas (LNG) companies refuse to learn from their repeat money losing mistakes.

1982 LNG bomb cartoon in Vancouver Sun

LNG is frac’d gas. LNG is a massive money losing polluter, and seems to only make money if billions in “subsidies” are stolen from the people by politicians feeding companies like you.

Germany is reportedly over loaded with stored LNG. Greed has its limit. How the hell do think you would sell your LNG?

Non fossil fuel (aka non rape & pillage) energy projects put your caveman frac’d gas project to shame, environmentally, socially, culturally and economically.

But lucky you, you know investor courts/panels/judges are especially picked to serve dubious companies like you and your investors, against the global environment and citizenry, even when the judges/panel/experts know you are grossly over fantasizing future profits to distract from the billions in losses fossil fuels are farting on investors.

Fortunately, a few judges picked to serve polluters are starting to face reality.

And, Canada’s money pit:

Hey Ruby et al! How much money have you speculated your investors ought to have provided the tens of thousands of Canadians forced from their homes and businesses in Canada because of fossil fuel industry caused climate change and industry’s leaking flammable gases fuelling wild fires?

How much money have you speculated your investors need to send to help pay for the many firefighters from around the world trying to save communities currently under siege, worsening annually because of the insatiable greed and lies by companies like yours wanting to profit off of destroying earth’s livable climate? How much money needs to be speculated to cover your share to help pay for the helicopters and other machinery?

May 23, 2023: Make sure to listen to the bit on the massive Fox Creek Fire (frac central) where thousands remain under mandatory evacuation, starts at around 18 Min:

***

Dear Ruby, Osler et al,

How much compensation would you owe Canadians for atmospheric appropriation if your Énergie Saguenay LNG project had proceeded?

Compensation for atmospheric appropriation by Andrew L. Fanning & Jason Hickel, June 5, 2003, Nature Sustainability

Abstract

Research on carbon inequalities shows that some countries are overshooting their fair share of the remaining carbon budget and hold disproportionate responsibility for climate breakdown. Scholars argue that overshooting countries owe compensation or reparations to undershooting countries for atmospheric appropriation and climate-related damages. Here we develop a procedure to quantify the level of compensation owed in a ‘net zero’ scenario where all countries decarbonize by 2050, using carbon prices from IPCC scenarios that limit global warming to 1.5 °C and tracking cumulative emissions from 1960 across 168 countries. We find that even in this ambitious scenario, the global North would overshoot its collective equality-based share of the 1.5 °C carbon budget by a factor of three, appropriating half of the global South’s share in the process.

We calculate that compensation of US$192 trillion would be owed to the undershooting countries of the global South for the appropriation of their atmospheric fair shares by 2050, with an average disbursement to those countries of US$940 per capita per year. We also examine countries’ overshoot of equality-based shares of 350 ppm and 2 °C carbon budgets and quantify the level of compensation owed using earlier and later starting years (1850 and 1992) for comparison.

***

Look out Ruby et al!

Global youth will not bend over cowardly, selfishly and greedily like Canadian white men of old. They’re coming for you and yours and they are relentless and have truth and science on their side. You only have law and dirty judges on your side (which are getting older and older and fast dying off).

![]()

![]()

![]()

Blake Shaffer @bcshaffer:

Plan for 1400MW of solar across several sites in southern AB. More than the entire solar capacity in the province right now (around 1100MW).

Greek company Mytilineos to launch Canada’s largest solar farm in Alberta – The Globe and Mail

Greek company Mytilineos opens Canada’s largest solar park in Alberta by Fried Warner, May 31, 2023 Gerona originally in the Globe and Mail with this headline on the front page: Greek company Mytilineos to launch Canada’s largest solar farm in Alberta, The Greek company feels more comfortable investing in Canada than in the U.S. its CEO says by Eric Reguly

One of Greece’s leading industrial and energy companies is launching a $1.7 billion solar power project in Alberta, which it says will be the largest of its kind in Canada.

According to Mytilineos SA, the investment actually consists of five projects, two of which are approaching the “ready to build” phase and are expected to receive regulatory approvals shortly, allowing construction to begin later this year. All five projects are expected to be fully operational by the end of 2026.

When completed, the entire project will have a capacity of 1.4 gigawatts, enough to power 200,000 homes.

“This is our first investment in Canada,” said Evangelos Mytilineos, the company’s chairman and CEO, in an interview in Athens. “Business conditions in Canada are generally good and we feel more comfortable there than in the United States. Canada feels more like Europe to us.”

The project will be built on separate lots in southern Alberta, one of Canada’s sunniest regions and home to many of the nation’s largest solar farms, including Greengate Power’s giant Travers solar project, which began commercial operation last November.

Founded in 1990, Mytilineos grew from a family-run metallurgical company that opened in 1908. The company is listed on the Athens Stock Exchange and operates in two main business areas: metallurgy and power generation. It employs around 5,500 people.

The company owns one of Europe’s largest aluminum refineries, which it bought from Canadian Alcan (now Rio Tinto Alcan) in 2004. On the energy side, the company operates natural gas-fired plants in Greece, trades gas and builds renewable energy projects with offices in more than 30 countries.

Fairfax Financial Holdings Ltd. of Toronto is behind Mytilineos. led by Prem Watsa, which first bought into the Greek company in 2012 and has since increased its stake to 4.7 percent. This makes it the second largest shareholder after Mr Mytilineos, who owns 27 percent. Fairfax has the option to increase its stake to 6.4 percent.

After a year-long price increase of almost 75 percent, Mytilineos has a market value of 4.2 billion euros. In the first quarter, the company reported a doubling of net profit to 143 million euros on sales of almost 1.4 billion euros.

Mr Mytilineos, 69, said North America is attracting global energy investment because the United States and Canada have made the green transition a priority. The US Inflation Reduction Act, enacted by President Joe Biden last year, will allocate hundreds of billions of dollars to energy security and combating climate change.

Canada has responded with measures to accelerate the transition to net-zero emissions. Last fall, the federal government announced the tax credit for clean technology investments. Alberta has adopted its own incentives, such as the Renewable Electricity Program, which offers long-term government contracts to renewable energy producers.

According to Canada’s Energy Regulatory Agency, fossil fuels account for nearly 90 percent of Alberta’s electricity generation. The province is under pressure to lower that percentage as Ottawa strives to reach the statutory net-zero emissions target by 2050.

Mr Mytilineos said the Alberta solar project could choose between a five-year tax deferral or a subsidy covering 30 percent of capital expenditures.

The Company’s Alberta solar farms will be located near the towns and hamlets of Georgetown, Sunnynook, Dolcy, Eastervale and Red Willow. The Sunnynook farm will be the largest with a capacity of 332 megawatts; the others will have an output of 246 to 280 megawatts.

The company could eventually add battery storage to the projects, although Mr Mytilineos said the technology wasn’t advanced enough to jump on the idea (one of his projects in the UK involves battery storage technology).

He also said the company is considering building an aluminum plant somewhere in Canada or the US, where industrial energy is far cheaper than in Europe. Aluminum smelters consume enormous amounts of energy and can become uneconomic when electricity prices rise, as has happened in Europe since the start of the war in Ukraine 15 months ago.

Mytilineos’ investment marks a new phase in Greek industry. A decade ago, the country was effectively bankrupt and on the verge of leaving the eurozone. The austerity programs demanded in return for bailouts overseen by the troika – the European Central Bank, the European Commission and the International Monetary Fund – plunged Greece into an economic depression, crippling many employers and squashing their investment plans.

Today Greece is one of the fastest growing economies in the European Union and some Greek companies are expanding abroad. Mr Mytilineos said he was “proud” to make a significant Greek investment in Canada.

![]()

![]()

![]()

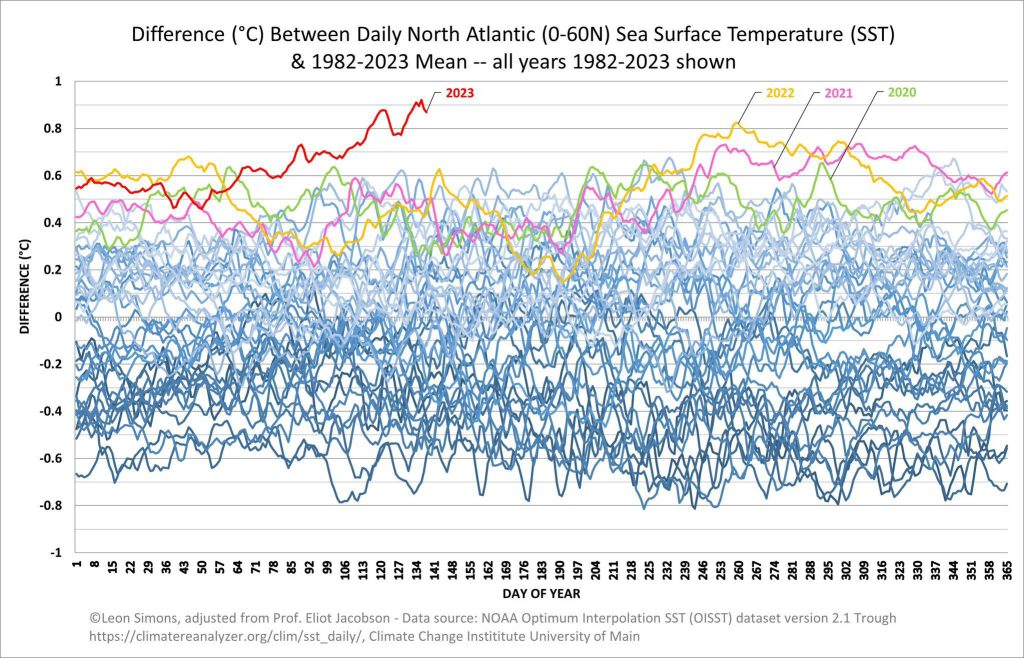

Michael Thomas@curious_founder May 23, 2023:

In 2010, the International Energy Agency (IEA) projected that the world would generate 630 TWh of electricity from solar in 2035.

Last year, the world generated 2x more than that.

![]() Ruby et al, have you calculated the losses in your speculated out to lunch “profits” because of fossil fuels going down?

Ruby et al, have you calculated the losses in your speculated out to lunch “profits” because of fossil fuels going down?![]()

Shale Drillers Are Auctioning Off Rigs at Bargain Basement Prices by Alex Kimani, May 17, 2023, Oilprice

- FT: oil drilling equipment is being auctioned off due to lack of demand.

- According to Baker Hughes data, U.S. oil and natural gas rig count has declined 6% in the year-to-date to 731 last week.

- Especially the dropoff in natural gas drilling has surprised analysts.

The much-touted second shale boom has lately been getting a reality check as equipment demand declines sharply, a worrying sign that drilling in U.S. shale energy regions is leveling off.

The Financial Times has reported that next week, Texas auctioneer Kruse Asset Management will auction off two unused, top-of-the-line drilling rigs valued at $40 million and $30 million when built in 2019 at starting bids of just $12.9M and $2.3M, respectively.

“There’s no reason for them to be so cheap, but there’s just no demand,” Dan Kruse, chief executive of Kruse Asset Management, has told the Financial Times.

According to Baker Hughes data, U.S. oil and natural gas rig count has declined 6% in the year-to-date to 731 last week, reversing a steady climb since the depths of the pandemic. The current tally is a far cry from the nearly 2,000 rigs that were running around mid-2014 at the peak of the shale boom. Last week, rig count for gas-directed rigs dropped by 16, or 10 per cent–the steepest weekly fall since 2016. Expectations for another shale boom are getting tamped down due to rising costs as well as limited supplies of labor and equipment that continue to hamstring efforts by U.S. shale producers to quickly ramp up production.

Still, a number of experts have predicted that U.S. production will continue growing. A week ago, the Energy Information Administration (EIA) forecast U.S. crude production will rise about 5% in 2023, while fuel demand will increase 1%.

U.S. crude oil exports for the month of April surpassed forecasts, hitting a record 4.5 million barrels per day in March thanks to a strong Chinese market due to rising fuel demand. U.S. crude exports grew 22% last year from 2021 after Russia’s invasion of Ukraine led the U.S., the EU and Canada to ban imports of Russian oil and dramatically altered global flows.

China is the world’s second largest oil consumer, and has recorded an economic resurgence ever since it rolled back its strict zero-covid policies. April exports to China surged to ~850,000 barrels per day, the highest level since May 2020.

Catch-22: Canada’s attempts to phase out fossil fuel might result in it paying the polluters by Kyla Tienhaara, Canada Research Chair in Economy and Environment, Queen’s University, Ontario, May 22, 2023, Yahoo News

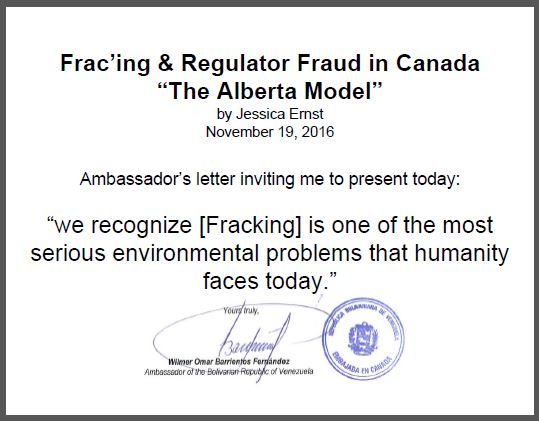

US$20 billion: That’s how much American investors think Canadian taxpayers should fork over to compensate them for their failed bid to develop a liquefied natural gas (LNG) facility in Québec.

That’s almost a fifth of the province’s total budget for this year.

Ruby River Capital LLC, the U.S.-based owner of GNL Québec Inc., filed a claim against Canada under the North American Free Trade Agreement (NAFTA) after its Énergie Saguenay project failed to pass a federal environmental impact assessment.

The proposed LNG terminal had already been rejected by the Québec government over concerns that it would increase greenhouse gas emissions and negatively impact First Nations and marine mammals.

Canada faces a no-win situation — a catch-22. If the government does not rapidly phase out fossil fuels, it will fail to meet its commitments under the Paris Agreement to address the climate crisis. But when it takes steps to do so, foreign investors invoke international trade and investment agreements like NAFTA and threaten to drain public coffers.

Paying the polluters

Unlike environmental treaties, trade and investment agreements have teeth. They are enforceable through a system known as Investor-State Dispute Settlement (ISDS) that allows foreign investors to bypass local courts and bring claims for monetary compensation to a panel of three arbitrators. More than 1,200 ISDS cases have been launched against governments around the world in the last 25 years.

Between 1996 and 2018, Canada was sued more than 40 times by American investors through the investment chapter in NAFTA. To date, Canada has lost or settled (with compensation) 10 claims. Canadian governments have paid out more than $263 million in damages and settlements.

When NAFTA was replaced in 2018 with the U.S.-Mexico-Canada Agreement (USMCA), it did not include an ISDS mechanism between Canada and the U.S. Chrystia Freeland, the then-deputy prime minister of Canada, noted at the time that the removal of ISDS “strengthened our government’s right to regulate in the public interest, to protect public health and the environment.”

Ruby River was only able to launch its case because USMCA allowed firms that had made investments before NAFTA’s termination — on July 1, 2020, — to continue to bring ISDS claims for three years — until June 30, 2023.

Importantly, Ruby River spent only about CDN$165 million on the Énergie Saguenay project proposal. However, the firm is permitted within the ISDS system to seek “lost future profits” based on speculation about the performance of notoriously volatile oil and gas markets.

Risks to climate policy

Québec is a member of the global Beyond Oil and Gas Alliance and is the first jurisdiction in the world to ban all oil and gas production. The province is being sued over this ban by several fossil fuel firms — seeking more compensation than was offered — in Québec’s Superior Court.

Had these companies been foreign, and thereby qualified for the protection of an investment treaty, they likely would have chosen ISDS instead. This is because ISDS generally provides broader scope for claims — and larger awards — than domestic courts.

Other jurisdictions need to follow Québec’s lead. The global carbon budget has no room for new coal, oil or gas developments. Construction of new fossil fuel infrastructure also needs to be limited, as it would lock in continued extraction long into the future.

Despite clear messages to this effect from the Intergovernmental Panel on Climate Change and the International Energy Agency, investors continue to propose new fossil fuel projects.![]() That’s because they are incredibly stupid and arrogant and can’t read the writing on the frac’d wall.

That’s because they are incredibly stupid and arrogant and can’t read the writing on the frac’d wall.![]()

They do so in full knowledge that governments need to act to curb emissions in line with their international commitments and that future climate policies may negatively impact their investments.

Allowing these companies to demand billions in compensation creates moral hazard and could dampen necessary policy action.

Governments are increasingly aware of this risk and many are taking action. The European Union is seeking to withdraw from the Energy Charter Treaty, the largest investment treaty in the world, because it “is not aligned with the Paris Agreement, the EU Climate Law or the objectives of the European Green Deal.”

The Biden administration is committed to not signing up to new agreements with ISDS and a number of Democrats are calling for the removal of the mechanism from existing deals. Other countries such as Australia and New Zealand have worked to exclude ISDS from some of their trade agreements.

Future threats

Canada will soon escape from the legacy of NAFTA. However, the government remains exposed to the threat of ISDS through other trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), as well as dozens of bilateral investment treaties.

When the U.K. officially joins the CPTPP, the risk of ISDS claims from fossil fuel firms will increase dramatically.

The idea that public finance, desperately needed for the energy transition and climate adaptation, will be redirected to compensate fossil fuel firms currently making record profits is offensive.

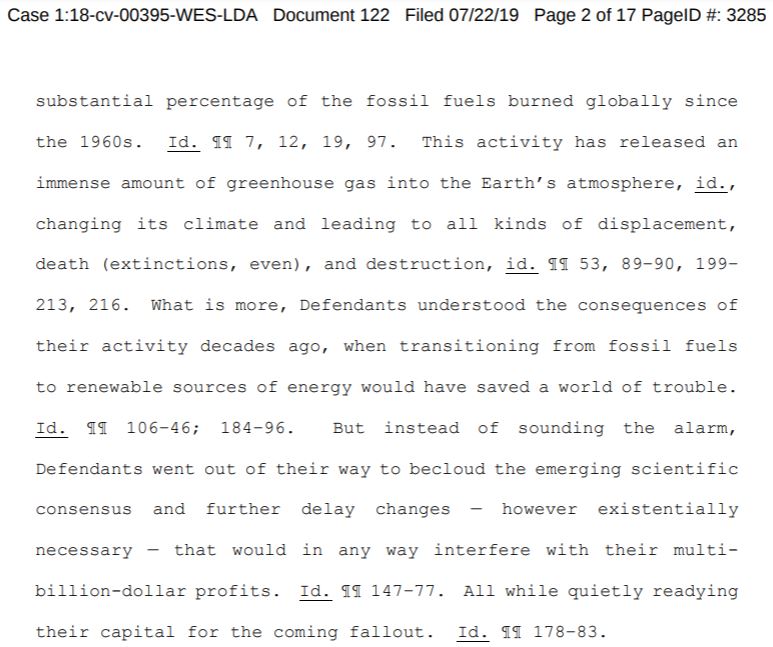

In light of the increasing body of evidence that documents how the industry has actively obstructed climate action and helped to spread disinformation about climate science, it is communities impacted by climate change that should be compensated by fossil fuel firms, not the other way around.

The Canadian government should adopt a consistent approach to ISDS. The exclusion of ISDS from USMCA should be emulated in any future agreements, and Canada should work with treaty partners to remove access to the system in all current ones.

This article is republished from The Conversation, an independent nonprofit news site dedicated to sharing ideas from academic experts. The Conversation has a variety of fascinating free newsletters.

Read more:

- Coastal GasLink and Canada’s pension fund colonialism

- A bridge to nowhere: Natural gas will not lead Canada to a sustainable energy future

Kyla Tienhaara receives funding from the Canada Research Chairs Program and SSHRC (Government of Canada). She collaborates with and provides pro bono advice for a number of non-profit organizations working on climate and investment issues.

Rise in extreme wildfires linked directly to emissions from oil companies in new study, Researchers set out to clearly quantify connection between companies, emissions and climate events by Benjamin Shingler, CBC News, May 24, 2023

As fires blaze in Alberta, Saskatchewan and B.C., new research has drawn a direct and measurable link between carbon emissions traced back to the world’s major fossil fuel producers and the increase in extreme wildfires across western Canada and the United States.

The peer-reviewed study, published last week in the journal Environmental Research Letters, found that 37 per cent of the total burned forest area in Western Canada and the United States between 1986-2021 can be traced back to 88 major fossil fuel producers and cement manufacturers.

“What we found is that the emissions from these companies have dramatically increased wildfire activity,” said Carly Phillips, co-author on the study and a researcher at the Science Hub for Climate Litigation at the Union of Concerned Scientists.

The findings build on previous studies that have quantified the contribution of those same 88 companies to the increase in global temperatures, and others that have shown how a climate-driven “vapour pressure deficit” (VPD) — a measure of the atmosphere’s drying power — has contributed to the increased area of forest burned in Western Canada and the U.S.

Using modelling data, researchers were able to determine that emissions traced back to those 88 companies resulted in an additional 80,000 kilometres squared being burned. That’s an area larger than the size of Ireland.

Energy industry responds to research

The Canadian Association of Petroleum Producers (CAPP) responded to the study in an email to CBC News.

“While our view may differ from the group who produced the study, what we can agree on is the need for continued work towards driving down greenhouse gas emissions,” said CAPP spokesperson Jay Averill.

“Canada’s oil and natural gas industry is one of the largest investors in emissions reduction innovation in the country,” Averill said, citing carbon capture and electrification programs.![]() Bull shit! Those just prolong the dying oil and gas and LNG industries and increase the pollution and harms. It’s well known that carbon capture is to steal from the citizenry and future to pay for enhanced oil recovery and frac’ing, and does not work to reduce industry’s deadly pollution. AER has heaps of papers proving this, I do not have time to list them all.

Bull shit! Those just prolong the dying oil and gas and LNG industries and increase the pollution and harms. It’s well known that carbon capture is to steal from the citizenry and future to pay for enhanced oil recovery and frac’ing, and does not work to reduce industry’s deadly pollution. AER has heaps of papers proving this, I do not have time to list them all.![]()

Canadian companies have a role to play in reducing global carbon emissions by exporting more natural gas to countries who are relying on coal to power their economies, Averill added.

Jatan Buch, a research scientist at the Lamont-Doherty Earth Observatory at Columbia University, said in an email the research provides “strong evidence” of the impact of emissions traced back to specific fossil fuel companies.

Buch, who was not involved in the study, added that while research shows VPD is a leading driver in how far a wildfire spreads, other factors are also at play, including the precipitation and snowpack conditions early in the season, and the practices of prescribed burning and fire suppression.

Growing field of study

The research is part of a growing field of study known as attribution science, which attempts to measure how climate change directly affected recent extreme weather events.

Jennifer Baltzer, an associate professor in the department of biology at Wilfrid Laurier University in Ontario, said it’s becoming more common to see scientists make those connections.

“Last year, there were a number of studies that directly attributed the increase in emissions and associated climate warming with the massive heat waves that hit Europe,” said Baltzer, the Canada Research Chair in Forests and Global Change.

“I think we’re increasingly seeing scientists make stronger statements, which we need to be doing — stronger statements about the fact that, yes, these changes in climate are human-caused and they are driving these massive catastrophes that we’re seeing around the world.”

Baltzer, who was also not involved in the study, said the findings aren’t surprising, given previous research.

But she said the data helps draw links between previous research and the emissions from the world’s largest fossil fuel companies. “It’s really important to demonstrate those links.”

‘The accountability piece’

Phillips said drawing those links was part of her motivation, especially given that recent research and investigations have found oil companies knew about the threat of climate change decades ago but downplayed the dangers.

“Part of what this study does is show the linkages between these companies, their emissions and climate impacts, which will hopefully allow them to be held accountable for their fair share of the costs associated with wildfire,” she said.

- Analysis Canadian forest fires are the latest costly climate disaster that public accounts fail to capture

- Denmark is getting off fossil fuels. Are there lessons for Canada?

“I think the accountability piece for fossil fuel companies is really important and part of what makes this research unique. We know that historically industries have been held accountable for the risks of their products, whether it be tobacco or asbestos. And a big part of holding those companies accountable was research showing the linkages between their product and the impact.”

Christina Noel, a spokesperson for the American Petroleum Institute, said in a statement: “The clear agenda of this group aside, America’s oil and natural gas industry is focused on delivering affordable, reliable energy while reducing emissions.”

***

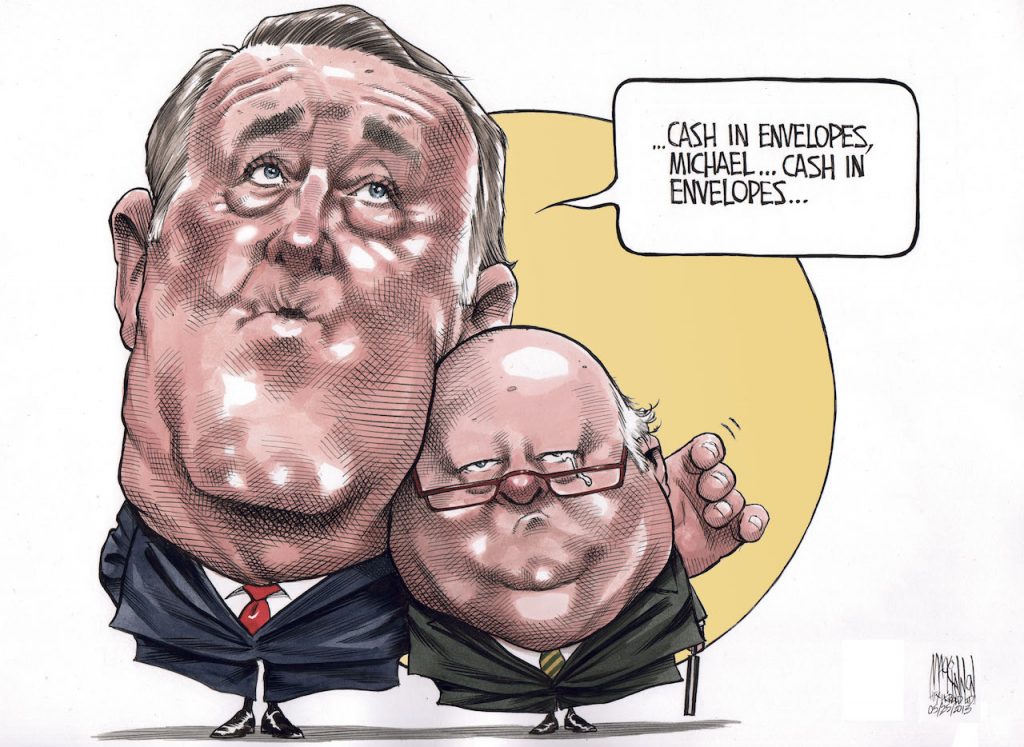

Ruby River Capital LLC initiates NAFTA claim for ‘gross procedural unfairness’, ‘manifest arbitrariness’ and ‘double standards’ employed by Québec and Canada in rejecting GNLQ LNG project by Shawn Denstedt, KC, Sander Duncanson, Laura Scott, Joey Chan, all out of Calgary (oil and gas capital of Canada which screamed no to frac’ing), May 5, 2023, Osler ![]() Represented Satan (Encana/Ovintiv) against me, Ernst vs Encana, and my community’s drinking water that the frac’er illegally intentionally frac’d

Represented Satan (Encana/Ovintiv) against me, Ernst vs Encana, and my community’s drinking water that the frac’er illegally intentionally frac’d![]()

Introduction

After seven years of navigating separate provincial and federal regulatory processes and sourcing US$120 million in investments, GNL Québec Inc. (GNLQ)’s proposed liquefied natural gas (LNG) facility in Québec (the GNLQ Project) was rejected by both levels of government in 2021 and 2022. The governments justified their decisions based on a variety of factors, including anticipated negative net contributions to global GHG emissions, deceleration of energy transition through foreign LNG imports, and GNLQ’s alleged failure to achieve social acceptability in Québec. ![]() Social licence is your responsibility to obtain Ruby, not ordinary Canadians running from wildfires and flooding largely caused by the polluting oil and gas industry, notably frac’ing.

Social licence is your responsibility to obtain Ruby, not ordinary Canadians running from wildfires and flooding largely caused by the polluting oil and gas industry, notably frac’ing.![]() On February 17, 2023, the United States parent company of GNLQ initiated an international arbitration claim against the government of Canada for, among other things, gross procedural unfairness, manifest arbitrariness and double standards employed by Québec and Canada in reaching their decisions, contrary to foreign investment safeguards set out in the North American Free Trade Agreement (NAFTA). This claim could have important implications for future environmental assessment decision-making across Canada.

On February 17, 2023, the United States parent company of GNLQ initiated an international arbitration claim against the government of Canada for, among other things, gross procedural unfairness, manifest arbitrariness and double standards employed by Québec and Canada in reaching their decisions, contrary to foreign investment safeguards set out in the North American Free Trade Agreement (NAFTA). This claim could have important implications for future environmental assessment decision-making across Canada.![]() Bullshit. This claim will make Osler and Ruby laughing stock among global youth, next in line to vote! Both your companies, Ruby and Osler, are putting your reputations down the frac drain.

Bullshit. This claim will make Osler and Ruby laughing stock among global youth, next in line to vote! Both your companies, Ruby and Osler, are putting your reputations down the frac drain.![]()

On June 30, 2023, the sunset period for investor-state arbitrations under NAFTA expires. Investors will no longer be able to challenge unfavourable decisions made by Canadian federal or provincial governments against an investor from the United States or Mexico, or by the United States or Mexico governments against a Canadian investor. Investors of major projects denied by one of these governments should pay close attention to the GNLQ Project arbitration and consider whether to file their own claim by June 30, 2023 to preserve their rights under NAFTA.![]() Way to threaten! Here’s one for you lawyers: May your water get illegally frac’d and your homes blow up in an Ovintiv frac explosion gone wrong, like Rosebud’s water tower exploding after Encana’s illegal aquifer fracs.

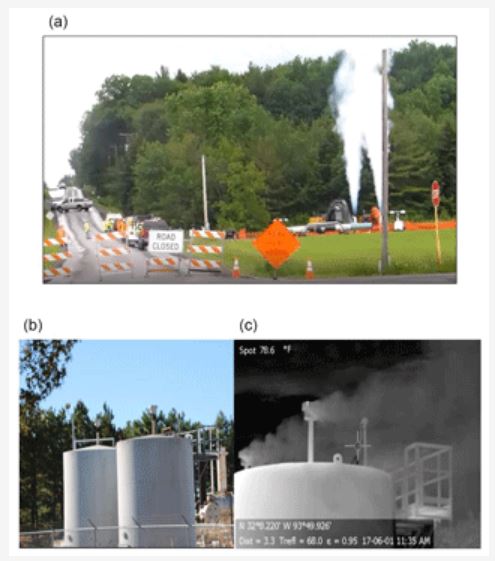

Way to threaten! Here’s one for you lawyers: May your water get illegally frac’d and your homes blow up in an Ovintiv frac explosion gone wrong, like Rosebud’s water tower exploding after Encana’s illegal aquifer fracs.![]()

Background

On February 17, 2023, Ruby River Capital LLC (Ruby River or the Claimant), one of the owners of GNLQ, filed a request for arbitration (Arbitration Request) with the World Bank Group International Centre for Settlement of Investment Disputes (ICSID) on behalf of Symbio Infrastructure Partnership Limited (Symbio) in response to Québec and Canada’s denial of the GNLQ Project, and incidental dismissal of Gazoduq Inc. (Gazoduq)’s associated natural![]() carbon intensive, water, air, community, land, food, public health polluting frac’d

carbon intensive, water, air, community, land, food, public health polluting frac’d![]() gas pipeline (Gazoduq Project) (collectively, the Projects). Ruby River claims that, by denying the Projects, Québec and Canada breached Chapter 11 of NAFTA which places obligations on Canada regarding its treatment of foreign investments.

gas pipeline (Gazoduq Project) (collectively, the Projects). Ruby River claims that, by denying the Projects, Québec and Canada breached Chapter 11 of NAFTA which places obligations on Canada regarding its treatment of foreign investments.![]() Seems it’s corporate responsibility, not gov’t, to read the room (aka, the world), and realize when your profit-raping games are up. LNG is a con, has always been a con, will never be financially viable without massive theft from the environment, the future, our youth, and taxpayers.

Seems it’s corporate responsibility, not gov’t, to read the room (aka, the world), and realize when your profit-raping games are up. LNG is a con, has always been a con, will never be financially viable without massive theft from the environment, the future, our youth, and taxpayers.![]()

The GNLQ Project was a proposed LNG facility and export terminal at the Port of Saguenay, Québec, which would ![]() could, maybe, in a big polluting dream

could, maybe, in a big polluting dream![]() have produced up to 10.5 million tonnes of LNG per year for 25 to 50 years. The Gazoduq Project was a proposed 780 kilometre long

have produced up to 10.5 million tonnes of LNG per year for 25 to 50 years. The Gazoduq Project was a proposed 780 kilometre long natural ![]() carbon intensive, water, air, community, land, food, public health polluting frac’d

carbon intensive, water, air, community, land, food, public health polluting frac’d![]() gas pipeline from North Ontario to the GNLQ Project, which would have transported

gas pipeline from North Ontario to the GNLQ Project, which would have transported natural ![]() carbon intensive, water, air, community, land, food, public health polluting frac’d

carbon intensive, water, air, community, land, food, public health polluting frac’d![]() gas (sourced in Western Canada)

gas (sourced in Western Canada)![]() heavily frac’d wildfire disaster zones, with fires in frac fields – how many started by the oil and gas industry’s endless leaks of flammable frac’d gases?

heavily frac’d wildfire disaster zones, with fires in frac fields – how many started by the oil and gas industry’s endless leaks of flammable frac’d gases?![]() to the GNLQ Project. The Projects were proposed to be carbon neutral throughout their construction and operation.

to the GNLQ Project. The Projects were proposed to be carbon neutral throughout their construction and operation.![]() Proposing means nothing. Any fool can promise to be clean when knowing carbon neutral LNG and pipelined frac’d gas is impossible. No such thing as carbon neutral when it comes to LNG or gas pipelines; LNG is frac’d unnatural gas which is always carbon intensive, harms community and environment, intentionally contaminates valuable water which the world is fast running out of, so are construction crews and building LNG vessels, never mind the polluting tankers shipping fuels, then, the LNG idling offshore, because of countries that bought and stored too much gas which more and more people do not want, as they watch the world burn up. What when LNG tankers blow up? There are net zero ways, but LNG is not and never will be, even if companies stop using diesel crews to frac.

Proposing means nothing. Any fool can promise to be clean when knowing carbon neutral LNG and pipelined frac’d gas is impossible. No such thing as carbon neutral when it comes to LNG or gas pipelines; LNG is frac’d unnatural gas which is always carbon intensive, harms community and environment, intentionally contaminates valuable water which the world is fast running out of, so are construction crews and building LNG vessels, never mind the polluting tankers shipping fuels, then, the LNG idling offshore, because of countries that bought and stored too much gas which more and more people do not want, as they watch the world burn up. What when LNG tankers blow up? There are net zero ways, but LNG is not and never will be, even if companies stop using diesel crews to frac. ![]()

The Projects would have been amongst the largest private industrial projects in Québec’s history, with estimated capital costs of roughly US$11.2 billion. ![]() Money does not entice. Big or biggest doesn’t either. Safe homes, safe water, breathable air, healthy foods (non radioactive frac waste contaminated)ce. Take your greed-induced fantasy speculations and shove em up your exaggerating asses.

Money does not entice. Big or biggest doesn’t either. Safe homes, safe water, breathable air, healthy foods (non radioactive frac waste contaminated)ce. Take your greed-induced fantasy speculations and shove em up your exaggerating asses.![]() US$9 billion of this amount was initially committed by business investor Warren Buffet, but Buffet withdrew his commitment in 2020, citing concerns over disruptions to regulatory approval processes.

US$9 billion of this amount was initially committed by business investor Warren Buffet, but Buffet withdrew his commitment in 2020, citing concerns over disruptions to regulatory approval processes.![]() I expect he withdrew for other more important reasons, like the billions in costs from legal liabilities in the many climate change lawsuits currently before the courts, with and more and more jurisdictions filing them the world over.

I expect he withdrew for other more important reasons, like the billions in costs from legal liabilities in the many climate change lawsuits currently before the courts, with and more and more jurisdictions filing them the world over.![]()

From 2014 to 2022, Ruby River and Symbio invested approximately US$120 million into the preparatory phase of the Projects, including various engineering and design studies, assessments of the environmental and socio-economic impacts of the Projects, consultation with local communities and Indigenous groups,![]() Clearly Ruby et al, your work was shit, otherwise, social licence would have been granted to you. I grew up in Quebec and have closely watched their powerful united stand against lying companies. They are much more intelligent, well read, and more courageous than Canadians west of them, and do not stand for lies and cons by Gaz du Shit frac’ers! Or lies by the likes of Ruby et al.

Clearly Ruby et al, your work was shit, otherwise, social licence would have been granted to you. I grew up in Quebec and have closely watched their powerful united stand against lying companies. They are much more intelligent, well read, and more courageous than Canadians west of them, and do not stand for lies and cons by Gaz du Shit frac’ers! Or lies by the likes of Ruby et al. ![]() and costs

and costs![]() bribes?

bribes? ![]() to advance regulatory applications.

to advance regulatory applications.

Environmental assessments

The proposed GNLQ Project underwent an environmental assessment by the Québec’s environmental assessment agency, Bureau d’audiences publiques sur l’environnement (BAPE), under Québec’s Environment Quality Act. BAPE’s Environmental Assessment Report (in French) (BAPE Report) was released on March 10, 2021. The BAPE Report cites concerns regarding GHG emissions, cumulative effects of related projects, uncertainty regarding LNG demand, effects on marine mammals, the energy transition of LNG purchasers, and the social acceptability of the GNLQ Project.

The BAPE Report ultimately concluded that the risks of the GNLQ Project outweighed the advantages.

![]() yup, what did I tell ya? Quebecers aint dumb obedient idiotic greedy sods believing industry’s lies like they do out west in Alberta, BC, SK, MB, Ontario! Industry doesn’t know what the hell to do with intelligent citizens such as Quebecers, that’s why companies get their evil stooges like hate-mongering pastors and misogynistic thugs like Jordan Peterson to brainwash westerners, and even more evil stunts like Jason Kenney, Steve Harper, Danielle Smith, Christy Clark destroying education and public health out west to ruin brains, damage neurological systems to dumb down voters and prevent critical thinking in the citizenry so that they obediently and silently take watching their communities burn down (like Ft Mac), their water poisoned or lost completely, their kids poisoned, their livestock dead, their water too flammable and contaminated after frac;ing to even use to flush toilets, their crops and grasses baked to dust. Ruby ought to have learned from Lone Pine’s vile gross greed and frac failures. WAKE UP RUBY RIVER ET AL AND OSLER, READ THE WORLD!

yup, what did I tell ya? Quebecers aint dumb obedient idiotic greedy sods believing industry’s lies like they do out west in Alberta, BC, SK, MB, Ontario! Industry doesn’t know what the hell to do with intelligent citizens such as Quebecers, that’s why companies get their evil stooges like hate-mongering pastors and misogynistic thugs like Jordan Peterson to brainwash westerners, and even more evil stunts like Jason Kenney, Steve Harper, Danielle Smith, Christy Clark destroying education and public health out west to ruin brains, damage neurological systems to dumb down voters and prevent critical thinking in the citizenry so that they obediently and silently take watching their communities burn down (like Ft Mac), their water poisoned or lost completely, their kids poisoned, their livestock dead, their water too flammable and contaminated after frac;ing to even use to flush toilets, their crops and grasses baked to dust. Ruby ought to have learned from Lone Pine’s vile gross greed and frac failures. WAKE UP RUBY RIVER ET AL AND OSLER, READ THE WORLD!![]()

At a press conference on July 21, 2021, Québec announced that it was refusing the GNLQ Project. Québec’s decision was published in the Government of Quebec Gazette [PDF] (in French) on August 17, 2021.

The GNLQ Project was also subject to an assessment by the Impact Assessment Agency of Canada (IAAC) under the Canadian Environmental Assessment Act (2012). IAAC’s Environmental Assessment Report [PDF] (IAAC Report) was released in November 2021. The IAAC Report indicated the GNLQ Project would result in significant environmental effects, including effects resulting from GHG emissions; direct and cumulative effects on marine mammals; and effects on the cultural heritage of the Innu First Nations. On February 7, 2022, Canada released a Decision Statement refusing to approve the GNLQ Project.

ICSID jurisdiction

Canada and the United States are both contracting states to the ICSID Convention [PDF].

Article 25(1) of the ICSID Convention states that the ICSID’s jurisdiction extends to “any legal dispute arising directly out of an investment, between a Contracting State … and a national of another Contracting State”, which by virtue of Article 25(2)(b) includes a corporation. This explains why the Arbitration Request was brought by Ruby River, Symbio’s U.S. parent company.

Article 1122 of NAFTA sets out each NAFTA party’s consent to ICSID arbitration under Article 25 of the ICSID Convention. NAFTA was replaced by the U.S.-Mexico-Canada Agreement (USMCA) on July 1, 2020. Chapter 14 of the USMCA contains similar provisions to NAFTA regarding the equitable treatment of foreign investors by each government. However, Article 14.2(4) of the USMCA specifically limits arbitration claims by foreign investors against Canada to legacy investment claims, as set out in Annex 14-C. Article 14-C authorizes the submission of an ICSID arbitration claim regarding a legacy investment (foreign investment made January 1, 1994 to July 1, 2020 in the territory of another USMCA party) pursuant to NAFTA Chapter 11 for a three year period (until June 30, 2023).

Alleged breach of NAFTA provisions

The Claimant alleges Canada breached articles 1102, 1103, 1105 and 1110 of NAFTA.![]() I claim based on decades of environmental and socio-economic assessments for the oil patch in Canada, and decades of frac and unnatural gas research, the Ruby is wrong and trying to take advantage of money grubbing lyin’ Brian Mulroney’s hideous and amoral NAFTA to steal $billions from ordinary Canadians, $billions Ruby and friends could never make in profits from this pitiful scheme of carbon intensive family and community harming caveman fossil frac projects.

I claim based on decades of environmental and socio-economic assessments for the oil patch in Canada, and decades of frac and unnatural gas research, the Ruby is wrong and trying to take advantage of money grubbing lyin’ Brian Mulroney’s hideous and amoral NAFTA to steal $billions from ordinary Canadians, $billions Ruby and friends could never make in profits from this pitiful scheme of carbon intensive family and community harming caveman fossil frac projects.

Ruby et al – you failed to read the room in Quebec, and you fail to face the horrific climate harms frac’d oil and gas, including LNG, is raging on the world.![]()

Articles 1102 and 1103

Articles 1102 and 1103 of NAFTA mandate that parties to NAFTA treat foreign investors no less favorably than the most favorable treatment accorded to domestic investors or any other investors.![]() Before or after the costs of the significant and plentiful harms to environment and communities we all know from experience, the companies/investors intend never to pay to mitigate.

Before or after the costs of the significant and plentiful harms to environment and communities we all know from experience, the companies/investors intend never to pay to mitigate.![]()

The Claimant argues that Canada and Québec’s refusal of the GNLQ Project constituted discriminatory treatment towards its U.S. investors. In particular, the Claimant alleges that Québec and Canada’s environmental assessment processes were marred by double standards.![]() HA HA HA HA. ROARING LAUGHTER. CLUSTERFUCKERS! Your fingers are pointing back at you.

HA HA HA HA. ROARING LAUGHTER. CLUSTERFUCKERS! Your fingers are pointing back at you.![]() For example, the Claimant notes that assessments of other projects (such as LNG Canada) did not consider GHG emissions on a global scale or the potential international impact of substituting other energy products.

For example, the Claimant notes that assessments of other projects (such as LNG Canada) did not consider GHG emissions on a global scale or the potential international impact of substituting other energy products. ![]() Oh FFS! Quebec is filled with completely different kettle of concerns and intelligent citizens than elsewhere in Canada. Read the BAPE statements on frac’ing from many years ago! And the many frac projects that have been cancelled because the people of Quebec loudly said NO Fracking, it’s too harmful!

Oh FFS! Quebec is filled with completely different kettle of concerns and intelligent citizens than elsewhere in Canada. Read the BAPE statements on frac’ing from many years ago! And the many frac projects that have been cancelled because the people of Quebec loudly said NO Fracking, it’s too harmful!![]() The Claimant argues that the application of these criteria solely to the GNLQ Project contradicts previous assessments and is manifestly discriminatory.

The Claimant argues that the application of these criteria solely to the GNLQ Project contradicts previous assessments and is manifestly discriminatory.

NAFTA Article 1105(1)

Article 1105(1) sets out a minimum standard of treatment and provides that parties to NAFTA must treat foreign investors in accordance with international law, including fair and equitable treatment and full protection and security.![]() Must law firms write honestly in their statements of claim and legal filings? Is it legal to lie in filings, like Osler did for Encana in its statement of defence in response to my lawsuit? Like it seems Osler is doing for Ruby by grossly over speculating profits while not subtracting the many more tens of $billions in harms its frac’d gases and project(s) would have caused?

Must law firms write honestly in their statements of claim and legal filings? Is it legal to lie in filings, like Osler did for Encana in its statement of defence in response to my lawsuit? Like it seems Osler is doing for Ruby by grossly over speculating profits while not subtracting the many more tens of $billions in harms its frac’d gases and project(s) would have caused?![]()

The Claimant alleges that the “gross procedural unfairness” and “manifest arbitrariness” underlying Québec and Canada’s refusal of the GNLQ Project constitute a breach of Article 1105(1). In particular, the Claimant argues Québec and Canada engaged in the following conduct, leading GNLQ and its affiliates to believe that the GNLQ Project would be approved:

- Québec made specific commitments to GNLQ in support of the GNLQ Project, inducing Symbio to make additional investments, including:

- confirming Hydro-Québec would allocate electricity to the GNLQ Project

- brokering a deal with Canada and local governments to ensure access to sufficient lands at the Port of Saguenay

- providing tax incentives to the GNLQ Project

- establishing a dedicated Inter-Ministerial Committee to facilitate and assist the GNLQ Project to advance through the various stages of provincial approval

- making a formal offer to finance the GNLQ Project through Québec’s economic development and investment agency, Investissement Québec

- Québec repeatedly voiced support for the GNLQ Project in the press and Québec Parliament.

- Québec and Canada repeatedly affirmed LNG’s role in transitioning towards carbon-neutral economies.

- Between 2014 and 2022, Québec repeatedly supported or initiated other domestic LNG-related investments across Québec.

Holy shit Ruby, did you and yours fuck up! What a wonderful list of gifts you blew. So many gifts you could have rec’d, had you not screwed up your assessments and consultations and had you told the truth. I do not believe the above list helps Ruby’s legal standing, I think it worsens it, because it shows just how badly the company fucked up to lose all that.

Holy shit Ruby, did you and yours fuck up! What a wonderful list of gifts you blew. So many gifts you could have rec’d, had you not screwed up your assessments and consultations and had you told the truth. I do not believe the above list helps Ruby’s legal standing, I think it worsens it, because it shows just how badly the company fucked up to lose all that.

Following the issuance of the BAPE Report, Québec announced that the GNLQ Project would have to meet three additional criteria: (i) making a positive net contribution to global GHG reductions; (ii) promoting energy transition; and (iii) achieving social acceptability. The Claimant argues that first two criteria had never been mentioned before and the third only became a prominent issue following the issuance of the BAPE Report.![]() Bullshit! The people screamed NO! Ruby et al, Osler lawyers, you all need to get your ears cleaned.

Bullshit! The people screamed NO! Ruby et al, Osler lawyers, you all need to get your ears cleaned.![]() However, the BAPE Report does discuss energy transition in section 3.4. Nonetheless, the Claimant argues that no opportunity was provided for GNLQ to respond to the new criteria.

However, the BAPE Report does discuss energy transition in section 3.4. Nonetheless, the Claimant argues that no opportunity was provided for GNLQ to respond to the new criteria.

The Claimant further alleges that rejecting the GNLQ Project was a political move by both Québec and Canada, and that their rejection had nothing to do with environmental concerns. In particular, the Claimant notes that Canada announced it would reject the GNLQ Project in the lead up to the federal election in the fall of 2021, after Québec had refused the GNLQ Project, but prior to the conclusion of IAAC’s environmental assessment process.

Article 1110

Article 1110 of NAFTA provides that no party to NAFTA shall directly or indirectly expropriate a foreign investment in its territory, except for a public purpose, on a non-discriminatory basis, in accordance with due process of law and on the payment of compensation.

The Claimant argues that Québec and Canada’s refusal of the GNLQ Project are “measures tantamount to expropriation![]() FFS! Such pathetic over reach. Nothing was expropriated in my expert view, it’s quite simple: Ruby fucked up and pissed off the good and intelligent people of Quebec.

FFS! Such pathetic over reach. Nothing was expropriated in my expert view, it’s quite simple: Ruby fucked up and pissed off the good and intelligent people of Quebec.![]() … in that they substantially deprived Symbio and its U.S. investors of all economic value in their investments and of any reasonably-to-be-expected

… in that they substantially deprived Symbio and its U.S. investors of all economic value in their investments and of any reasonably-to-be-expected ![]() Roaring laughter. Ruby and Osler et al need to go back to school and learn what reasonable means and that we are taught in kindergarten, to leave places we visit/use better, tidier and cleaner than we found them

Roaring laughter. Ruby and Osler et al need to go back to school and learn what reasonable means and that we are taught in kindergarten, to leave places we visit/use better, tidier and cleaner than we found them![]() economic benefit.” The Claimant further states that, as a result of Québec and Canada’s decisions, Symbio’s investments in both Projects “have essentially become worthless and any prospect of commercial return has now disappeared despite extremely strong global demand for LNG – and for reliable long-term supply

economic benefit.” The Claimant further states that, as a result of Québec and Canada’s decisions, Symbio’s investments in both Projects “have essentially become worthless and any prospect of commercial return has now disappeared despite extremely strong global demand for LNG – and for reliable long-term supply![]() frac wells are failing all over the place, even with more and more water injected, and bigger and bigger fracs. Long term? Pipe dream or wet dream, take your pick.

frac wells are failing all over the place, even with more and more water injected, and bigger and bigger fracs. Long term? Pipe dream or wet dream, take your pick.![]() from net-zero emissions export projects such as the GNLQ Project.”

from net-zero emissions export projects such as the GNLQ Project.”![]() There is no possible way, this project would have ever been net zero.

There is no possible way, this project would have ever been net zero.![]()

The Claimant argues that Canada did not pursue a legitimate public purpose, as its decision to refuse the GNLQ Project was arbitrary and politically-motivated. Therefore, according to the Claimant, Canada must pay compensation for the full market value of its expropriated investments.![]() HOLY FRAC JUMP!~ From “speculated” profits of $20 billion to full market value of stolen $20 billion? Ruby and Osler must know who their judges are and how they’re going to rule (as usual, for frac’ers). Fuckin’ losers, no wonder Quebec people screamed “NO!” at you and your polluting harmful invasive project. If you had told the truth, they might have given you a chance.

HOLY FRAC JUMP!~ From “speculated” profits of $20 billion to full market value of stolen $20 billion? Ruby and Osler must know who their judges are and how they’re going to rule (as usual, for frac’ers). Fuckin’ losers, no wonder Quebec people screamed “NO!” at you and your polluting harmful invasive project. If you had told the truth, they might have given you a chance.![]()

Damages

The Claimant seeks US$120 million in sunk costs, and an additional US$20 billion in lost profits, as damages. The Claimant further seeks compound interest on the amount of damages awarded, and compensation for costs of the arbitration.![]() The citizenry asks same for the harms frac’ing and fossil fuel pollution is causing Canadians.

The citizenry asks same for the harms frac’ing and fossil fuel pollution is causing Canadians.![]()

Next steps

The ICSID Acting Secretary General registered the Arbitration Request on March 9, 2023. While Article 37 of the ICSID Convention requires an arbitral tribunal to be constituted as soon as possible after registration of a request, no further process steps have occurred to date.

Implications

This arbitration highlights the interplay between government policy and environmental assessments, and the risk that environmental assessment regulations are becoming increasingly politicized.![]() In my view, that’s a fabrication meant to threaten other jurisdictions to obediently enable crimes by frac’ing and LNG even as those jurisdictions currently face horrific brutally expensive climate change hell (like Alberta, BC and SK currently with the heavy rain fall warnings and floods concurrent with loss of potable water and extreme wildfires blazing. Such threats have no place in this matter.

In my view, that’s a fabrication meant to threaten other jurisdictions to obediently enable crimes by frac’ing and LNG even as those jurisdictions currently face horrific brutally expensive climate change hell (like Alberta, BC and SK currently with the heavy rain fall warnings and floods concurrent with loss of potable water and extreme wildfires blazing. Such threats have no place in this matter.![]() This echoes concerns recently raised before the Supreme Court of Canada in the Impact Assessment Act reference case that environmental assessments are increasingly being used as a vehicle to implement government policies that promote or seek to impede certain industries, such as oil and gas or coal, rather than focusing more specifically on safeguarding against adverse environmental effects from the particular project.

This echoes concerns recently raised before the Supreme Court of Canada in the Impact Assessment Act reference case that environmental assessments are increasingly being used as a vehicle to implement government policies that promote or seek to impede certain industries, such as oil and gas or coal, rather than focusing more specifically on safeguarding against adverse environmental effects from the particular project.![]() Pffft, the supreme court of Canada lies in rulings, currently has one judge (Russell Brown) suspended while under investigation for drunken hanky panky in the USA, and CJ Richard Wagner lied to Harvard law students in a formal speech (I’m working on a post about that, and when it’s complete, will link it here). It’s not a trustworthy, respectable or credible reference anymore thanks to too many Steve Harper judges.

Pffft, the supreme court of Canada lies in rulings, currently has one judge (Russell Brown) suspended while under investigation for drunken hanky panky in the USA, and CJ Richard Wagner lied to Harvard law students in a formal speech (I’m working on a post about that, and when it’s complete, will link it here). It’s not a trustworthy, respectable or credible reference anymore thanks to too many Steve Harper judges.![]()

In the case of GNLQ’s claim, an international body will assess whether Canada is liable for damages where a foreign company has invested in a project, pursued the project through Canadian and provincial regulatory processes (meeting all regulatory requirements along the way) ![]() Another lie? Come on! The People of Quebec Yelled NO! Not meeting the requirement to get social licence. Big fat frac fail! As is lying about net zero and the climate harms

Another lie? Come on! The People of Quebec Yelled NO! Not meeting the requirement to get social licence. Big fat frac fail! As is lying about net zero and the climate harms![]() and the project is subsequently rejected on policy grounds. If successful, this claim would provide significant ammunition to those who are advocating for changes to environmental decision-making in Canada.

and the project is subsequently rejected on policy grounds. If successful, this claim would provide significant ammunition to those who are advocating for changes to environmental decision-making in Canada. ![]() Ah. Finally, some honesty!~ Seems this lawsuit is more about threatening countries, states and provinces growing increasingly terrified at the fossil fuel industry’s – notably frac’d gas – caused global warming and associated climate damages and suffering expected to cost $trillions to clean up/repair, with most of the damages, such as other species extirpated, permanent water loss, cancers and more from toxic air etc etc etc, not even fixable no matter how much money you throw at it. The harms caused by this industry and its decades of cruel lies are infinite and devastating. Entire countries are being destroyed, and you Ruby and Osler, lie about net zero and expropriation? Really, take your lawsuit, your failed assessments and consulations, dishonesty and fuck off.

Ah. Finally, some honesty!~ Seems this lawsuit is more about threatening countries, states and provinces growing increasingly terrified at the fossil fuel industry’s – notably frac’d gas – caused global warming and associated climate damages and suffering expected to cost $trillions to clean up/repair, with most of the damages, such as other species extirpated, permanent water loss, cancers and more from toxic air etc etc etc, not even fixable no matter how much money you throw at it. The harms caused by this industry and its decades of cruel lies are infinite and devastating. Entire countries are being destroyed, and you Ruby and Osler, lie about net zero and expropriation? Really, take your lawsuit, your failed assessments and consulations, dishonesty and fuck off.![]() As such, this claim should be monitored by companies and investors considering investments in future major projects in the country.

As such, this claim should be monitored by companies and investors considering investments in future major projects in the country.

This arbitration also highlights how private companies can avail themselves of the dispute resolution mechanism under NAFTA Chapter 11. GNLQ is not the first private company to bring this type of claim. For example, the ICSID is currently considering an arbitration claim under NAFTA made by TC Energy Corporation and TransCanada Pipelines Limited against the United States government related to President Biden’s January 20, 2021 decision to revoke the approval for the Keystone XL Pipeline, issued by former President Trump on March 29, 2019. The ICSID is also currently considering an arbitration claim under NAFTA by United States Investors Koch Industries, Inc. (Koch) and Koch Supply & Trading, LP against the Canadian government related to Premier Doug Ford’s cancellation of Ontario’s Climate Change Mitigation and Low-Carbon Economy Act and Cap and Trade Program Regulation, under which Koch made investments in carbon allowances that subsequently became worthless. As noted above, the opportunity for private companies to initiate these types of claims will end after June 30, 2023. As such, any company that believes it may have grounds to initiate a NAFTA claim should consider doing so prior to June 30, 2023.![]() It’s dishonest to leave out Lone Pine losing their mega frac money NAFTA case against Canada! That case was also about Quebec saying no and the company grossly fantasizing lost profits.

It’s dishonest to leave out Lone Pine losing their mega frac money NAFTA case against Canada! That case was also about Quebec saying no and the company grossly fantasizing lost profits.![]()

Refer also to:

Horror of Horrors!

Have a good look NAFTA arbitration panel on Ruby’s claim by Osler:

2023: North America Rig Count Reduction Rumbles On

North America dropped another seven rigs week on week, according to Baker Hughes’ latest rotary rig count, which was posted on May 26. The total rig figure comprises 570 oil rigs, 137 gas rigs, and four miscellaneous rigs. Alaska, Colorado, Louisiana, New Mexico, Oklahoma, and Utah all dropped rigs, while Texas and Wyoming added rigs, week on week. The total North America rig count is down 32 compared to year ago levels.

2023: Solar to Outshine Oil in Global Investment? ETF in Focus

According to a recent International Energy Agency (IEA) report, the global energy investment landscape is experiencing a monumental shift, as quoted on CNBC. The agency anticipates that by 2023, total investments in energy will touch approximately $2.8 trillion, with more than $1.7 trillion channeled toward clean energy technologies. Of this, solar investments alone are predicted to exceed $1 billion per day, reflecting an encouraging trend in energy transition.

2023 05 23: Laurie Garrett@Laurie_Garrett:

Getting harder to convene “civil” annual stockholder meetings, Big Oil? If you think these folks are mad now, how much rage do you think your fossil fuel extraction industry will face when global average temperature tops the +1.5 C threshold, sometime in the next 48 months?

![]() The lyrics and singing in clip above are top notch! Much higher quality than Ruby’s NAFTA filing. And they’re honest.

The lyrics and singing in clip above are top notch! Much higher quality than Ruby’s NAFTA filing. And they’re honest.![]()

2023 05 23: Fossil Free London@fossilfreeLDN:

BREAKING: Chaos at Shell AGM as climate protesters sing ‘Go to Hell, Shell’!

2023: Japan Gas Imports Fall to Two-Decade Low on Energy Savings Push

Japan’s liquefied natural gas imports last month fell to the lowest in more than 20 years as efforts to save energy and boost nuclear power reduced the need for the fossil fuel. Japan’s gas storage is so well stocked that importers were offering to sell shipments last month. Japan’s government has been appealing to households and businesses to conserve energy, after last year’s energy crisis stretched the grid, risked blackouts and raised utility bills. The drop in LNG deliveries to Japan, a top importer, is helping to ease the global fuel shortage, pushing prices to the lowest level in two years.

Honolulu has lost more than 5 miles of its famous beaches to sea level rise and storm surges. Sunny-day flooding during high tides makes many city roads impassable, and water mains for the public drinking water system are corroding from saltwater because of sea level rise. The damage has left the city and county spending millions of dollars on repairs and infrastructure to try to adapt to the rising risks.

Unwilling to have their taxpayers bear the full brunt of these costs, the city and county sued Sunoco LP, Exxon Mobil Corp. and other big oil companies in 2020. Their case – one of more than two dozen involving U.S. cities, counties and states suing the oil industry over climate change – just got a break from the U.S. Supreme Court. That has significantly increased their odds of succeeding.

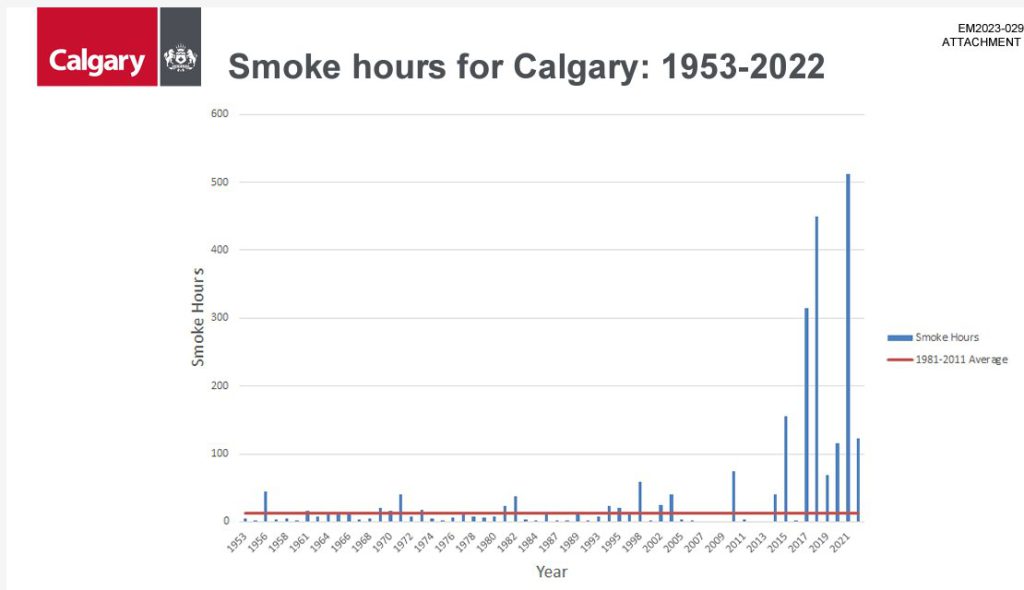

Compare Calgary’s smoke hours with oil and gas frac’ing (dramatically ramped up in 2009). From Page 13, City of Calgary Report which does not mention frac’ing. Why ignore industry forcing mass leakage of flammable gases across the province, country, globally (except where citizens were smart enough to keep it out)?

2023 05 19: Fossil Fuel Companies Should Pay Trillions in ‘Climate Reparations,’ New Study Argues ![]() How much of that does Ruby need to subtract from their $20Billion in “speculated” profits?

How much of that does Ruby need to subtract from their $20Billion in “speculated” profits?![]()

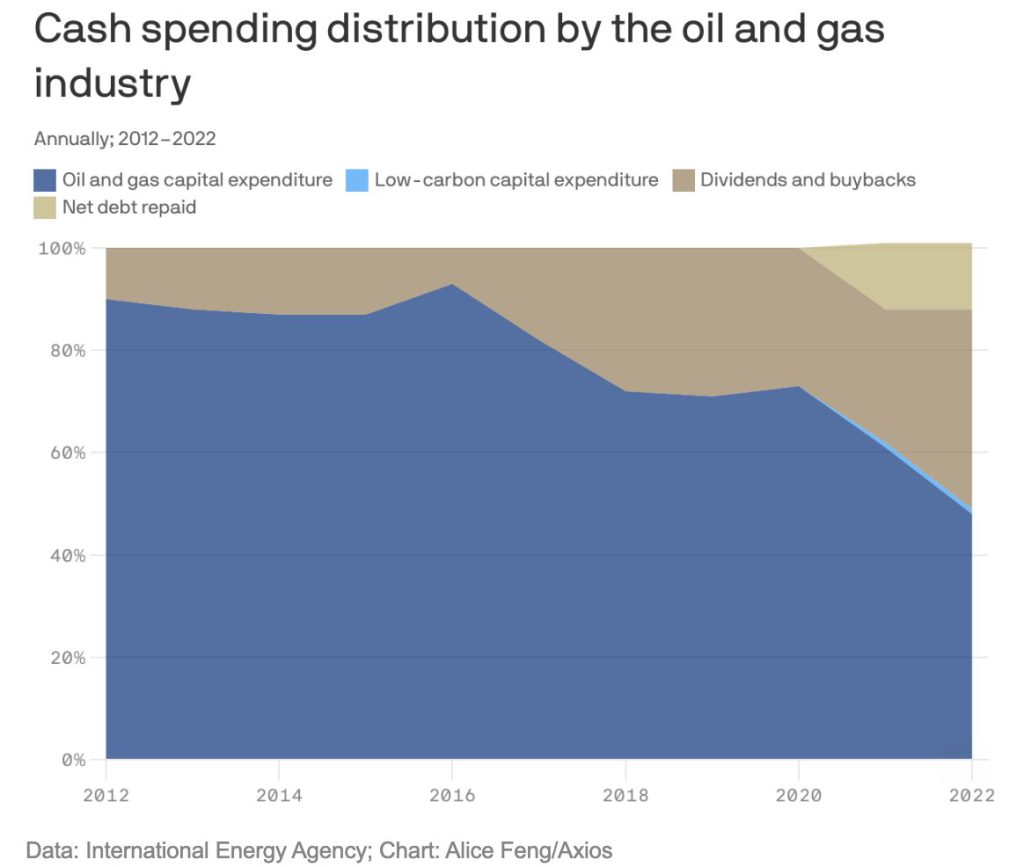

2022 from 2012, annually, best graph I’ve seen showing how boldly the oil & gas industry lies:

You need to work hard to to see the low-carbon capital expenditure. Note the net debt repaid.

2022: Switching to renewable energy could save trillions – study

2021: Gérard Montpetit: Judicial terrorism and frac’ing

2020: UK: Frac’ing is over as the big frac lies fail

2020: Shale’s Bust Shows Basis of Boom: Debt, Debt and Debt

… Shale producers’ financial problems stem from a decade’s worth of huge production growth using new fracking technologies funded by massive borrowing and financing from Wall Street.

Producers wooed investors by touting rosy estimates of how much crude oil they could profitably drill. But those estimates have proved too optimistic.

2019: Mega list of bankrupt companies! ![]() In Alberta no less, where frac’ers and oil and gas companies are above the law and get to freely damage public infrastructure, pollute, abuse communities, families, farms and small businesses (and harm their profits), and environment, get $billions in freebies and tax breaks, kill workers, they still can’t succeed financially.

In Alberta no less, where frac’ers and oil and gas companies are above the law and get to freely damage public infrastructure, pollute, abuse communities, families, farms and small businesses (and harm their profits), and environment, get $billions in freebies and tax breaks, kill workers, they still can’t succeed financially.![]()

2019: Houston-based Nine Energy shares slumped by -70.98% year to date; Lays off 70 employees, closes operations in Calgary, Red Deer and Grand Prairie, leaves Canada. Will they clean up on their way out?![]() Of course not, frac’ers, aka con artists, never do.

Of course not, frac’ers, aka con artists, never do.![]()

2019: Shell, ExxonMobil, Chevron & BP Could Be Legally & Morally Liable for Climate Crisis in Philippines

Snap below from the ruling:

2019: Frac’ing greed & insanity: More billions of frac dollars to go down the drain

2019: Another one bites the Frac Dust: Trident’s demise has far-reaching ramifications.

2016:

2016: Unsecured creditors owed $400M unlikely to collect on Sanjel liquidation

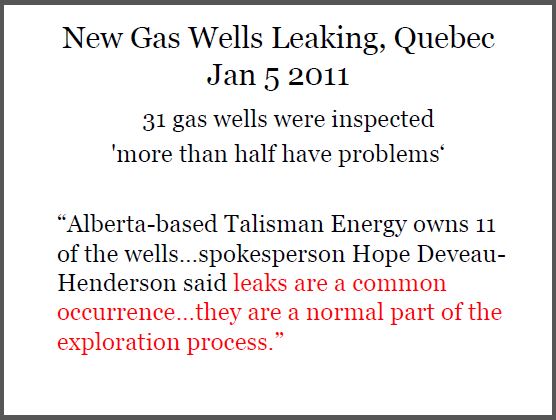

2015: Quicksilver bankruptcy deals blow to LNG terminal in Campbell River Company that frac’d near Zimmermans, with their drinking water subsequently becoming dangerously contaminated with methane and ethane (industry depth signature).

2015: Unconventional ponzi scheme implodes

2015: Frac company gone broke under your home?

“By any responsible account,” Chief Justice Castille wrote, “the exploitation of the Marcellus Shale Formation will produce a detrimental effect on the environment, on the people, their children, and the future generations, and potentially on the public purse, perhaps rivaling the environmental effects of coal extraction.”

2013: Shell CEO Peter Voser says he regrets the failure of Shell’s huge bet on US shale

2013: Quebec tables bill to block shale gas fracking

2013: UK taxpayers to pay for fracking pollution if companies go bust,

2012: Exxon: Fracking failure in China, Europe shale

… A proportion (25% to 100%) of the water used in hydraulic fracturing is not recovered, and consequently this water is lost permanently to re-use, which differs from some other water uses in which water can be recovered and processed for re-use. …

2011: Fracking will cause ‘irreversible harm’ Shale-gas extraction a huge risk

2006: My drinking water after Encana illegally frac’d directly into the fresh water aquifers that supply my well, come on over Ruby and Osler, I’ll share it with you and your kids.

Photo by Colin Smith

etc.

etc.

etc.