Read first!

2017 02 17: Brilliant! MUST LISTEN! BNN Interviews Alberta Oil Patch Consultant Brent Nimeck on Lexin and AER’s Orphan Wells: “This problem is 30 years in the making. … I would call it a Ponzi Scheme…. This is an orchestrated fraud from multiple angles: Industry, CAPP and the Alberta Energy Regulator have enabled this to happen. … Through our independent analysis and we’ve confirmed this at multiple sources within the energy regulator, the liabilities are over $300 billion. That’s what’s on the hook for Alberta taxpayers right now – $300 billion.”

Tax relief for industry and municipalities by Alberta Government, July 2, 2019

The Government of Alberta is acting swiftly to provide urgent, timely tax relief for shallow gas producers in dire straits. [Don’t families, small businesses and farms in Alberta suffering with frac’d water also need swift, urgent timely tax relief and, safe alternate water supplies?]

Economic mismanagement from the previous administration combined with low commodity prices have left natural gas producers on the brink of bankruptcy. As part of government’s overall action plan, immediate steps will be taken to work with municipalities to reduce 2019 taxes on shallow gas wells and pipelines. Shallow gas producers will receive more than $23 million in total support extended from this tax relief.

“You can’t tax business into bankruptcy. Unlike the previous government, which sat on its hands, our government is taking swift action to support shallow gas producers, protect municipalities and ensure a fair assessment model is in place for wells and pipelines. This initiative will prevent further company failures and job losses in our province, as we saw recently with Trident Exploration, while creating a more viable system for industry and government.”Kaycee Madu, Minister of Municipal Affairs

While property taxes go to municipalities, the assessment model for linear property such as pipelines is determined by the province. The model has not been updated since 2005, despite tremendous changes in the natural gas sector.

“Alberta’s natural gas industry has been hurting for years due to extreme [greed] low prices, inaction by previous administrations and an outdated property tax model. Our government committed to protecting Alberta’s natural gas industry and this measure is a tangible solution that will provide much-needed, short-term relief to our producers. We will continue to bring all stakeholders to the table to find collaborative solutions on this critical issue.”Dale Nally, Associate Minister of Natural Gas

Municipal Affairs will soon provide a list of affected wells to municipalities and companies.

“We recognize that municipal and education property taxes are not the core cause of the industry’s struggle, but are likely the only area in which short-term relief can be found, so we’re pleased with the Government of Alberta’s announcement, as it helps the shallow gas industry without unfairly penalizing rural municipalities. That said, in the long term, property tax should not be seen as a tool for relief.”Al Kemmere, president, Rural Municipalities of Alberta

When these companies go bankrupt, it’s not just the employees who suffer – leaseholders, local communities and provincial revenues are all affected. This initiative makes it clear that Alberta’s new government is focused on removing barriers to the success of the energy sector.

“This announcement is much-needed, positive news for Alberta’s natural gas sector, and for all Albertans. Rapid and decisive leadership from this government on the natural gas file is a demonstration of their commitment to protect Alberta jobs and we welcome this measure.” Tristan Goodman, president and CEO, Explorers and Producers Association of Canada

Quick facts

- About 65,000 wells qualify.

- The wells are predominantly found in 15 municipalities.

- Municipalities will continue to collect the remainder of property taxes from shallow gas companies, which go directly into their [drinking water aquifers]

local budgets. - This decision addresses fixed costs as referenced in the Natural Gas Advisory Panel’s Roadmap to Recovery report.

Province offers one-time tax relief for natural gas producers by Sammy Hudes, July 2, 2019, Calgary Herald

The UCP will offer tax relief this year for shallow gas producers suffering from a “broken” assessment system, the government announced Tuesday.

The province said it would be reducing municipal taxes on shallow gas wells and pipelines by 35 per cent, effective this tax year. The province would pay for that one-time reduction.

“It’s well established that the natural gas industry is in bad shape, particularly when gas is selling at a negative price,” said a government official.

“We looked at the situation and said that everyone agrees that the assessment system is inaccurate and so we’re going to act now to bring that down to what we think the true level should be and then we’ll commit to a proper full review of that system for the next municipal tax year.”

The problem with the assessment system is that it is valuing assets “higher than they should be,” the official said.

To provide relief, the province will ask municipalities to reduce taxes on shallow gas wells and pipelines by 35 per cent — the approximate amount by which the government believes the assessment system overvalues those assets — and cover the resulting municipal revenue loss.

The government would offset the revenue shortfall by reducing the amount of education tax required to be sent to the province by an equivalent amount.

The province said there will be no net loss to municipalities, as it would provide more than $23 million in education property tax credits in return.

“It’s an interim measure. The property taxes model should not be the one used for relief year-after-year,” said Al Kemmere, president of Rural Municipalities of Alberta. “This is a one-time thing that the province has decided to take on and it should not become a regular norm to have it happen.”

A government official confirmed that in future years, municipalities would tax shallow gas wells and pipelines at a lower rate.

That value will be determined by an assessment review, which the government aims to complete by December.

“This is mid-year in a tax year for municipalities and we didn’t think it was fair to impose that on them with no notice halfway through a budget,” the official said. “We saw Trident go under a few months ago and we think there might be a couple more coming. But the assessment system for wells and pipelines has been broken for a long time.”

In May, junior oil and gas company Trident Exploration Corp. announced it would cease operations and turn over care of its 4,700 wells to the Alberta Energy Regulator.

The privately-held Calgary-based company blamed its demise on low natural gas prices and high lease and property tax bills.

Natural gas producers in Alberta face intense pressure from volatile prices, infrastructure constraints, shrinking markets in the United States, investor apathy and growing liability concerns about aging wells.

Alberta’s new minister in charge of natural gas said last month that a large price differential was hurting Western Canadian producers — with natural gas prices in Alberta measuring less than a tenth of the benchmark American gas sold for — and could lead to more companies failing.

“Some days we are almost giving this product away for free,” said associate natural gas minister Dale Nally.

Tristan Goodman, president and CEO of the Explorers and Producers Association of Canada, applauded the government’s announcement. He said it “corrects, fairly rapidly, that error around reasonable tax rates” for shallow gas producers.

He said the “unique situation” faced by shallow gas producers has led to high tax assessments.

“There’s many of these wells but they don’t produce a lot. But they produce for very lengthy periods, so practically, the value of these assets is just not comparable to other assets across this province,” Goodman said.

“It’s putting them in an incredibly difficult financial situation and the unreasonable tax rates could actually lead to further bankruptcies.”

The province said its move would help prevent further bankruptcies and protect jobs.

It added it would be distributing a list of shallow gas wells which qualify for relief this year to affected municipalities and companies.

There are about 20-30 of those companies, primarily based in southeastern Alberta, totalling upwards of 66,000 wells, according to a government spokesperson.

***

Refer also to:

A few weeks ago, lost in the never-ending fog of Brexit, the cross-party public accounts committee released a damning report on the public cost of decommissioning oil and gas infrastructure. Their report vindicates every argument Labour has made against the government’s massive tax breaks for oil and gas companies, under its Transferable Tax History (TTH) policy.

2014 08 28: Canadian Association of Petroleum Producers: Coal bed methane operations contaminate water resources CAPP advertisement in The Calgary Herald

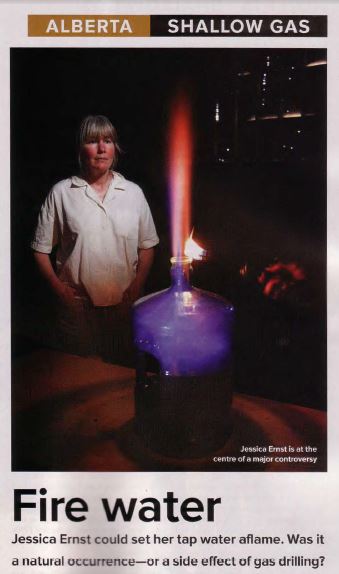

Yet CAPP’s Alex Ferguson says many worries about water quality are based on past operations involving coal-bed methane — shallow deposits in closer proximity to groundwater. These did occasionally contaminate water resources, he says. In some of the more infamous instances, affected landowners could light their well water on fire. Alex Ferguson was appointed Commissioner and CEO of the BC Oil and Gas Commission from 2007-2011.

***

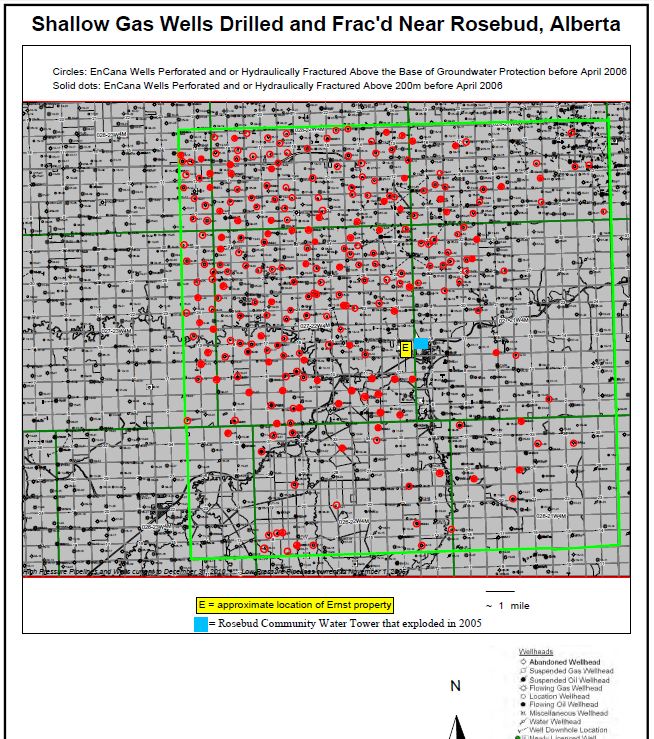

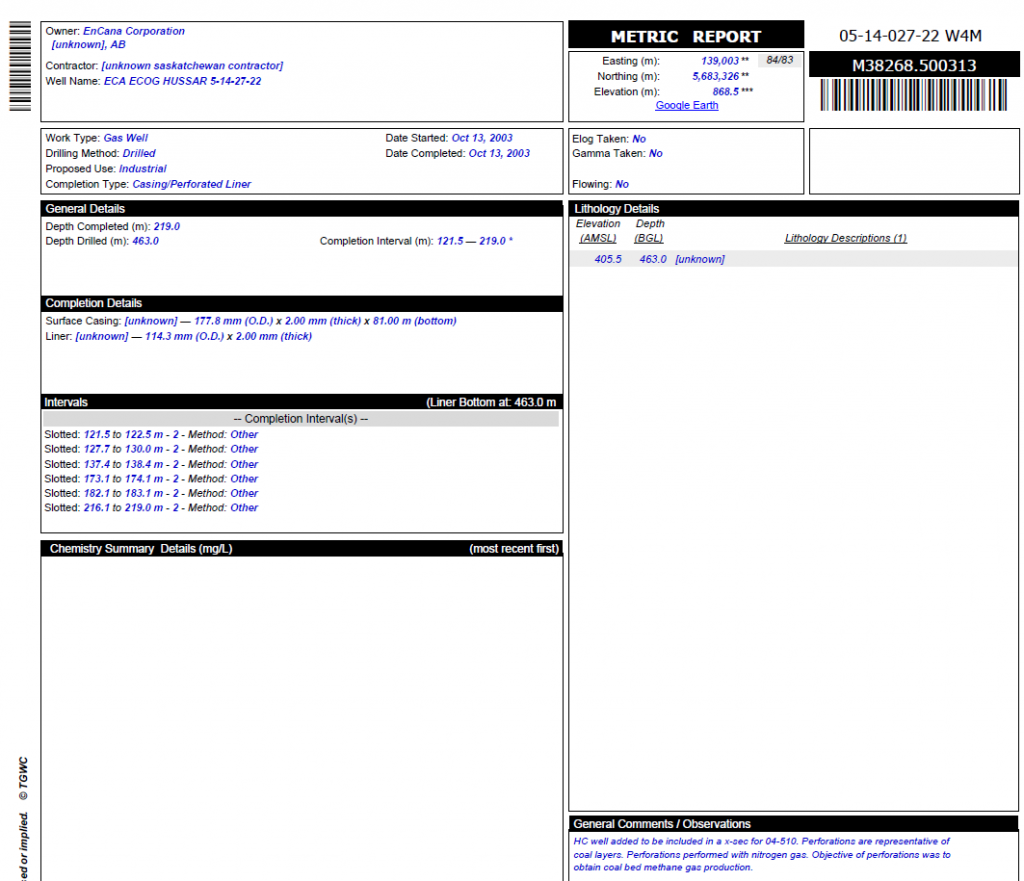

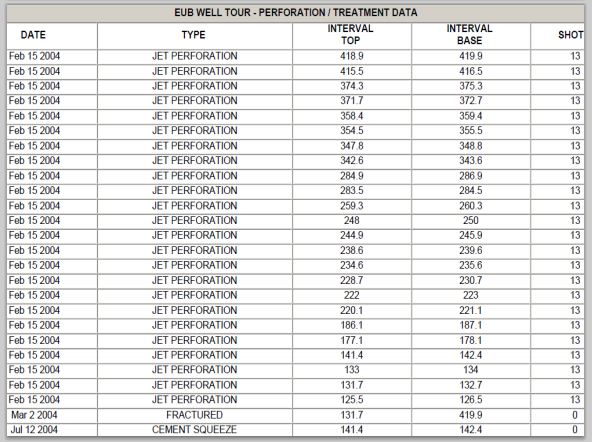

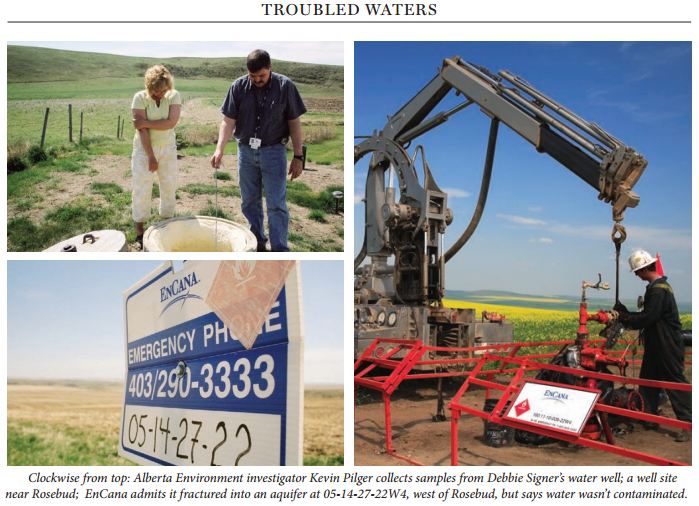

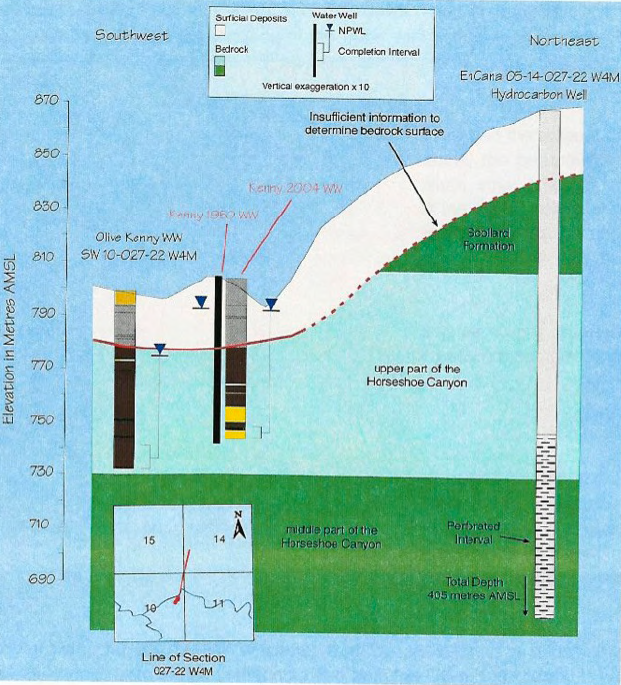

Refer also below to Encana’s own data/reports proving the company frac’d directly into Rosebud’s drinking water aquifers (to find out more about shallow gas frac’ing and Encana/regulator law violations in Alberta, read Andrew Nikiforuk’s award winning Slick Water):

Data above filed by Encana on Alberta’s groundwater database. Below, data filed by Encana with the EUB (now AER)

Above: Encana admits it fractured into an aquifer (it was in reality two aquifers, as stated by the Alberta Govt in their Statement of Defence) west of Rosebud. Encana’s admission was published in Alberta Views, October 1, 2006

Schematic above from HCL (Hydrogeological Consultants Ltd.) report for Encana, showing the perfs and fracs of Encana’s 5-14-27-22-W4M shallow gas well in relation to impacted Rosebud water wells in the valley. Ernst’s water well is also in the valley, southeast of and in groundwater flow from Encana’s gas well.