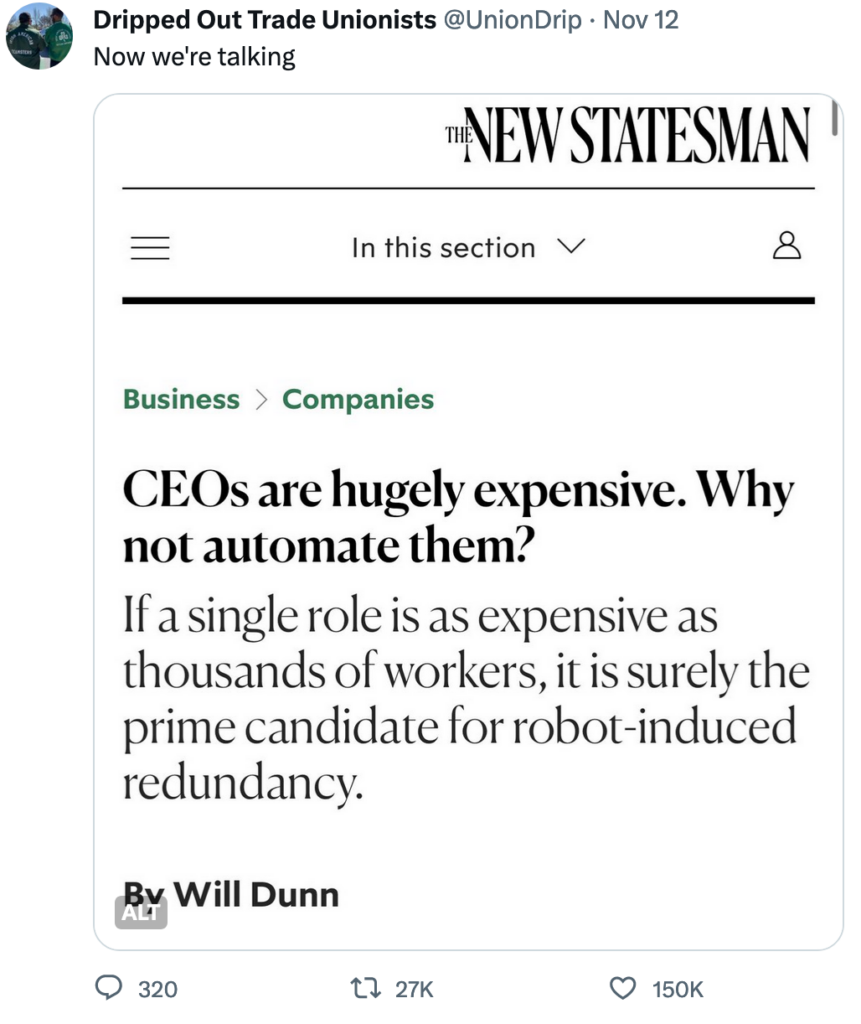

CEOs are hugely expensive. Why not automate them? If a single role is as expensive as thousands of workers, it is surely the prime candidate for robot-induced redundancy by Will Dunn, May 2023, The New Statesman

On Wednesday 31 May, it was reported that Alex Mahon, CEO of Channel 4, could receive record annual pay of £1.4m. This article was originally published on 26 April 2021 and asks, as Executive pay continues to rise, does a company need a CEO at all?

Over the next two weeks, the boards of BAE Systems, AstraZeneca, Glencore, Flutter Entertainment and the London Stock Exchange all face the possibility of shareholder revolts over executive pay at their forthcoming annual general meetings (AGMs). As the AGM season begins, there is a particular focus on pay.

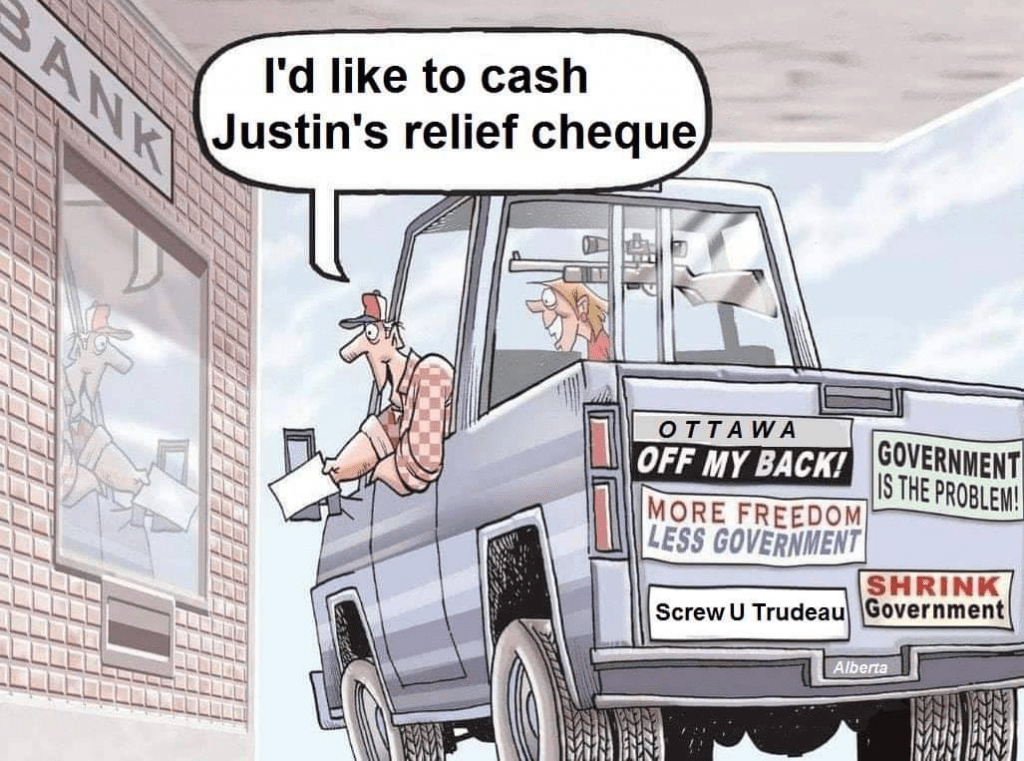

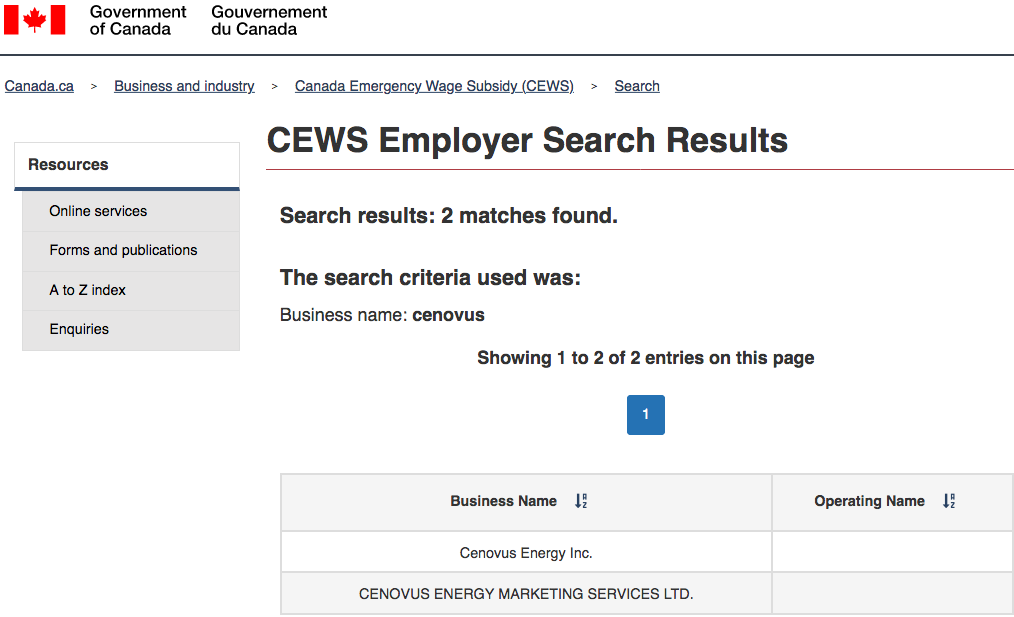

Executive pay is often the most contentious item at an AGM, but this year is clearly exceptional. The people running companies that have been severely impacted by Covid-19 can’t be blamed for the devastation of their revenues by the pandemic, but they also can’t take credit for the government stimulus that has kept them afloat. Last week, for example, nearly 40 per cent of shareholders in the estate agents Foxtons voted against its chief executive officer, Nicholas Budden, receiving a bonus of just under £1m; Foxtons has received about £7m in direct government assistance and is benefiting from the government’s continued inflation of the housing market. The person who has done most to ensure Foxtons’ ongoing good fortune is not Nicholas Budden but Rishi Sunak.

Under the Enterprise and Regulatory Reform Act, executive pay is voted on at least every three years, and this process forces shareholders and the public to confront how much the people at the top take home. Tim Steiner, the highest-paid CEO in the FTSE 100, was paid £58.7m in 2019 for running Ocado, which is 2,605 times the median income of his employees for that year, while the average FTSE100 CEO makes more than £15,000 a day.

As the High Pay Centre’s annual assessment of CEO pay points out, a top-heavy wage bill extends beyond the CEO, and could be unsustainable for any company this year. “When one considers high earners beyond the CEO”, says the report, ”there is actually quite significant potential for companies to safeguard jobs and incomes by asking higher-paid staff to make sacrifices”.

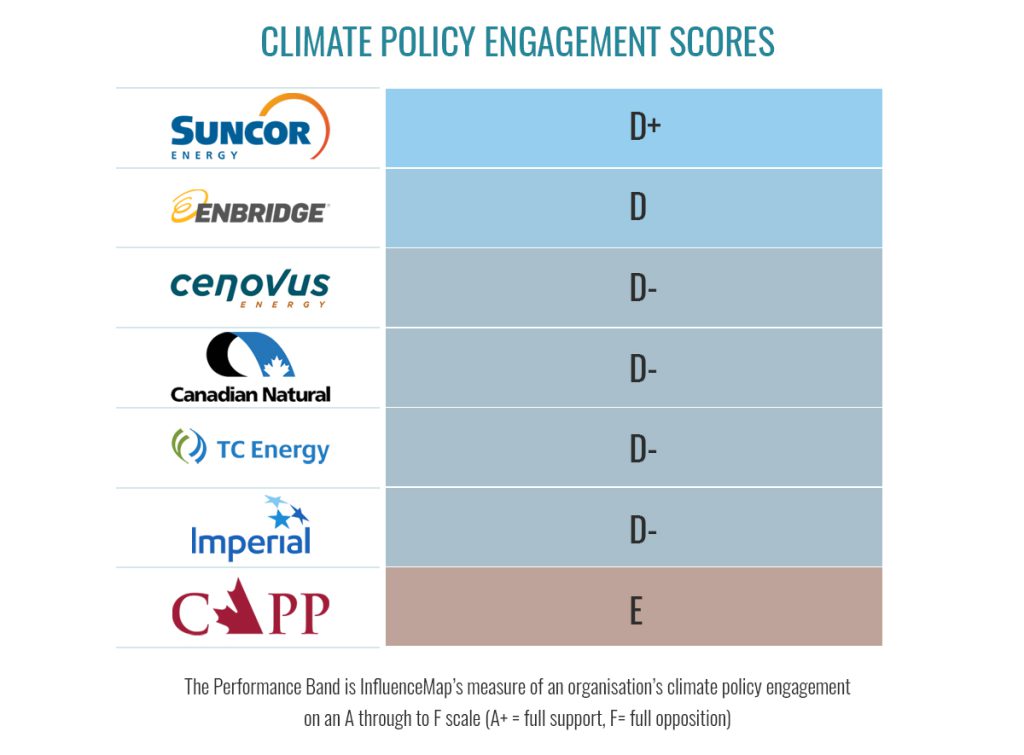

In the longer term, as companies commit to greater automation of many roles, it’s pertinent to ask whether a company needs a CEO at all.![]() Notably in the oil, gas, frac, coal and bitumen patch.

Notably in the oil, gas, frac, coal and bitumen patch.![]()

A few weeks ago Christine Carrillo, an American tech CEO, raised this question herself when she tweeted a spectacularly tone-deaf appreciation of her executive assistant, whose work allows Carrillo to “write [and] surf every day” as well as “cook dinner and read every night”. In Carrillo’s unusually frank description of the work her EA does – most of her emails, most of the work on fundraising, playbooks, operations, recruitment, research, updating investors, invoicing “and so much more” – she guessed that this unnamed worker “saves me 60% of time”.

Predictably, a horde arrived to point out that if someone else is doing 60 per cent of Carrillo’s job, they should be paid 50 per cent more than her. But as Carrillo – with a frankly breathtaking lack of self-awareness – informed another commenter, her EA is based in the Philippines.

The main (and often the only) reason to outsource a role is to pay less for it.

If most of a CEO’s job can be outsourced, this suggests it could also be automated. But while companies are racing to automate entry- and mid-level roles, senior executives and decision makers show much less interest in automating themselves.

There’s a good argument for automating from the top rather than from the bottom. As we know from the annotated copy of Thinking, Fast and Slow that sits (I assume) on every CEO’s Isamu Noguchi nightstand, human decision-making is the product of irrational biases and assumptions. This is one of the reasons strategy is so difficult, and roles that involve strategic decision-making are so well paid. But the difficulty of making genuinely rational strategic decisions, and the cost of the people who do so, are also good reasons to hand this work over to software.

Automating jobs can be risky, especially in public-facing roles. After Microsoft sacked a large team of journalists in 2020 in order to replace them with AI, it almost immediately had to contend with the PR disaster of the software’s failure to distinguish between two women of colour.

Amazon had to abandon its AI recruitment tool after it learned to discriminate against women.

And when GPT-3, one of the most advanced AI language models, was used as a medical chatbot in 2020, it responded to a (simulated) patient presenting with suicidal ideation by telling them to kill themselves.

What links these examples is that they were all attempts to automate the kind of work that happens without being scrutinised by lots of other people in a company. Top-level strategic decisions are different. They are usually debated before they’re put into practice – unless, and this is just another reason to automate them, employees feel they can’t speak up for fear of incurring the CEO’s displeasure.

Where automated management – or “decision intelligence”, as Google and IBM call it – has been deployed, it’s produced impressive results. Hong Kong’s mass transit system put software in charge of scheduling its maintenance in 2004, and enjoys a reputation as one of the world’s most punctual and best-run metros.

Clearly, chief execs didn’t get where they are today by volunteering to clear out their corner offices and hand over their caviar spittoons to robots. But management is a very large variable cost that only seems to increase – Persimmon’s bonus scheme paid out half a billion pounds to 150 execs in a single year – while technology moves in the other direction, becoming cheaper and more reliable over time.

It is often asked whether CEO pay is fair or ethical. But company owners and investors should be asking if their top management could be done well by a machine – and if so, why is it so expensive?

Refer also to:

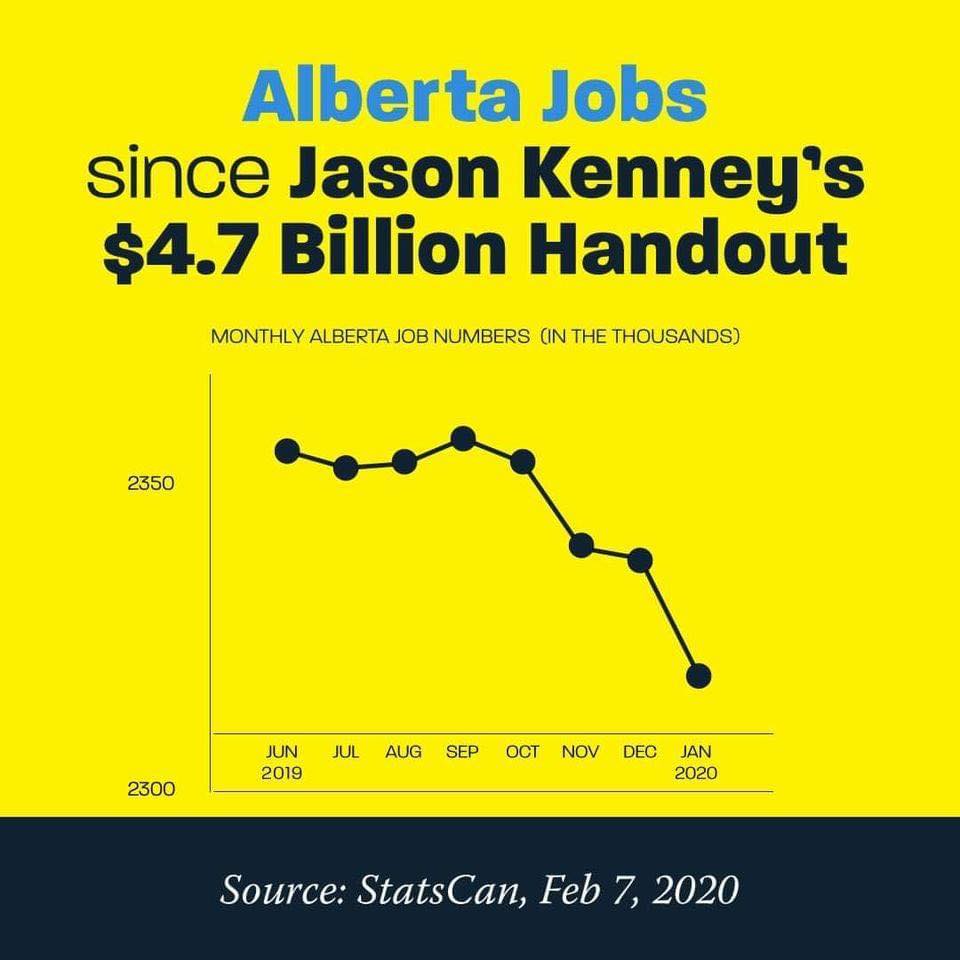

Analyzing Alberta’s “gooey delusion of perpetual oil revenue.” Robyn Allen: Globe and Mail columnist Robyn Urback sends wrong message characterizing Albertans as helplessly bullied, “Jobs are disappearing because oil producers have accelerated their strategy of displacing workers with technology.” … “Big Oil seems to have decided Alberta’s males are disposable.”![]() while con politicos federally and provincially, and those disposable males, blame Trudeau for the job losses, and everything else.

while con politicos federally and provincially, and those disposable males, blame Trudeau for the job losses, and everything else.![]()

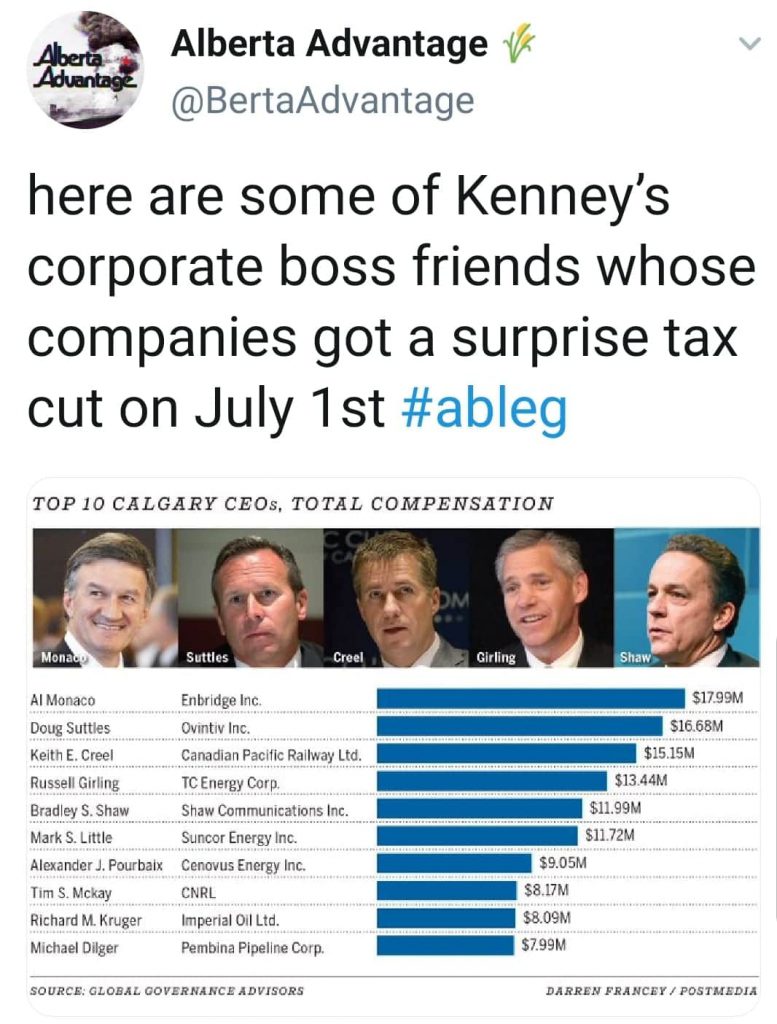

Top 100 People Killing the Planet, Includes Encana’s CEO Doug Suttles

Shell CEO Peter Voser says he regrets the failure of Shell’s huge bet on US shale

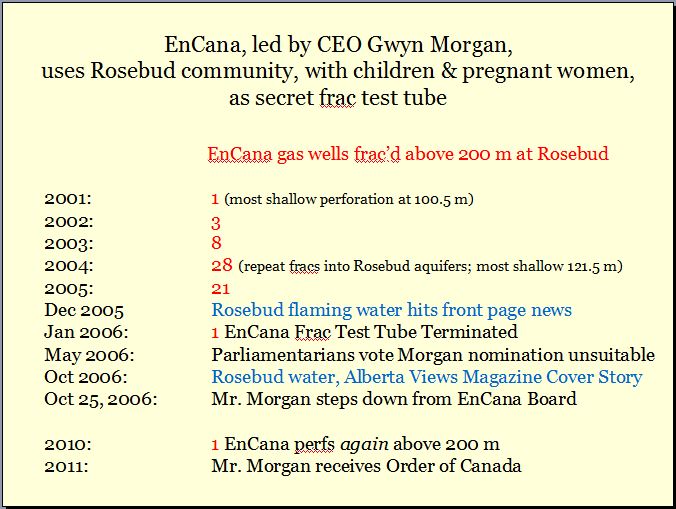

POETIC JUSTICE Minority Interests: A poem about Ex-Encana CEO Gwyn Morgan