Canada Revenue Agency names companies that received federal emergency wage subsidy by Bill Curry and Patrick Brethour, December 21, 2020, The Globe and Mail

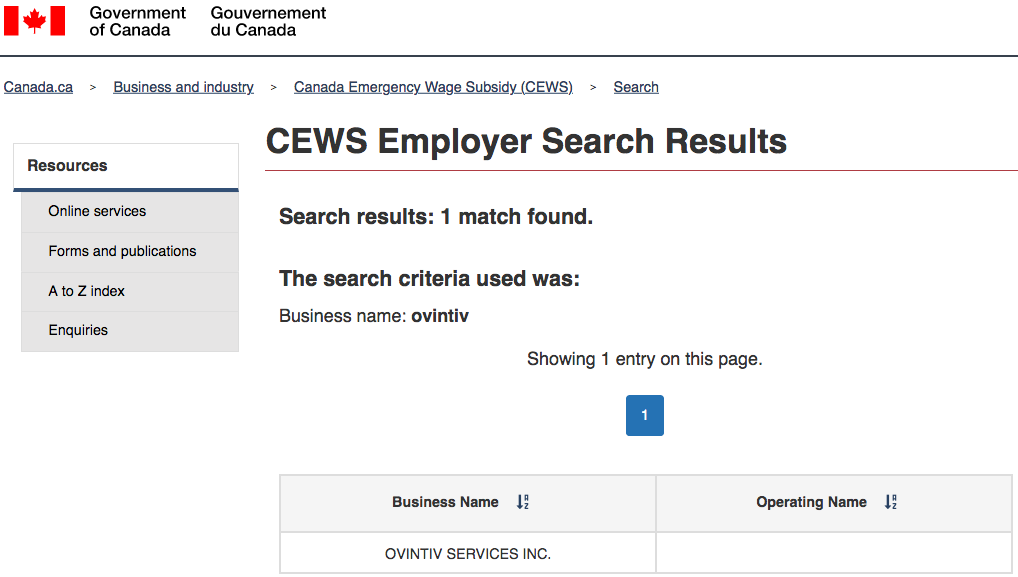

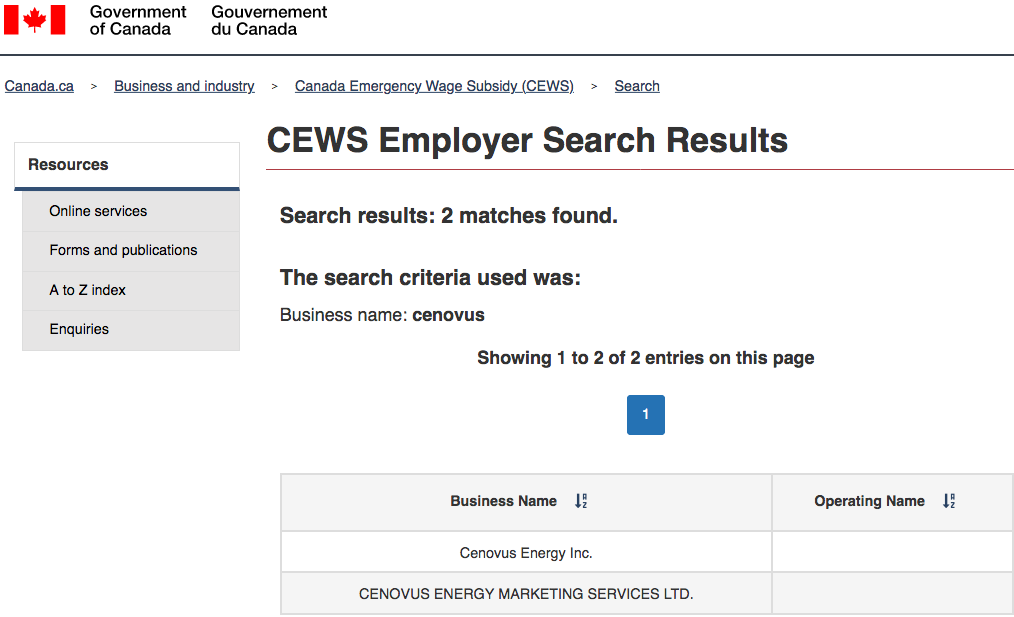

The Canada Revenue Agency released the names of all companies that received the Canada Emergency Wage Subsidy on Monday, and urged employees to report any suspicious activities related to the pandemic-relief program, which has paid out more than $54-billion since April.

The names are in a searchable online database. The information shows only the names of the companies. It does not indicate the amount of the subsidy, or when it was received.

The CRA also states that to protect the privacy of individuals, only the corporations will be identified. ![]() I want to know how much two-steak, ex Head of AER, ex VP of Encana/Cenovus, Gerry Protti got, directly or indirectly! And what about illegal aquifer frac’er lead of Encana, Gwyn Morgan? And charter-violation enabling “brotherhood” lead of AER when it was EUB, Neil McCrank?

I want to know how much two-steak, ex Head of AER, ex VP of Encana/Cenovus, Gerry Protti got, directly or indirectly! And what about illegal aquifer frac’er lead of Encana, Gwyn Morgan? And charter-violation enabling “brotherhood” lead of AER when it was EUB, Neil McCrank?![]()

To date, the agency says, more than 368,000 businesses, non-profits and charities in Canada have received the Canada Emergency Wage Subsidy (CEWS).

Immediately underneath the search tool, the CRA includes a link for Canadians to report suspected fraud.

Under the heading “information for employees,” the CRA states “if you have reason to believe a CEWS applicant is misusing the subsidy, you can report suspicious activities to the CRA.” Clicking a link goes to a page on how to report “suspected tax or benefit cheating in Canada.”

Aaron Wudrick, federal director of the Canadian Taxpayers Federation, said the publication of recipients’ names is a positive step, but that the government should go further and provide subsidy amounts, at least for the largest payments. Publishing such information would potentially highlight any abuses, he said, and awareness of such disclosures would reduce any future abuse, he said.

Mr. Wudrick said there is a clear contrast between the government’s tone when it comes to the CEWS program, where it has repeatedly warned of steep penalties for abuse, and its much softer approach to possible wrongful payments to individuals. “The onus has been flipped,” he said.

Before the release of the database, the CEWS recipients that had been identified were mainly large public companies that revealed such information through routine disclosures of revenue and expenses.

The program was designed to provide short-term wage support for companies that suddenly experienced a sharp decline in revenue owing to COVID-19. The size of benefit is proportional to the degree of revenue loss.

In an e-mailed statement, Parliamentary Budget Officer Yves Giroux said the database is a “good first step” toward transparency, since it will allow parliamentarians and Canadians to find out which companies received payments under the CEWS program.

Alla Drigola, director of parliamentary affairs and SME (small and medium-sized enterprises) policy for the Canadian Chamber of Commerce, said it was always clear that Ottawa might release the names of CEWS recipients, adding that the program has “stringent safeguards” to head off abuse. The CRA has already started midyear audits for CEWS recipients. Ms. Drigola urged the government to delay those audits, particularly for small businesses, until the worst of the pandemic has passed.

A recent review of CEWS disclosures by the Financial Post found that at least 68 publicly traded Canadian companies continued to pay out shareholder dividends while receiving the wage subsidy. The review found those companies got at least $1-billion in CEWS and paid out more than $5-billion in dividends.

The government did not impose restrictions on dividends or executive compensation for companies that accessed the CEWS. It did say such restrictions would apply on a separate pandemic loan program for large companies called the Large Employer Emergency Financing Facility, which has delivered only two loans to date.

Finance Minister Chrystia Freeland recently told MPs on the House of Commons Finance Committee that companies should ![]() The escape hatch word regulators and gov’ts use to help corporations avoid accountability and responsibility when eating up public money

The escape hatch word regulators and gov’ts use to help corporations avoid accountability and responsibility when eating up public money![]() use CEWS payments to pay employees only.

use CEWS payments to pay employees only.

“That money cannot be used for any other purpose. That’s something that is very important for Canadians to know and that’s something that the government needs to be and is very careful about,” she said in response to a question from NDP MP Peter Julian about dividend payments. “The design of the wage subsidy was to encourage as many companies as possible to keep as many Canadians on the payroll. The wage subsidy has so far kept almost four million Canadians on the job.”

The government’s request for Canadians to report fraud concerns related to the wage subsidy comes as Prime Minister Justin Trudeau recently said Canadians shouldn’t worry about receiving CRA notices related to the Canada Emergency Response Benefit (CERB).

While the CEWS went to employers, the CERB was paid directly to individuals who lost nearly all of their income and who earned at least $5,000 during the previous 12 months or the previous tax year. The CRA recently sent letters to CERB recipients whose qualifying incomes the agency was not able to confirm. Some have said there was confusion over whether the $5,000 threshold referred to gross income or net income after expenses.

“If that letter is causing you anxiety, don’t worry about it,” Mr. Trudeau said in a year-end interview with CBC News broadcast on the weekend.

![]()

Refer also to:

And as the deal is massaged, how many hundreds of millions of dollars in “bonuses” will pad pockets of ultra rich executives as they scrap job after job after job?

****

And the frac-harmed in Canada, remain on their own and get no help.