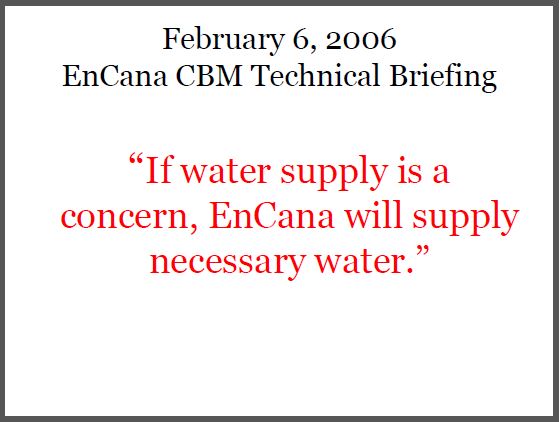

Any money to repair Rosebud’s drinking water aquifers, illegally frac’d and contaminated by Encana in 2004 – years before devilishly hatching out Cenovus?

How many billions of dollars in liabilities including not yet cleaned up spills and leaking wells is Husky dumping with this deal?

And as the deal is massaged, how many hundreds of millions of dollars in “bonuses” will pad pockets of ultra rich executives as they scrap job after job after job?

As ever, job kill off to feed the greed in the oil patch:

Snap above taken July 2, 2015 of a comment to Yedlin article in the Calgary Herald

‘Already struggling’ Calgary downtown core will be hit hard by job cuts from Cenovus-Husky merger, ‘If this isn’t the wakeup call in the sense of the oil and gas industry is not going to save Calgary, then I don’t know what is’ by Tyler Dawson, Oct 27, 2020, National Post

… The two companies said Tuesday the merger would result in roughly 2,100 layoffs as Husky joins Cenovus, a $3.8-billion deal that will make Cenovus the third-largest energy company in Canada. It’s not clear what jobs, specifically, might be lost. “The downtown of Calgary is the goose that lays the golden eggs in terms of the operation of our city and these job losses will hurt in a number of different ways,” said Coun. Evan Woolley, whose ward encompasses half of downtown Calgary.

Tuesday’s news is just the latest blow Calgary in general, and downtown Calgary in particular, has faced. Adam Legge, the president and CEO of the Business Council of Alberta, said the downtown vacancy rate is close to 30 per cent, and any further reduction will mean fewer downtown workers frequenting small businesses such as restaurants and dry cleaners in the city centre. … Downtown Calgary, unlike many other large cities, is heavily commercial, with few residential properties. This means, simply, the businesses and organizations downtown rely, in large part, on commuter traffic to put bums in barstools and cash on counters. … In Calgary’s specific case, much of that premiere downtown real estate is — or was — occupied by oil and gas giants.

“To suggest that the oil and gas industry will fill up that vacancy any time soon, or ever, is a faulty assumption. If this isn’t the wakeup call in the sense of the oil and gas industry is not going to save Calgary, then I don’t know what is,” said Dan Harmsen, partner and senior vice-president at Barclay Street Real Estate. …The layoffs at Cenovus-Husky aren’t even the first in recent weeks. TC Energy, the company behind the Coastal GasLink pipeline through northern British Columbia, announced an unspecified number of layoffs some weeks ago, followed by Suncor, which said it would shed 2,000 jobs over the next 18 months.

In total, the energy industry dropped 23,600 Canadian jobs in just three months this spring. …

Cenovus to cut up to 25% of workforce after merger with Husky, The job losses could total about 2,150 positions by Reuters, Oct 27, 2020, Calgary Herald

Cenovus Energy plans to cut 20 per cent to 25 per cent of its workforce after it acquires Husky Energy, the companies told Reuters on Tuesday, as Cenovus begins to slash costs in the Canadian oil patch’s biggest merger in four years. The job losses could total about 2,150 positions, based on the size of their workforces, with the majority to take place in Calgary, Alberta, Cenovus and Husky said in a statement. Cenovus confirmed the job cuts after two sources told Reuters of the magnitude of the reductions.

And, here’s the expected tanking of Cenovus (as happened to Encana/Ovintiv):

Cenovus Energy shares plummet on news of its $3.8B deal to buy Husky Energy by Dan Healing, The Canadian Press, Oct 26, 2020, Global News

… Analysts generally applauded the surprise Cenovus-Husky hookup announced Sunday for its operational advantages but criticized the plus-20-per-cent premium in the price for Husky. … The companies have identified $1.2 billion in potential annual cost savings which will include workforce reductions. But Gupta added the premium is “excessive” and joined other observers in predicting Cenovus shares would trade lower, as they did, falling by as much as 15 per cent to $4.15 in Monday trading in Toronto before closing down 8.4 per cent at $4.47. Husky, meanwhile, gained as much as 14.2 per cent to $3.62 before closing up 12 per cent at $3.55 . Husky shareholders are to receive 0.7845 of a Cenovus share plus 0.0651 of a Cenovus share purchase warrant in exchange for each Husky common share if the deal is concluded. Cenovus shareholders would own about 61 per cent of the combined company and Husky shareholders about 39 per cent.

The transaction must be approved by at least two-thirds of Husky’s shareholders but Hong Kong billionaire Li Ka-Shing controls 70 per cent of Husky’s shares and has agreed to vote them in favour of the deal. …

***

John Reed

All other oil producing countries are humming along just fine. Why can’t Canada get it’s stuff together and create policies that get this industry in Canada back on track?

Diana Daunheimer Reply to @John Reed:

In the past four years alone, over $35 billion in subsidies to the industry have been implemented in Alberta. This does not include the fact that the industry pays almost no fees in enforcement fines, no money to public health or environmental damages, gets their water for free and gets to use our airsheds and land as dumping grounds for indsutry waste, also for free. They also have sweeping exemptions for carbon costs and a deduction scheme built into the MRR. The NDP decreased royalties to the lowest in the history of the province and subsidized more than any PC government and still the industry is incapable of staying solvent? I think it’s time to address what is wrong with their business model, not federal policies.

$26 billion to NWUpgrader, nearly one million per day is being paid by Albertans since June 2018, because the plant is not operational, but payments are due.

$2.6 billion to Keystone XL

$2 billion for upgrading bitumen

$1 billion plus for petrochemical startups

$1.6 billion average per year in Crown Royalty Reductions

$1 billion in emerging/marginal plays, MRR RMC carbon cost deductions and other incentive programs

$1+ billion for bitumen rail cars

$400 million in CCIR payments for innovation

$235 million for OWF

$50 million for Education Property Tax relief resulting from oil and gas linear defaults

$400+ million from AIMCO for funding nearly insolvent operators such as Calfrac and Perpetual

$160 million/year for otherwise flared solution gas royalty reduction

$250,000 per facility, per year for methane emissions reductions

$1 million just announced in clear fuel exemptions for drilling

$60-260 billion in unsecured oil, gas, bitumen and coal liabilities and over $9 billion in oil and gas debt held by ATB

Diana Daunheimer

How can you write an article on this issue Mr. Bakx, yet fail to mention the Property Education Requistion Credit (PERC) program, implemented by the NDP, in response to delinquent oil and gas operators? Is it that readers would be even more outraged to learn that up to $50 million dollars is being taken from the Education Tax Fund, to compensate municipalities for their losses?

As for CAPP, Canadians should lobby to have them abolished. Industry operators do not have sufficient funding to pay for municipal taxes, surface lease payments, or for their hundreds of billions in liable assets, but can still afford to pay $4.64 per boe for membership with CAPP? Not to mention the tens of millions more each year, supporting an additional 200 industry groups, controlled oppostion eNGOs (examples, Pembina and Alberta EcoTrust) and the complex network of Synergy Alberta members. Governments should mandate that industry funding spent on lobbying, synergy and disingeneous stakeholder relations, is directed towards defaults and liabilties…instead of taking it from our children’s education fund.

AIMCo (ATB/Heritage Fund connected) announce $200 Million (bailout?) investment in “Quite leveraged” Calfrac

Shale Slaughter Continues; Wall Street turned off the tap on credit for drillers

U.S. Shale Is Doomed No Matter What They Do: “More bankruptcies are all but certain as oil and gas borrowers must repay or refinance **several hundred billion dollars** of debt over the next six months”

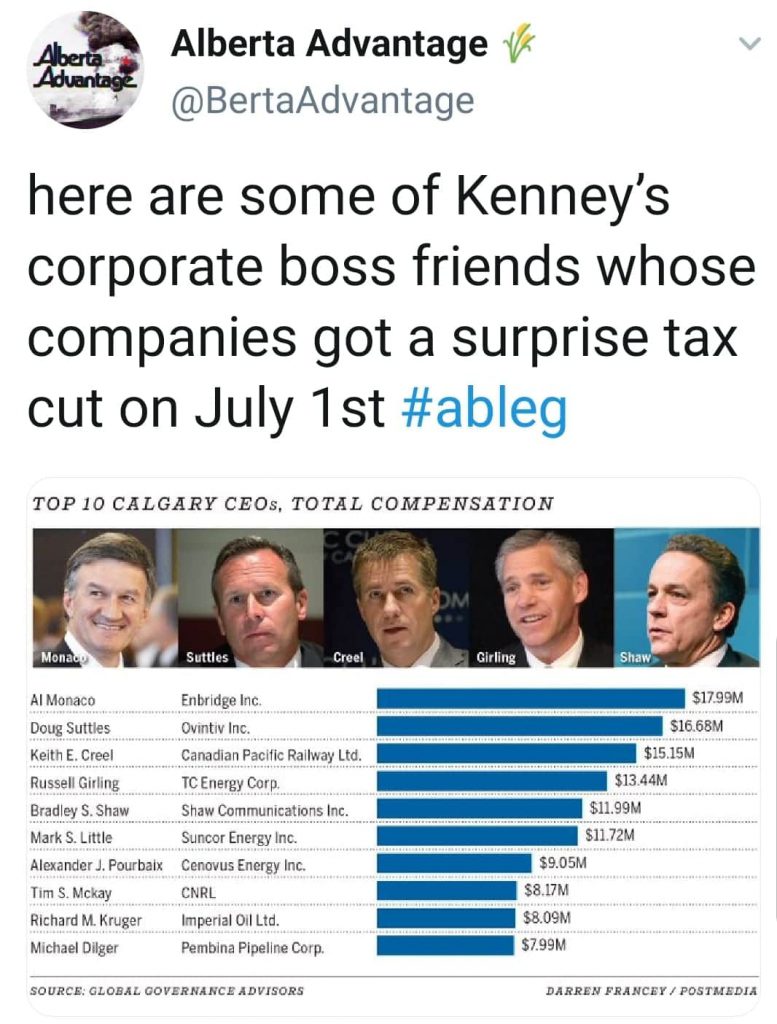

Kenney warns Albertans to brace for major cuts while giving massive tax cuts to rich corporations. CitizenWhoPaysTaxes: “Mom… how come we can’t have any nice things? Shut up son and wave to the nice Mr Kenney.”

Kenney’s $4.5 billion in corporate tax cuts obviously not enough to feed the greed.

Reality Check Questions:

Is AIMCo being used by Alberta politicians to relieve major players of their reclamation obligations by financing the sale of the depleted resources accompanied by massive liabilities….?

….is AIMCo (and Alberta teachers’ pensions, etc) being used to expand the orphan well problem and or delay any remedy to it?

Is AIMCo (supposedly the Alberta public’s savings account) intentionally being set up to take on the reclamation obligations?

Is this why Kenney is after our CPP?

End Reality Check Questions

… In a motion filed in Alberta’s Court of Queen’s Bench, the bondholders alleged that Sanjel, one of the largest fracking companies in Canada, “used the guise of good faith negotiations as a means of depriving bondholders of their opportunity to protect their interests.” … The creditors had also signalled their intention to go after Sanjel’s landlord, which is owned by Sanjel’s shareholders, to recoup some of the US$300 million they say they are owed.

But the creditors attempt to block the sale was denied in court on Thursday, according to people with knowledge of the case.

Canada Pension Plan intentionally making $Billion Bad investments in frac’ing?

Why commit to spend a billion to take on $billions in US Oilfield liabilities? Destroy the retirement of hardworking Canadians, burden us with US oilfield’s toxic legacy? Canada Pension Plan arm commits up to $1 billion to buy oil assets in U.S.

Oil firms bring record level of debt to bankruptcy court by Paul Takahashi, Oct. 24, 2020, Houston Chronicle

Debt from oil and gas bankruptcies reached a record high this year and will likely rise even higher as more companies file for Chapter 11 during the worst oil bust in decades.

North American energy companies have brought $89 billion of debt to bankruptcy court this year, up from about $70 billion during the last oil bust in 2014-16, according to a report published this week by Norwegian research firm Rystad Energy that analyzed data from Dallas law firm Haynes and Boone.

Fewer exploration, production and oil-field service companies have filed for bankruptcy this year: 84, compared with the historical high of 142 in 2016. But each bankruptcy filing this year reported significantly higher debt….

The average bankruptcy debt per company this year is $1.05 billion so far, almost twice as much as the 2017 level of $576 million.

Rystad, a Norwegian energy research firm, warned that it expects another 15 to 21 exploration and production companies to file for bankruptcy by the end of the year, pushing the related debt to more than $100 billion. Although crude prices have climbed back to around $40 a barrel, recovery remains tenuous….

“While oil and gas market fundamentals have improved significantly now compared with April-May, we argue that the North American bankruptcy wave is not over yet,” Artem Abramov, Rystad’s head of shale research, said in the report. “A significant number of small- and mid-size public and private producers are still experiencing financial challenges in the current price environment and questions about their ability to service their debt (in the next couple of years) remain.”

Houston-based Fieldwood Energy, The Woodlands-based Arena Energy and Chaparral Energy of Oklahoma City — oil and gas producers operating in the Gulf of Mexico — were among the latest companies to file for Chapter 11 in recent months. Several energy companies said they were forced to file for bankruptcy after lenders pulled credit lines as revenue dried up.

Energy bankruptcies were rising before the coronavirus pandemic wiped out global demand for crude and petroleum products such as gasoline and jet fuel.

Oil and gas companies are under increasing financial pressure after many investors pulled out of the sector in 2018 after years of underperformance.

Since the previous oil bust that ended in 2016, exploration, 448 production and oil-field services companies have filed for bankruptcy, bringing more than $272 billion of debt to court, Haynes and Boone said.

Energy Deals Shift to Renewables and U.S. Shale Bargains by powermag, Oct 23, 2020

At a time when deal activity in the energy and natural resources sector has slowed dramatically—down 26.2% globally year-on-year—one development in particular may define the industry’s near-term future.

In mid-May 2020, French oil major Total opted not to pursue a deal, announced in 2019, to purchase the African assets of Anadarko Petroleum, a U.S. producer that was being acquired by Occidental Petroleum. Two weeks after it withdrew its $8.8 billion proposal for offshore oil and gas properties in Ghana, Total announced it would spend about $3.8 billion for a majority stake in a renewable energy project in the British North Sea.

Total’s decision to move away from traditional oil and gas investments could be an indicator of what lies ahead for the industry.

The oil and gas sector was already on the brink of radical change before the COVID-19 pandemic crushed global demand for energy.

Facing a capital shortage as the shale revolution foundered, and a lagging stock performance, fossil fuel producers are under mounting investor pressure for cleaner energy in an effort to combat climate change. Traditional oil and gas producers are rethinking their long-term strategies, and increasingly, they are diversifying outside of the traditional oil and gas space.

Bargains in the Oil Patch

In the “Oil Patch,” the outlook is far bleaker. With West Texas Intermediate crude prices hovering just above $30 a barrel, few companies can make meaningful profits. Oil and gas businesses are desperately moving to control costs, and deals are more likely to focus on distressed asset sales, especially among smaller U.S. producers, which have been the hardest hit by the price and demand declines in the first half of the year. Not surprisingly, North America suffered the steepest decline among regions for second quarter (Q2) 2020 energy and natural resources deal value, falling 84.4% from a year earlier and 28.9% from the first quarter. It did, however, post one of the smallest declines in volume, falling 22.6% year-on-year, with 205 deals in Q2 2020. By comparison, Western Europe saw a decline of 42.4%, with 166 deals.

This could be a sign that some oil and gas assets remain attractive, albeit at lower prices. The likely potential buyers are some of the biggest players in U.S. shale now—majors or larger independents that have the financial resources to survive the downturn. These companies may decide to consolidate their positions and take advantage of the bargains.

The agreement between OPEC countries and Russia that extended production curtailments of 9.7 million barrels a day—or about 10% of global output—through July, could encourage more deal activity in 2020. However, some smaller members of the cartel may be hard-pressed to maintain lower quotas, and an uptick in U.S. production could send prices tumbling again.

It is worth noting that the current market is quite different from the last oil downturn. In 2016, capital markets were flush, which propped up asset values. This time around, capital markets have largely dried up for the industry. As a result, as the year goes on, we are likely to see quality assets available at low prices.

Private equity players, especially distressed funds, are also likely to remain key investors in oil and gas properties, but only at rock-bottom valuations, and it may take several months for the market to balance. Buyers will be looking for significant bargains, while sellers will be looking for higher prices to raise much-needed cash. When deals begin to flow, the primary targets will likely be smaller companies and assets with the lowest cost of production.

Bankruptcies and Restructurings

One factor likely to fuel deal activity in the sector will be bankruptcies. Rystad Energy, a Norwegian research firm, predicted that as many as 73 energy companies may file for bankruptcy this year. That number is expected to grow to more than 240 by the end of 2021 as oil demand remains weak, keeping prices depressed.

The bankruptcy surge could spark some consolidation across the industry. We may also see out-of-court restructurings in which the core business emerges with a new set of owners. Any consolidation that occurs outside of forced restructurings, however, will likely come through equity mergers, given the lack of investor capital available.

An important participant in the restructurings will be investors who loaned money against companies’ reserves. These reserve-based lenders have been hit hard by declining commodity prices. With few other options, they will take equity positions in restructurings, essentially betting that over time they can receive a higher recovery than if they liquidate assets immediately.

One issue that could cause some potential buyers to pause is environmental liability. The rapid shutdown of U.S. production has raised concerns about environmental consequences of unplugged wells. Private equity and other financial buyers in particular will be reluctant to take on significant decommissioning and abandonment liabilities, and may look for sellers to retain at least a portion of these liabilities, as we have seen in recent years in UK North Sea deals, for example.

We are already seeing a growing number of situations in which environmental liability could play a role, such as when an operator files for bankruptcy after shutting-in as many as half of its wells to conserve cash. Many of those wells are unlikely to come back online quickly, if at all, and many states require that they be plugged.

But buyers typically only want to purchase producing wells. If bankruptcy courts approve the sale of the producing wells, it could leave state regulators with a bankrupt debtor that is unable to plug wells properly. Courts may order the sale proceeds from producing wells to cover the costs of environmental liabilities, leaving fewer proceeds for distribution among unsecured creditors.

Eyeing a Renewable Future

Like other facets of the energy industry, renewables have been affected by the global lockdowns and stay-at-home orders brought on by the pandemic. Factory closings, in particular, have cut electricity demand, disrupted supply chains, and created delays in the construction of new wind farms and solar arrays. But unlike oil, which faces the prospect of long-term demand declines and continued weakness in pricing, electricity demand is expected to rebound as economies reopen around the globe.

This rebound may be somewhat tempered in the U.S. because of very low natural gas prices, which tend to pressure electricity prices. But broadly, this backdrop is creating opportunities for traditional energy players to potentially pick-up renewable assets, at least those operating as merchant power plants, on the cheap—before longer-term trends start to reemerge.

Energy transition remained a motivator for deal activity throughout the first half of 2020, as governments around the globe continued to call for reductions in greenhouse gas emissions. While distressed oil and gas assets may result in bargain hunting in the Oil Patch, relatively strong activity continues in the power and utility sector, with an eye toward renewable energy.

A prime example occurred in June when the Abu Dhabi National Energy Co. (TAQA) completed a transaction with Abu Dhabi Power Corp., creating one of the EMEA (Europe, Middle East, and Africa) region’s largest utility companies, and its third-largest publicly traded company by market capitalization. TAQA now has 23 GW of power generation capacity globally, of which 1.4 GW are from renewable sources, and 4.4 GW under development, of which 2 GW are from renewable sources.

Additionally, COVID-19 stimulus packages around the world may provide an important source of capital for deal activity in the renewable and power sectors. In July, the European Union announced a COVID-19 recovery fund, of which 30% or €550 billion must be spent on climate initiatives over 2021–2027.

Even in the U.S., where the Trump administration has been more supportive of conventional energy production, the Treasury Department extended the deadline for onshore wind and solar projects to qualify for the production tax credit (PTC) and investment tax credit (ITC). Onshore wind projects that started construction in 2016 and 2017 now have five rather than four years to finish construction for the PTC benefits. For solar developers, the IRS will now allow equipment bought in 2019 to be delivered into October 2020, while still retaining its eligibility for the ITC.

Prior to the COVID-19 outbreak, and especially when compared with oil and gas, renewables were in a state of growth driven as much by public policy and sentiment as by economics. But those factors will not change as the pandemic subsides. If anything, the recovery from the COVID-19 shutdowns may serve as a catalyst for the change that was already underway in the sector, with big oil following the trend set by Total in early June, and shifting its focus away from fossil fuels to a cleaner future.

Subject: How Much Further In The Hole Can Alberta Afford To Go—-With A Con Artist [Premier]??

Date: Sun, 25 Oct 2020 13:17:06 -0600

From: Stewart Shields email hidden; JavaScript is required

To: Prime ministre email hidden; JavaScript is required, email hidden; JavaScript is required, chrystia freeland email hidden; JavaScript is required, email hidden; JavaScript is required, letters email hidden; JavaScript is required, email hidden; JavaScript is required, Ministerial Unit email hidden; JavaScript is required, Ministre / Minister (EC) email hidden; JavaScript is required

CC: Brian Jean email hidden; JavaScript is required, email hidden; JavaScript is required, email hidden; JavaScript is required, email hidden; JavaScript is required, Lacombe Ponoka email hidden; JavaScript is required, email hidden; JavaScript is required, Public Interest Alberta email hidden; JavaScript is required

The shrinkage in the Oilpatch continues as it should- with the players themselves deciding how the game is played!! It continues to disappoint to see our federal tax dollars being Gifted to many of these shyster industry members —who drove Alberta broke- by capturing and milking the publicly owned resources from a Conservative Government who were very unstable on their feet!! The combined company will have upgrading facilities that Cenovus never had prior to this deal that should help on the profit margins for Cenovus !!

A close examination of the Canadian oilpatch must have us question so many of the Alberta Conservative Parties moves–with petroleum properties over the past 30 years?? How could Albertans be so unintelligent to again vote for the same political system that ran Alberta broke by flooding our petroleum developers with billions upon billions of our Alberta publics petroleum properties??

The Con Artist we now have as [Premier] is attempting to make our federal taxes available to the Shyster petroleum producers—while he sits tight on $18 billion- in a” Rainy Day” ‘’Heritage Fund” that Kenney had nothing to do with gathering? However—the glitter of wealthy in this Heritage Fund is what brought Kenney to the Alberta political scene—and again the glitter of this wealth is way Kenney sits on this wealth like an old “Clucking Hen” trying to hatch out far more profit for his retirement years?? Most Albertan have no idea how well worked-over the Alberta Owning public of petroleum properties have been until they realize that A $ 260 billion dollar environmental bill –is all we have left for the ownership of a trove of wealthy petroleum properties??

Stewart Shields

Cenovus to buy Husky Energy in deal valued at $23.6B, company will remain in Alberta

CALGARY — Cenovus Energy Inc. will buy Husky Energy Inc. in an all-stock transaction valued at $23.6 billion, the Calgary-based companies said Sunday in a joint announcement.

The merged Cenovus Energy Inc. will remain headquartered in Alberta. The deal would combine the companies into a new integrated oil and gas business with increased and more stable cash flows, the statement said. ![]() Pfffft! I don’t believe it.

Pfffft! I don’t believe it.![]()

Cenovus CEO Alex Pourbaix will head the combined company, with Husky chief financial officer Jeff Hart taking on that role at the new entity.

“We will be a leaner, stronger and more integrated company, exceptionally well-suited to weather the current environment and be a strong Canadian energy leader in the years ahead,” Pourbaix said in the statement. “The diverse portfolio will enable us to deliver stable cash flow through price cycles, while focusing capital on the highest-return assets and opportunities. The combined company will also have an efficient cost structure and ample liquidity.” ![]() Slick jibberish to con the masses?

Slick jibberish to con the masses?![]()

… Last Monday, ConocoPhillips announced it would buy shale producer Concho Resources in a deal valued at $9.7 billion that would create one of the largest U.S. oil producers.

Earlier in the month, one analyst pointed to the acquisition of a 17.6 per cent stake in Calgary oil and gas producer NuVista Energy Ltd. by rival Paramount Resources Ltd. as part of a trend toward “forced” consolidation in the troubled Canadian energy sector.

News of the Cenovus-Husky deal follows a Friday announcement from Alberta’s government that the province would end its oil curtailment quotas, a temporary measure intended to support oil prices. Spokespeople for both companies said Friday they welcomed the move. Indeed, Cenovus had already been producing above its curtailment levels with credits purchased from other companies. ![]() Create another greed-induced price crash just after prices started rising?

Create another greed-induced price crash just after prices started rising?![]()

Combining the companies will create annual savings of $1.2 billion, largely achieved within the first year and independent of commodity prices, the companies said.

“Bringing our talented people and complementary assets together will enable us to deliver the full potential of this resilient new company,” Husky CEO Rob Peabody said in the statement. “The integration of Cenovus’s best-in-class in situ oil sands assets with Husky’s extensive North American upgrading, refining and transportation network … will create a low-cost competitor and support long-term value creation.”

The combined company will be the third largest Canadian oil and natural gas producer, based on total company production, Cenovus said. It will have low exposure to oilsands benchmark crude, which typically trades at a discount to North American benchmark West Texas intermediate.

The transaction has been approved by both boards and is expected to close in the first quarter of 2021, pending shareholder and regulatory approvals.

Husky shareholders will receive 0.7845 of a Cenovus share plus 0.0651 of a Cenovus share purchase warrant in exchange for each Husky common share.

Job losses to come in wake of Cenovus-Husky transaction, but scale unknown, Cenovus spokesperson Reg Curren said ‘difficult decisions’ were ahead of the company, the result of ‘inevitable overlaps and redundancies in mergers of this type’ by Jason Herring, Oct 25, 2020, Calgary Herald

Layoffs are on the horizon for employees at both Cenovus Energy Inc. and Husky Energy Inc. after the companies announced a merger Sunday morning, but the scope of cuts remains unknown.

The joint announcement from the Calgary-based companies revealed Cenovus would buy Husky in an all-stock transaction valued at $23.6 billion, including debt.

The oil and gas giants will merge into Cenovus Energy Inc., which will remain headquartered in Alberta. It will become the third-largest Canadian oil and natural gas producer based on total production.

During a conference call with investors and stakeholders, Cenovus president and CEO Alex Pourbaix alluded to layoffs but did not provide specifics.

“Transactions like this are necessary to ensure our companies and investors stay strong, but there is no escaping the impact they inevitably have on some extremely talented and dedicated people,” said Pourbaix, who will head the combined company. ![]() Nasty!

Nasty!![]()

Our commitment is to make the best decisions we can and to treat everybody fairly and with respect and support as we go through this process.”

Cenovus spokesperson Reg Curren said “difficult decisions” were ahead of the company, the result of “inevitable overlaps and redundancies in mergers of this type.” He reiterated that details on job losses would not be immediately revealed.

“As part of the announcement, we identified $600 million in operating and corporate cost reductions, with a significant portion of that achieved through workforce reductions,” Curren said in a statement.

“We have identified the number of positions we anticipate will be eliminated to help achieve the cost efficiencies. Out of respect for our staff members, we want the chance to talk to them first about our workforce reductions so we will not be providing more details publicly today.” ![]() Always trash for the harmed.

Always trash for the harmed.![]()

Last October, Husky reportedly laid off hundreds of Calgary employees as the company dealt with continued impacts of the collapse in oil prices. …

Many more cuts can be expected at Husky as well as Cenovus, predicts Gil McGowan, president of the Alberta Federation of Labour. He said the oil and gas job market is only expected to grow bleaker in the coming months as more consolidations are anticipated.

“What makes it worse is that this almost certainly isn’t expected to be the last deal of its kind,” he said. “What this announcement illustrates is that the pain is going to continue.”

Business Council of Alberta president Adam Legge acknowledged likely job losses.

“No one likes to see any further job losses than what this province has already been experiencing, and that’s the likely, unfortunate outcome of these kinds of mergers,” he said. “(It will be felt) through everything from real estate to job losses.”

Cenovus said Sunday they had yet to make any decisions on their office space.

In past Alberta oil and gas mergers, including the 2009 deal between Petro-Canada and Suncor, sublease space was added to the market as companies aimed to cut redundancies. The same could happen here, speculated Greg Kwong, the Calgary managing director for real-estate brokerage company CBRE. …

Legge praised the merger from a business standpoint, saying it should make Cenovus more resilient and diverse and give the company “a new lease on life.” ![]() Smells like an intentional death plan to me.

Smells like an intentional death plan to me.![]()

“This is great news for Cenovus. It expands their footprint, gets them into some of the downstream retail market, which it sounds like they’ve been looking at for quite some time,” he said. “It’s probably a sign of more to come in the sense that as companies look to thrive in a new landscape, the reality is they’ll need to survive through scale.”