Some huge-money-losing background:

2014: Fracking in the Red & Junk Bonds Backing Fracking Facing $11.6 Billion Loss

Down down down the frac’ers go, taking our pensions, drinking water, environment, communities, health and more with them, all to make a few rich richer and more vulgar.

How many billions of American dollars in liabilities is the CPP intentionally shouldering Canadians with while enriching illegal aquifer frac’er Encana/Ovintiv?

2019 07 23: Canada Pension Plan intentionally making $Billion Bad investments in frac’ing? Or copying AIMCo laundering ordinary peoples’ pensions into flailing failing frac’ing companies while tucking big money into Encana/Ovintiv?

Pension Pirates on a tear in Alberta! Where’s the RCMP? Too busy harming the frac-harmed to keep Encana/Ovintiv happy?

The big shale shake-up is here by Axios, October 20, 2020

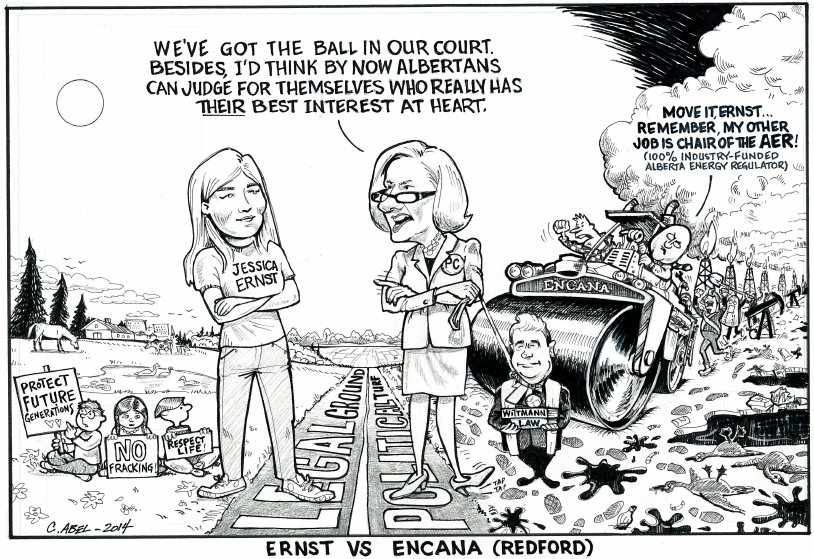

![]() Ovintiv was Run-Away-to-the-USA Scaredy-Cat Bully Encana

Ovintiv was Run-Away-to-the-USA Scaredy-Cat Bully Encana![]()

It’s really on now. Last night, the Wall Street Journal reported that Pioneer Natural Resources is in talks to buy Parsley Energy, and the Financial Times followed with a similar story about the big independents.

Why it matters: A wave of shale patch consolidation, predicted since the pandemic started hammering the industry’s already difficult finances, now seems to be happening.

State of play: Reports of a Pioneer-Parsley deal arrived the same day that ConocoPhillips announced a $9.7 billion all-stock deal to acquire Concho Resources.

Devon Energy and WPX Energy announced a merger in late September.

And, don’t forget Chevron’s deal to buy the big independent Noble Energy announced in July.

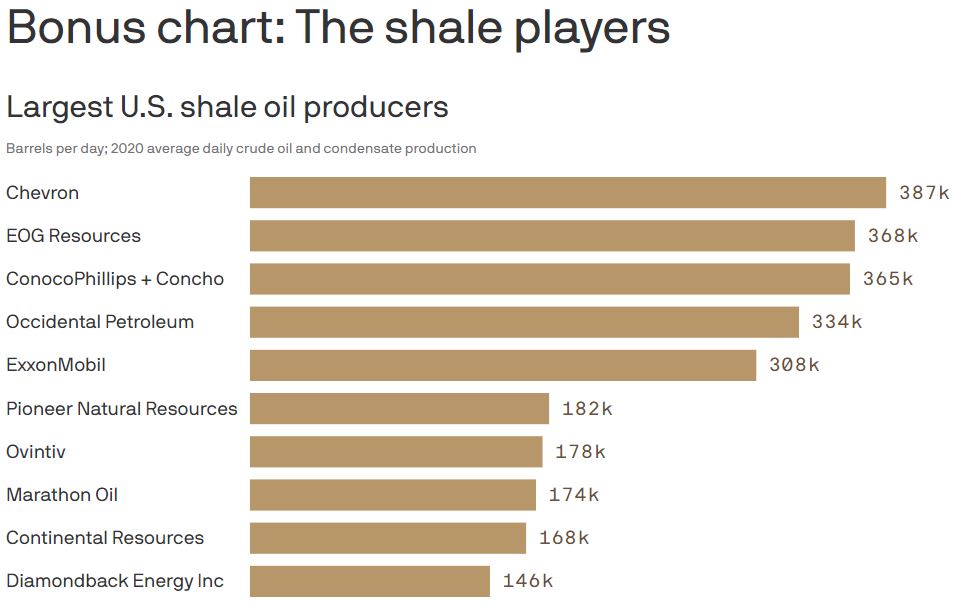

Bonus chart: The shale players:

This chart could soon look pretty different at this pace, but right now that’s the 10 largest U.S. shale oil producers based on Wood Mackenzie data.

Why it matters: It shows how the ConocoPhillips’ planned acquisition of Concho Resources announced yesterday would put the combined company in third place, per WoodMac’s tally.

What they’re saying: Robert Clarke, a top WoodMac analyst, says the deal makes sense.

He notes that Concho’s history gives them a lot of “incumbent” knowledge about the prolific Permian Basin, while Conoco is a “proven leader” in shale tech overall.

“This can be seen in how its Bakken and Eagle Ford projects have progressed down the cost curve as well as how successfully it manages later-life shale declines,” he adds.

Of note: The chart looks at data from this year, which has seen lower production due to the pandemic.

The figures don’t reflect Chevron’s just-completed acquisition of Noble Energy, nor Devon Energy’s proposed merger with WPX Energy, which would put them on the list.

The Drilldown: Canada Pension Plan must stop investing in fracking, say Colorado residents by Felixe Denson, Oct 19, 2020, ipolitics

The Lead

Colorado residents are asking Canadians to help stop the Canada Pension Plan from investing in Crestone Peak Resources, according to a video released this morning by an organization called 350 Colorado and Shift Action for Pension Wealth & Planet Health.

In “An Open Letter from Colorado to Canadian Pension Savers,” citizens discuss the impact that Crestone fracking projects have had on their lives and ask Canadian residents to help stop them.

“Your pension savings are being invested in ways that pollute our air and our water, harm the health of our children, and even influence our election to benefit the oil industry,” said Leslie Weise, who lives with her family three kilometres from the proposed site.

![]() Canadians suffer the same and as a fat frac bonus, get our pensions stolen by cruel politicians to fill pockets of rich American higher ups in multinational oil and gas companies and or failing frac’ers. I expect all Canadians – including our oil ‘n frac patch enabling judges and the RCMP – will collectively lose billions of dollars because of CPP knowingly investing in the failing frac industry, and apparently being used to launder our pension money into Encana/Ovintiv. In my direct experiences and observations of Encana/Ovintiv abusing my fellow Canadians; infiltrating community groups (that were trying to protect their families and drinking water) transforming them into enabling synergizers; funding/controlling environmental NGOs, turning them into despicable frac enablers and agents of harm working hard to discredit, smear and silence citizens courageous enough to speak out; controlling our regulators, turning them into deregulators, putting Encana/Ovintiv people at the top (e.g. lying Gerard Protti and Mark Taylor) and throughout; brainwashing school children (e.g. Insider Education); and much much more, Encana/Ovintiv wins Most Evil Corporation in Canada Award.

Canadians suffer the same and as a fat frac bonus, get our pensions stolen by cruel politicians to fill pockets of rich American higher ups in multinational oil and gas companies and or failing frac’ers. I expect all Canadians – including our oil ‘n frac patch enabling judges and the RCMP – will collectively lose billions of dollars because of CPP knowingly investing in the failing frac industry, and apparently being used to launder our pension money into Encana/Ovintiv. In my direct experiences and observations of Encana/Ovintiv abusing my fellow Canadians; infiltrating community groups (that were trying to protect their families and drinking water) transforming them into enabling synergizers; funding/controlling environmental NGOs, turning them into despicable frac enablers and agents of harm working hard to discredit, smear and silence citizens courageous enough to speak out; controlling our regulators, turning them into deregulators, putting Encana/Ovintiv people at the top (e.g. lying Gerard Protti and Mark Taylor) and throughout; brainwashing school children (e.g. Insider Education); and much much more, Encana/Ovintiv wins Most Evil Corporation in Canada Award.![]()

The Canadian Pension Plan Investment Board developed Crestone Peak Resources in 2015 and owns 51,000 acres worth of oil and gas wells and drill sites in Colorado. Crestone bought the land from Calgary-based Encana Corp. for close to $600 million, according to an article in the Globe and Mail in September.

According to residents, many fracking sites are being developed less than a kilometre from schools and homes. Poor air quality, including poisonous gas leaks, have given them health problems. ![]() Same in Canada – with the added bonus of Encana/Ovintiv illegally frac’ing Rosebud’s (Alberta) drinking water aquifers in 2004, contaminating them, with the regulators helping cover-up the crimes and contamination, and violating my rights for daring to ask for responsible regulation and agree to answer questions from the media (which Supreme Court of Canada Justice Rosalie Abella magically turned into me being a vexatious litigant in her ruling in Ernst vs AER even though I was not a litigant at the time).

Same in Canada – with the added bonus of Encana/Ovintiv illegally frac’ing Rosebud’s (Alberta) drinking water aquifers in 2004, contaminating them, with the regulators helping cover-up the crimes and contamination, and violating my rights for daring to ask for responsible regulation and agree to answer questions from the media (which Supreme Court of Canada Justice Rosalie Abella magically turned into me being a vexatious litigant in her ruling in Ernst vs AER even though I was not a litigant at the time).

Encana/Ovintiv still has not appropriately and completely fulfilled the Alberta Court of Queen’s Bench 2014 Order to disclose to me all relevant records relating to my lawsuit against the company. Trade secrets are not allowed in Alberta’s Rules of Court. Read more sordid Encana/Ovintiv, regulator and judicial industry details in Andrew Nikiforuk’s award-winning Slick Water.![]()

More than 1,000 formal complaints about Crestone’s operations have been made to the state regulator so far.

Environmental group says CPP breaking its rules with third-party donations in U.S. by The Canadian Press, Sept 28, 2020, The Globe and Mail

The Canada Pension Plan is overlooking its own rules that say its money cannot be used for political ends, says an environmental group.

John Bennett of Friends of the Earth says Crestone Peak Resources – a Colorado-based company wholly owned by the plan – should refund the more than $600,000 it has donated to industry-friendly political candidates and lobbyists.

“Everybody who’s got a job is putting money into that plan,” Bennett said Monday. “We want our money back.”

Crestone Peak was formed when Canadian energy giant Encana (now Ovintiv) sold off U.S. assets. It is 95 per cent held by the Canada Pension Plan and the CPP has a member on Crestone’s five-seat board.

Privately held, Crestone Peak is not subject to disclosure rules that govern publicly traded companies. ![]() Tricky nasty CPP, I expect led into this secrecy slime by Encana.

Tricky nasty CPP, I expect led into this secrecy slime by Encana.![]()

The code of conduct for CPP directors says: “Because of our public mandate, we must avoid any appearance of (the CPP investment board) favouring or disapproving of a particular political group, candidate, or political position.” ![]() Canada is a mighty corrupt country, with dirty, pissing-on-the-rule-of-law politicians, regulators, corporations, police, spy agencies, and judges gallore. CPP Board members I expect don’t give a shit about breaking their own rules – “regulators” in Canada do it all the time. Thankfully, the world is starting to notice Canada’s corruption and dirty courts which I expect is pissing off the rich and powerful raping us and our country.

Canada is a mighty corrupt country, with dirty, pissing-on-the-rule-of-law politicians, regulators, corporations, police, spy agencies, and judges gallore. CPP Board members I expect don’t give a shit about breaking their own rules – “regulators” in Canada do it all the time. Thankfully, the world is starting to notice Canada’s corruption and dirty courts which I expect is pissing off the rich and powerful raping us and our country.![]()

Colorado public records say Crestone has given more than $300,000 to the Senate Majority Fund, explicitly aimed at restoring a Republican majority to the Colorado senate. It has donated $200,000 to Better Colorado Now, which describes its purpose as to “oppose Democrat candidates for governor.”

Crestone has funded other pro-Republican groups, as well as groups fighting regulation of the energy industry, the records show.

The Canada Pension Plan Investment Board disputes the accusations.

Michel Leduc, the senior managing director and global head of public affairs and communications, said Crestone is an independent operator and distinct from the investment board. ![]() Like all the Dickheads appointed to powerful positions in Canadian agencies such as the CPP Investment Board, AIMCo and our regulators, I don’t believe a word he says. The sneaky shit squirreling around between Encana/Ovintiv and CPP Investment Board had me lose all respect and trust in CPP years ago.

Like all the Dickheads appointed to powerful positions in Canadian agencies such as the CPP Investment Board, AIMCo and our regulators, I don’t believe a word he says. The sneaky shit squirreling around between Encana/Ovintiv and CPP Investment Board had me lose all respect and trust in CPP years ago.![]()

“Virtually every significant operator in the U.S.A., across technology, financial services, telecommunications, energy, transportation, manufacturing and so on, are politically engaged as part of the policy making process. The notion that we wouldn’t invest in companies making donations is nonsense as it would force us out of the most significant economy in the world,” he said in a statement.

No pension plan funds were used for political donations, he added.

On the board’s website, it describes an extensive research program to understand and evaluate climate risks as well as to position its portfolio to avoid risk and take advantage of opportunities. That research is supposed to play a part in all the plan’s investments.

Bennett said he was stonewalled when he asked to see an analysis of how Crestone conforms to those guidelines.

“(Reports) can be redacted to deal with the financial things, but they should make public what their thinking is when they make a big investment,” he said. ![]() I expect if that were made public, Encana/Ovintiv would look mighty bad to investors (the company would flop into the sewer without their blind money), so I expect the company wouldn’t stand for it at the Investment Board, just like the company pisses on transparency at CER (prev NEB), AER and OGC, etc. and document exchange for my lawsuit.

I expect if that were made public, Encana/Ovintiv would look mighty bad to investors (the company would flop into the sewer without their blind money), so I expect the company wouldn’t stand for it at the Investment Board, just like the company pisses on transparency at CER (prev NEB), AER and OGC, etc. and document exchange for my lawsuit.![]()

Bennett said the Crestone situation points out problems with how the pension plan lives up to its promises of environmental sustainability and political neutrality.

Both pension plan employees and the companies the plan controls should be prohibited from political activity, he said. The plan should also be blocked from setting up privately held companies.

Its investments should also be subject to a financial “stress test” to see how exposed they are to climate risks, he said.

The CPP has many millions invested in fossil fuels.

Bennett said that puts its at odds with pension funds and investment funds around the globe, which are increasingly backing away from fossil fuel investments. Norway’s pension fund – believed to be the world’s largest – is selling off $10-billion worth of fossil fuel stocks over environmental concerns.

“Our pension funds should be invested in things that are secure for the long-term future,” Bennett said “There are lots of questions whether fossil fuel investments are good for the long term.”

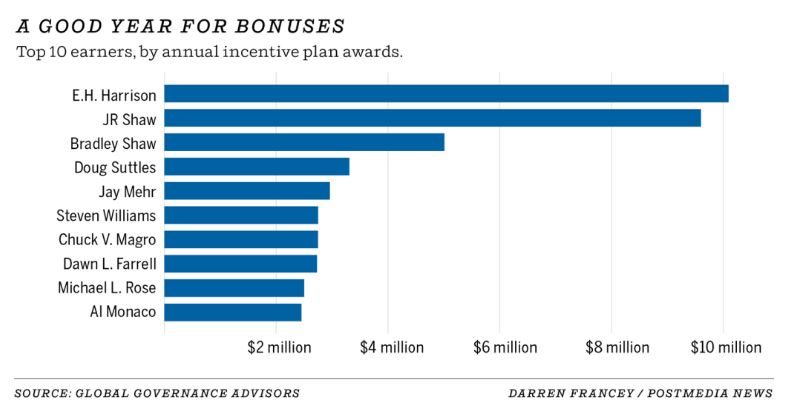

Lying, polluting and abusing ordinary citizens, our pensions and environment pays well:

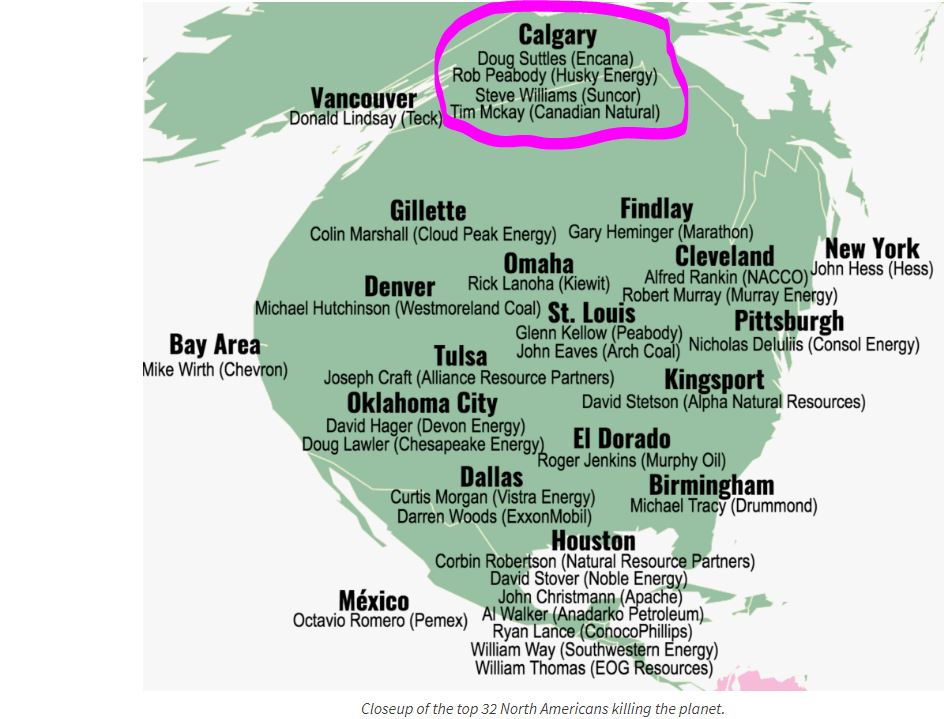

Top 100 People Killing the Planet, Includes Encana/Ovintiv’s CEO Doug Suttles

“Handled?” Lied to minimize it is more accurate.