Does the Ontario Teachers’ Pension fund inherit the law violations? Will investors repair Rosebud’s aquifers? Pipeline safe water to the community?

Snap taken July 2, 2015 of above comment to Yedlin article

Rumours prove true as Cenovus sells royalty lands by Deborah Yedlin, July 2, 2015, Calgary Herald

More than two weeks of rumours proved true Tuesday when Cenovus announced it had sold its Heritage Royalty Partnership to a subsidiary of the Ontario Teachers’ Pension Plan (OTPP) for $3.3 billion.

“It’s a milestone acquisition for us. We believe this asset is an excellent acquisition for us at a very attractive and opportunistic time in the cycle,” said Ziad Hindo, who manages the Tactical Asset Allocation and Natural Resources portfolios at OTPP.

Given the current commodity price environment, it’s an eye-popping price. Most analysts had expected the assets would sell in the $2.2 billion to $2.5 billion range. The added kick to the price was the surprise addition of a gross overriding royalty on two properties — 3 per cent at Pelican Lake in Alberta and five per cent at Weyburn in Saskatchewan. [Does that include covering damages for the groundwater contamination at the Kerr’s and their gas erupting, killer-gravel pit?]

Hindo admitted OTPP was taking advantage of the downdraft in oil prices that has affected valuations in the sector. “As a pension plan we tend to be contrarian in our strategy. We are capitalizing on the sell-off we have seen in oil and gas prices and in energy assets,” he said.

While there was some commentary Tuesday that Cenovus could rue the decision to include both assets — some thought they could have been spun off separately or sold in a joint deal with another company to capture a higher value — Cenovus management and its board clearly decided it was more important to remove any measure of uncertainty [WHAT DO ENCANA AND CENOVUS KNOW THAT INVESTORS DON’T?] and preserve maximum flexibility.

It also should quell potential takeover rumblings. Imperial Oil and Suncor surfaced in recent months as possible buyers, though both companies said they weren’t looking.

And that’s what seems to have transpired, even though Cenovus shares didn’t reflect that sentiment. Preliminary number-crunching shows the deal should translate in a $2 per share uplift, although Cenovus shares closed up 17 cents Tuesday at $19.97, below the bought-deal January price of $22.25 per share.

Some of that, however, might be because the shares were already reflecting a $2 billion transaction. It was just a question of when a deal would take place.

That Cenovus was going to do something beyond the share issue to keep its balance sheet and dividend intact had been widely expected, even before comments made during its first-quarter conference call. The chatter around Cenovus in the hallways of the Scotiabank CAPP conference last April centred on speculation as to when — not if — the company would cut its dividend. At that time, the consensus was that even with the equity deal earlier in the year that raised $1.5 billion, it wouldn’t be enough for the company to maintain its 20-25 per cent dividend payout, which is viewed as rich.

At the current price deck, analysts are suggesting the dividend is safe for as long as three years if oil prices don’t increase. Given the higher probability that oil prices will strengthen, Cenovus appears to have gotten itself out of a tough spot.

According to Peters & Co., the deal puts Cenovus’ debt to cash flow ratio at 0.5 times 2016 estimates on a go forward basis.

“This financial position ranks as being exceptionally strong versus its peers, with Suncor having the next best financial position among the large caps,” it said.

The report also pointed out the median debt to cash flow for the large cap group is 1.9 times, with Encana sitting at 4.5 times — the high end of the range.

Given where things are in the energy world, it’s not a bad place to be. The fact Encana is sitting at the opposite end of the leverage scale will no doubt elicit more than a few comments, not to mention renewed chatter as to why the two companies were created in the first place.

There are two questions that arise from the deal, for both Cenovus and Canadian Natural Resources Ltd. The question for Cenovus, is what’s next. The company has so far been mum on what it will do with the proceeds.

If Cenovus were to look for advice from the investment community it would see the recommendations are not to return to previous capital allocation plans, where the view was that the dollars allocated to conventional plays were not yielding the same returns as what was being seen from the oilsands assets. Presumably, the $3.3 billion from Tuesday’s deal means it can revisit expansion plans within oilsands portfolios that were put on ice.

As for CNRL, it’s also in a position to do a similar deal with its royalty lands. Company management first addressed the notion in June 2014, saying it was looking at all options in terms of monetizing those assets. About half are freehold lands, where the company owns the petroleum rights in perpetuity, while the other half are in the form of gross overriding royalties. In March, the company said it is planning to follow through on a sale of the royalty lands this year. The Cenovus deal likely advances the timing.

As to whether Ontario Teachers has spoken with CNRL, Hindo said he couldn’t disclose if discussions had occurred. Read between the lines on that one.

Ontario Teachers decided to do the Heritage Royalty Partnership deal on its own, but it’s a safe bet other pension fund players would have liked to have been involved as partners rather than be on the outside looking in for the same reasons OTPP stepped forward.

As Hindo said, OTPP liked the royalty model because of its ability to generate stable cash flows and that the linkage to commodity prices provides a hedge against inflation. They are long-life assets which make them a good match for a pension plan’s liabilities.

From Cenovus’ standpoint, the execution risk associated with a transaction involving a pension fund is virtually zero.

We are now halfway through 2015 and oil prices remain precariously balanced, with more downside risk in the coming months. For that reason, expect innovative transactions that crystallize value and shore up balance sheets to be on the oilpatch agenda for the remainder of the year. [Emphasis added]

Cenovus Energy sells royalty lands for $3.3 billion in cash by Amanda Jordan, June 30, 2015, Calgary Herald

Cenovus Energy Inc. agreed to sell a package of royalty lands to Ontario Teachers’ Pension Plan for about $3.3 billion in cash as Canada’s fourth-largest oil producer seeks funding sources after the drop in crude prices. Cenovus’s Heritage Royalty Ltd. Partnership unit holds about 4.8 million acres of royalty and mineral fee title lands in Alberta, Saskatchewan and Manitoba, Cenovus said Tuesday in a statement. These generate revenue from drilling by other companies. “The proceeds from this sale will strengthen our balance sheet and provide us with greater resilience during these uncertain times as well as the flexibility to invest in organic projects with strong returns,” Cenovus Chief Executive Officer Brian Ferguson said in the statement.

The decision to monetize the properties comes after the dramatic drop in oil prices since last year. The Calgary-based company raised $1.5 billion in a share sale in February as it sought to weather the slump. Since then it has considered several options to boost value from the royalty business, including a potential initial public offering of the unit. The company confirmed it was in talks with the pension plan earlier this month. The sale to Ontario Teachers’ is set to improve Cenovus’s ratio of net debt to capitalization, which was 27 per cent at the end of the first quarter, according to the statement. The lands produce the equivalent of about 7,800 barrels of oil a day. The acreage is bigger than analysts had been expecting and it includes added royalties, including from the Pelican Lake project. Michael Dunn of FirstEnergy Capital Corp. estimated earlier this month that a value of as much as $3 billion wouldn’t be unreasonable. The company expects the deal to close by the end of July.

2015 06 US EPA Frac Review Report:

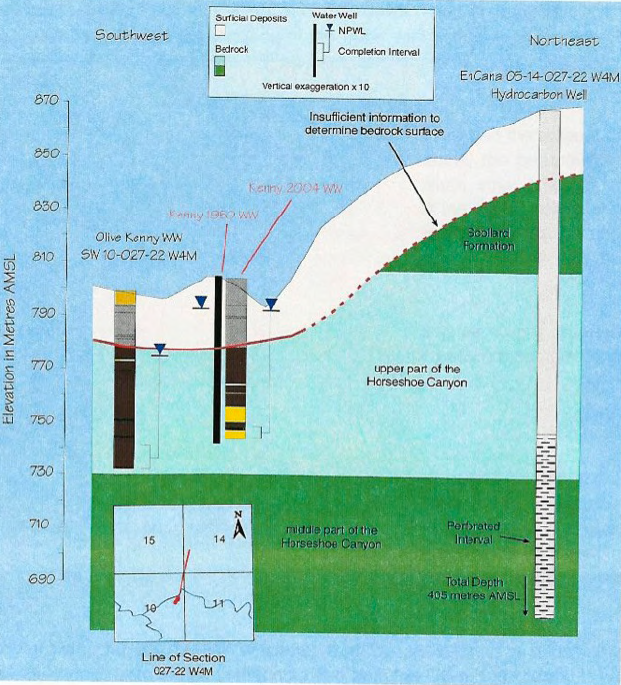

In one field in Alberta, Canada, there is evidence that fracturing in the same formation as a drinking water resource (in combination with well integrity problems; see Section 6.2.2.2) led to gas migration into water wells (Tilley and Muehlenbachs, 2012).

Energy giant Encana must fight for survival in new home by Jameson Berkow, June 1, 2012, Financial Post

Ironically, some of Encana’s current difficulties stem from the 2008 decision to spin off the company’s oil sands assets into what is now a very profitable Cenovus Energy Inc., which just this week won regulatory approval to begin developing a third site near northern Alberta’s Narrows Lake. [Emphasis added]

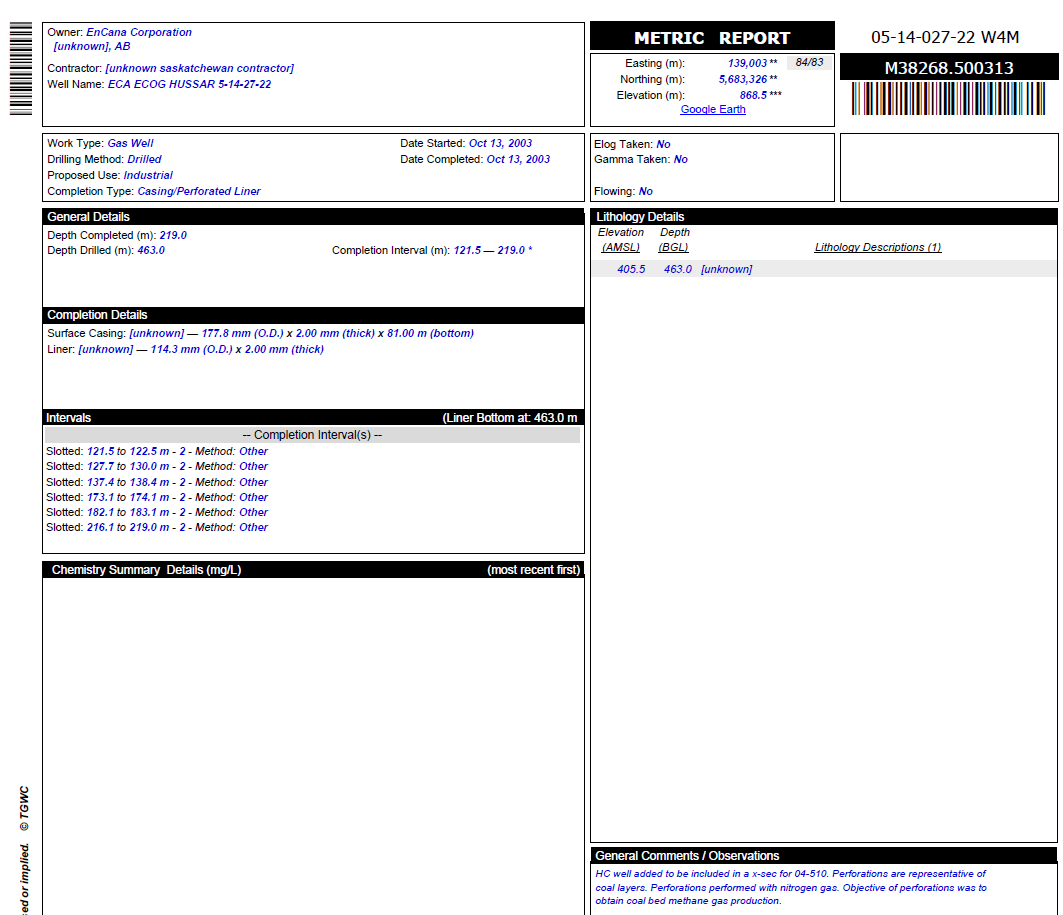

2004 Encana (now Cenovus) perf and frac data filed with the Alberta Water Well Data Base:

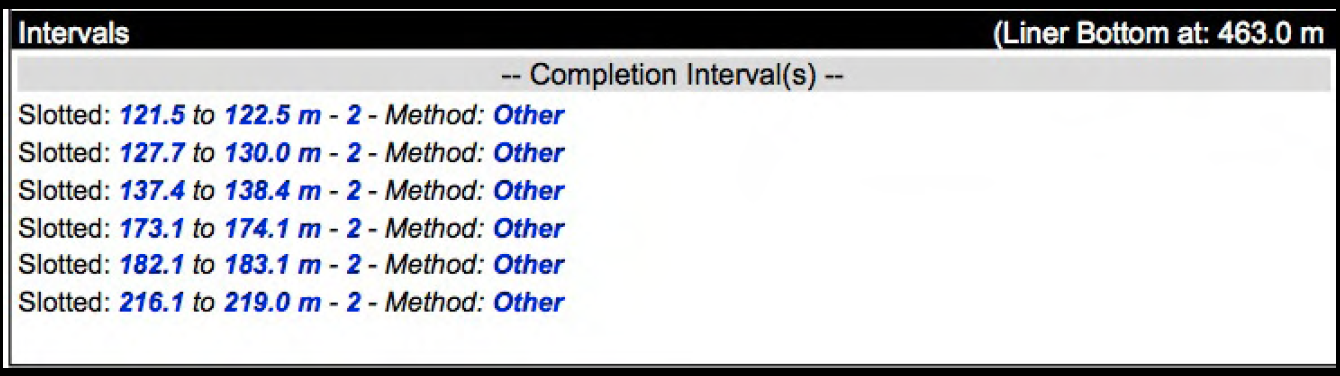

Close up of Encana (later split into Cenovus) perf and frac depths into Rosebud’s drinking water aquifers:

2005 01: Diagram from HCL’s hydrogeological investigation for Encana into the first water wells that went bad after Encana fractured Rosebud’s drinking water aquifers:

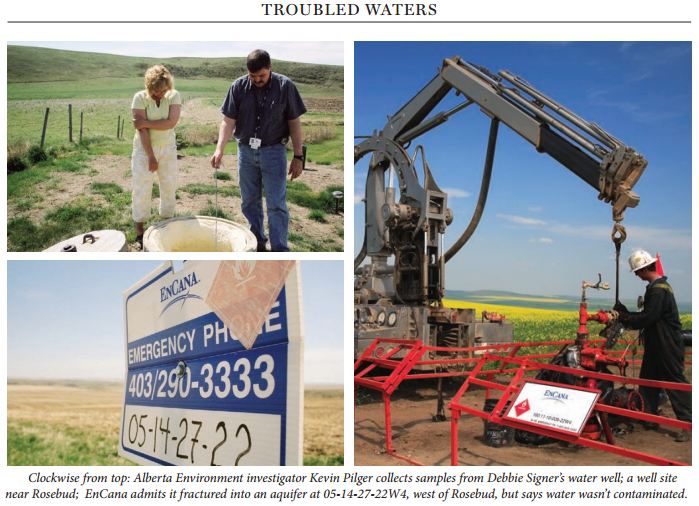

2006 10 Alberta Views article on the Debbie Signer water well contamination at Rosebud and Alberta Environment’s bullying, shaming and initial refusal to investigate:

[Refer also to:

Encana spinoff PrairieSky Royalty Ltd. surges in Toronto Stock Exchange debut