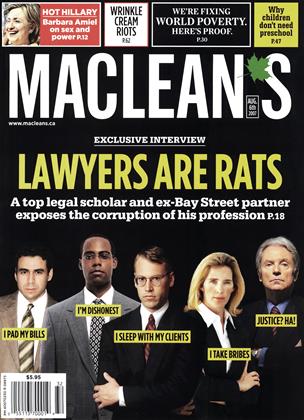

… And there’s an additional point: lawyers are taught to manipulate the rules…. If you’re a manipulator of rules, then you can’t respect the rules as such or believe that they incorporate important values. …

Former Goldman Sachs investment banker appointed to head CMHC by Bloomberg News, Dec 20, 2013

The Conservative government appointed a former investment banker to head the country’s housing agency on Friday, a sign Ottawa is ramping up the agency’s financial expertise as it seeks to rein in its massive mortgage insurance business

Canada named Evan Siddall, a former official with Goldman Sachs Group Inc., as chief executive officer of the country’s government-owned housing agency.

Siddall, who has been a special adviser to the Bank of Canada Governor for the past two years, will serve a five-year term at Canada Mortgage & Housing Corp. starting Jan. 1, the government said today in a statement.

Toronto-native Siddall holds a law degree from that city’s York University. He worked as a partner for Lazard Freres & Co. LLC and was managing director at the firm’s Canadian operations for six years, according to a biography on the Bank of Canada’s website. He has also held positions with Fort Reliance Co. and Bank of Montreal.

“I look forward to working with its dedicated staff, clients and stakeholders to ensure that Canadians continue to benefit from CMHC’s key role in providing affordable and accessible housing, as well as in promoting a strong financial system,” Siddall said in the statement.

At the central bank’s Toronto office, Siddal led projects that aimed to promote stability of the Canadian financial system.

In a Dec. 10 report, the central bank said “there is a risk of a correction in prices and construction activity” if the supply of new condo units in major cities such as Toronto isn’t absorbed. The housing market is also more vulnerable if demand has been inflated by investors who are more likely to get out of the market if it weakens, the bank said in the report.

CMHC boss Evan Siddall sees merit in doubling minimum home down payments from five to 10 percent by Charlie Smith, May 25th, 2020, Straight

… On January 1, 2010, CMHC mortgages were required to be reported on the balance sheets of banks.

In advance of this occurring and following the global economic meltdown in 2008, the Conservative government instructed CMHC to buy mortgage-backed securities from banks.

By 2010, the total federal buyback had reached $69 billion, according to Hilliard MacBeth’s 2015 book, When the Bubble Bursts: Surviving the Canadian Real Estate Crash.

MacBeth cited this to advance his argument that the federal government had actually bailed out Canadian banks during the 2008 financial crisis—even though this was never explicitly acknowledged by then prime minister Stephen Harper and then finance minister Jim Flaherty.

CMHC’s Evan Siddall prepares what could be his final acts as the most important person in Canadian housing, His biggest achievement might be the way in which he’s refocused CMHC on our housing needs, not our wants by Kevin Carmichael, Jan 03, 2020, Financial Post

… It’s Nov. 19, five years and 31 days since former prime minister Stephen Harper’s government appointed Siddall to a five-year term as the most important person in Canada’s housing nexus. In the spring of 2018, he agreed to stay an additional two years.

… CMHC, which was created to help build houses for veterans returning from the Second World War, used to be a reliable ally in the housing industry’s efforts to advance homeownership rates. …

Siddall joined CMHC as an outsider. His background was international finance as a dealmaker at Goldman Sachs Group Inc. and Lazard Ltd., two of the world’s biggest investment banks. He also worked at Irving Oil Ltd., one of Canada’s biggest industrial companies. Immediately before CMHC, Siddall had been working at the Bank of Canada as an adviser on financial regulation.

It’s important to remember that he was also handed a new mission.

The financial crisis was still a visceral memory in 2013. Harper’s government, especially finance minister Jim Flaherty, wanted someone who had a grasp of the bigger picture. The collapse of the United States housing market had pushed the global economy to the brink of a depression, and government-backed housing agencies in Washington had helped inflate the bubble. There was resolve to keep Canada off that path.

“Regrettably, CMHC became something rather more grand I think than it was intended to be,” Flaherty, who died in 2014, said around the time of Siddall’s appointment.

Your view of Siddall will depend on how you think Ottawa should work.

If you think senior bureaucrats and the heads of Crown corporations such CMHC and Export Development Canada should rarely be seen and almost never heard, then you probably see Siddall as an arrogant technocrat. “Arrogant” was the word Conservative member of Parliament Ron Liepert used during an exchange with Siddall at the Finance Committee in February 2017.

However, if you think democracies work best when policies are aggressively debated out in the open, rather than privately at caucus meetings or in the even smaller confines of the Office of the Prime Minister, then you might hope that Siddall inspires other public servants to follow his lead.

If not for Siddall’s alleged arrogance, there would have been less consideration over the past few years of the real-estate lobby’s contention that tighter mortgage rules were hurting the economy and unfairly punishing first-time buyers.

“Housing is too big a part of our economy and we’ve made it too easy to invest in housing, so that’s taking money out of the productive economy that otherwise would go there,” Siddall said during an interview that lasted the better part of an hour.

“All this comes back to my view that our job here at CMHC, and people think this is ironic, is to help people understand the perils of too much housing. You can have too much blood pressure. You can have too much housing.”

… “We don’t agree with (Siddall’s) analysis of the stress test,” CREA’s Bourque said. “We’d like to see it reviewed in a transparent way.”

His group would like to see requirements eased for regions where price appreciation has been milder, arguing that someone buying a $200,000 home in Saint John, N.B., should face fewer restrictions than a buyer in Vancouver or Toronto.

Mortgage Professionals Canada wants the rate at which borrowers must prove they can still make future payments lowered to three quarters of a percentage point above the offered rate, down from the current two percentage points. “The stress test is squeezing people out of the market, denying them a chance to build equity,” Taylor said. …

AIMCo taps former CMHC head Evan Siddall as next CEO by Ian Vandaelle, BNN Bloomberg, April 15, 2021

Former Canada Mortgage and Housing Corporation Chief Executive Officer Evan Siddall has been named the next chief executive officer of Alberta’s largest pension fund manager.

… Siddall retired from his role at CMHC earlier this month after helming the organization since the beginning of 2014. During that tenure, he frequently championed the mortgage stress test implemented by the federal government and other measures to help bolster housing-market stability, while also drawing criticism for predicting the COVID-19 pandemic would cause home prices to fall by as much as 18 per cent.

… AIMCo manages $118.6 billion on behalf of several provincial government funds and the pension funds of more than 300,000 Alberta public sector employees.

… Part of Siddall’s new mandate will be to strike a balance between investing in the energy industry, a key plank of Alberta’s economy, with the need to prepare for a lower-carbon future, Wiseman said in a broadcast interview Thursday. He added that investments in traditional energy and the green economy can not only co-exist but be complementary. …

AIMCo names former CMHC head Evan Siddall as next CEO by Andrew Willis, April 15, 2021, The Globe and Mail

Alberta’s government-owned investment fund named veteran Crown corporation leader Evan Siddall as its new chief executive officer on Thursday, while announcing the $118-billion asset manager significantly underperformed its benchmark last year.

Mr. Siddall, former CEO of Canada Mortgage and Housing Corp., will take over Alberta Investment Management Corp., or AIMCo, on July 1. He replaces Kevin Uebelein, who has run AIMCo for the past six years. The Edmonton asset manager invests on behalf of 31 provincial pension, endowment and government funds, including the Heritage Savings Trust Fund. …

Mr. Wiseman said Mr. Siddall was the board’s top choice as the next leader of AIMCo and brings a wealth of experience in financial markets and Crown corporations. Mr. Siddall, 55, holds a law degree and was at the Bank of Canada prior to joining CMHC in 2013. He previously worked as an investment banker with Bank of Montreal and Goldman Sachs, and as a senior executive at Irving Oil Ltd.

“Evan’s role is ultimately about serving AIMCo’s clients, who have very different needs,” said Mr. Wiseman, former CEO of Canada Pension Plan Investment Board. “Part of that role is to ensure the organization has flawless risk management, and is rewarded appropriately for the risks it does take.”

Mr. Siddall said in a press release he is delighted to join AIMCo and is “looking forward to working with AIMCo’s talented team of professionals in delivering consistently superior investment performance on behalf of our clients.” He is expected to move to Edmonton this summer. At CMHC, Mr. Siddall was active on social media and outspoken on hot-button issues such as mortgage lending standards and housing prices.

AIMCo’s current CEO, Mr. Uebelein, will depart on June 30. In a press release on Thursday, he said last year’s performance was “extremely humbling.” He said AIMCo’s public- and private-market portfolios are now performing well, and the fund is focusing new real estate investments on industrial and logistics properties, in the face of “challenged” outlooks for the office and retail sectors.

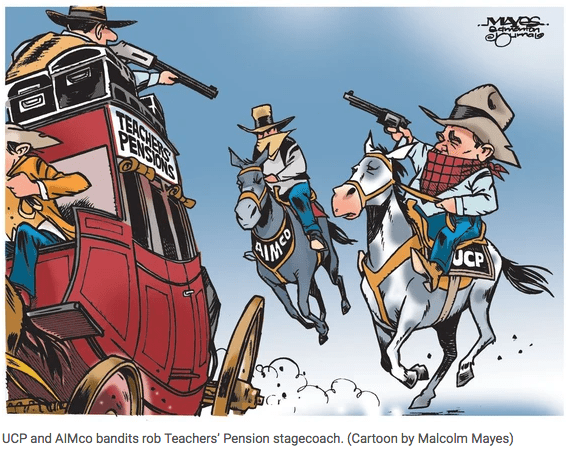

AIMCo’s new CEO arrives as Alberta Premier Jason Kenney’s government bulks up the fund manager by charging it with investing the $20-billion provincial teachers’ pension plan, a shift the teachers’ union is fighting in court. Mr. Kenney is also considering pulling the province’s contributions out of Canada Pension Plan and managing the money in Alberta.

The Alberta government also embraced confrontation with unionized employees last year by imposing a new investment agreement on AIMCo’s largest client, the $53-billion Local Authorities Pension Plan, a retirement fund for health care workers and government employees. In an interview on Thursday, LAPP chief executive Chris Brown said: “We have areas where we disagree, and we’re optimistic on new leadership, and looking forward to a conversation with Mr. Siddall on how we can find alignment on our common interests.”

In 2019, AIMCo’s CEO earned $2.8-million, compensation that is on par with similar-sized domestic pension plans and competitive with private-sector money managers. The fund manager ran a global campaign for a new leader, led by executive search firm Heidrick & Struggles International.

…

A few comments to the article:

Bhindi Properties LTD:

Oh god. What a wrong move. I am glad he left cmhc though.

Saward12:

Wiseman and Siddall both High flyers . …

El Guapo 66:

Carney and Siddall should be sent to a desert island with only one allowed to return. The country would be better off in the end.

Bessie Hearndale:

I think it’s a questionable hire. His prediction was spectacularly wrong. Why not hire the guy, or woman, who gets right. Should’t that be benchmark?

Dutch :

Good luck to the LAPP finding ‘common ground’ on which they can build a future.

Siddall has one stance: his own. Period. ![]() perfect! that’s how Alberta authorities roll, especially those that rape the public for personal gain.

perfect! that’s how Alberta authorities roll, especially those that rape the public for personal gain.![]()

RondeauGuy:

Continuously wrong forecasting the housing market when head of CMHC. Never admitted their forecasts were incorrect.

Peter Globe2:

For Aimco it just goes from bad to worse.

what a terrible, terrible selection.

Dutch58:

2.5% vs. a benchmark of 7.9%.

And everyone keeps their jobs.

This would never happen at a real investment firm.

Patient45:

Did you read the article? The CEO lost his job.

Dutch 58:

But the guys making the real decisions did not. The CEO did not pull the trigger on any of those trades.

Dutch58:

OMG. As if those clowns at AIMco were not arrogant enough, now they have this super arrogant blowhard leading them.

I have had dealings with this guy and he is ALWAYS right. Problem is, he is often wrong but would rather die that admit it or listen to good advice.

AIMco staff are the worst. They want Bay Street salaries but the job security of a government job. Some of their funds have underperformed for YEARS, but no one is sacked.

Disgusting.

my two cents are worthless:

I’m with you, AIMco’s results have not been great to put it mildly, yet the UCP thought it would be a great idea to have all of the public pension plans in Alberta (teachers, others) managed by AIMco. Terrible decision. Even worse would be to have the Albertan’s portion of CPP managed by AIMco.

This new hire — I don’t see anything in his history of having run a large pension fund or anything like it, guess those low returns will continue…

theologia50:

2020 was a banner year for most every pension plan. My own plan had a gross return of 16% and a 4-year fund return of 11.0%.

As for Alberta, no wonder the Heritage Fund, the fund for future generations [sic], is almost non-existent.

It’s sad, but the conservatives come across as incompetent. Imagine if there was no oil under the ground.

superdave1168:

Doesn’t matter who runs this fund. ucp government will always have their fingers in the pot. Can’t trust them to run this and the residence needs to be concern if they get hold of AB portion of the CPP

stephen184:

Good luck with that. Hopefully there will be no forecasting required with the role. This guy was a joke at CMHC ![]() I expect that’s why Steve Harper klan put him there, and why UCP snagged him for their dirty pot AIMCo.

I expect that’s why Steve Harper klan put him there, and why UCP snagged him for their dirty pot AIMCo.![]()

Refer also to: