Teachers! Do what you can to keep your pensions out of AIMCo & KKKenney’s filthy lucre lustie fingers!

Kenney & UCP: Don’t you dare touch my CPP! Alberta has stolen enough of my career, life, health, loved ones and home, frac’ing them.

First, these must reads:

BlackRock Takes Command by JOYCE NELSON, April 8, 2020, Counter Punch

The mainstream financial press has been remarkably quiet about the Federal Reserve’s appointment (March 24) of BlackRock to manage its massive corporate debt purchase program in response to the Covid-19 crisis. That silence might have a simple explanation: you don’t slag your boss if you know what’s good for you.

BlackRock’s CEO Larry Fink may now be the most powerful man in the world, overseeing not just the Fed’s new (potentially $4.5 trillion) corporate slush-fund, but also managing $27 trillion of the global economy (even before the March appointment). As the world’s largest asset manager, BlackRock already was managing $7 trillion for its global corporate investor-clients, along with another $20 trillion for clients through its financial risk-monitoring software (called Aladdin).

As Andrew Gavin Marshall has explained, “Unlike a bank, asset management firms do not manage and invest their own money but do so on behalf of their many clients. In the case of BlackRock, those clients come in the form of banks, corporations, insurance companies, pension funds, sovereign wealth funds, central banks, and foundations.” [1]

With $27 trillion under various forms of its management, BlackRock towers over the finance, insurance and real estate sectors. This much consolidated financial power may be unprecedented, but with BlackRock involved in virtually every major corporation across the planet (including the media), even BlackRock’s competitors (if that word even applies) are quiet about Fink’s appointment.

To date, only Pam Martens and Russ Martens at Wall Street on Parade.com are providing the needed ongoing and intrepid coverage. [2]

How Many Bailouts?

Rolling Stone’s Matt Taibbi has called this new bailout of Wall Street a “bailout of the last bailout” in 2008. [3] Less well known is that the 2008 Wall Street bailout was itself a bailout of an earlier 2001 Wall Street bailout, in which the Fed pumped more than $100 billion into a struggling financial sector (wounded by the dot.com bust) under cover of the 9/11 crisis. [4]

Some attention has lately been paid to the fact that, during the 2008 bailout, BlackRock’s Larry Fink played a major role in advising governments and corporations in how to deal with toxic assets from crashing banks. But something important is being overlooked.

As I wrote in my 2016 book Beyond Banksters, these governments and corporations “sought Fink’s advice, despite the fact that (as Fortune reported in 2008) BlackRock’s Larry Fink ‘was an early and vigorous promoter [of] the same mortgage-backed securities’ responsible for the crisis. ‘Now his firm is making millions cleaning up those toxic assets,’ Fortune noted.”

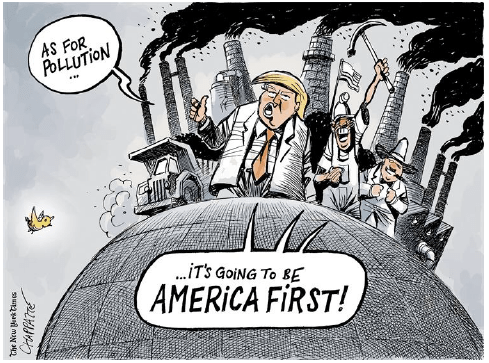

Clearly, during the years between the 2001 Wall Street bailout and the 2008 bailout, BlackRock saw an opportunity and acted on it. Then, when those securities became toxic, BlackRock saw another opportunity and again acted. Clever. ![]() Not dumb like Alberta’s AIMCo.

Not dumb like Alberta’s AIMCo.![]()

BlackRock is a key focus in my book (along with McKinsey & Company) because both firms have been playing an outsized role in Canada’s politics since the election of Prime Minister Justin Trudeau in 2015. Trudeau has created a Canada Infrastructure Bank – widely called the “privatization bank” by us serfs – and has proposed to pour some $120 billion into infrastructure spending in order to attract investment from the international financial sector. As I wrote, by August of 2016 Trudeau was reportedly “courting BlackRock” in the hopes that some of its huge torrent of money would be directed into Canada for infrastructure projects.

Of course, those private investors would want a sizeable return (at least 9%) on their investments, so most of those projects would be either: 1) the outright conversion of a publicly-owned asset into a private one (selling off roads, bridges, ports, airports, water and wastewater systems, etc.), or 2) the building of new infrastructure (like transit) through a public-private partnership (P3) in which the private sector would pocket the tolls and operate risk-free during long-term contracts, or 3) the clever combination of both, by which an existing public asset would become a P3.

More than ‘Bad Optics’

In an outrageous display of corporate arrogance, on November 14, 2016 BlackRock hosted a private summit in Toronto for “a select group of major international investors” with trillions of dollars in assets. They were allowed to meet and question PM Trudeau, Finance Minister Bill Morneau, Infrastructure Minister Amarjeet Sohi, and other federal officials, but the press was not allowed to be there to record the “opportunities” that our elected politicians were offering these banksters.

And in the latest move, on March 27 – the same day that the U.S. Congress approved the bailout bill making BlackRock a key financial overseer – Canada’s publicly-owned central bank, the Bank of Canada (BoC), suddenly announced that BlackRock will act as its advisor for a new quantitative-easing (QE) program for corporations – basically a money-spigot for a struggling corporate sector.

There was no tendering process for this role, and as one financial writer noted, BoC Governor Stephen Poloz appeared to be “opting to put urgency ahead of dithering over potential traps such as conflicts of interest, a rushed tendering process and bad optics.” [5]

But let’s be clear: the central banks on both sides of the Canada-U.S. border have now placed BlackRock in a primary position for effecting monetary and fiscal policy in both countries. That is much more than “bad optics.” That is flagrant corporatism.

There is a terrible irony here, and it’s worth some attention.

SIFI

When I wrote Beyond Banksters in 2016, BlackRock was managing a mere $15 trillion (not the $27 tillion it’s managing now). Not surprisingly, for several years there had been some financial voices calling for BlackRock to be designated as a “systemically important financial institute” (a SIFI), which would mean that it would be far more heavily regulated and would need to meet potentially higher capital requirements from U.S. regulators.

I quoted The Economist, for example, which in 2013 was worried that because so many companies rely on BlackRock’s Aladdin financial risk-monitoring software, there is a danger that they’d all “jump the same way” and “make things worse.”

Similarly the U.S. Treasury Department’s Office of Financial Research had issued a 2013 report that concluded that asset management firms like BlackRock and the funds they run are “vulnerable to shocks” and “may engage in ‘herding’ behavior that could amplify a shock to the financial system.”

But BlackRock had long been lobbying strenuously against being considered a SIFI.

Then in 2014 BlackRock executives somehow obtained a confidential Federal Reserve PowerPoint presentation that implied that BlackRock could pose the same financial risk as big banks. [6] Angered by this new jibe, BlackRock lobbied hard against this view, and, as I wrote, in April 2016 the company “avoided greater oversight from regulators in the U.S.”

Consider BlackRock’s position now: the new bailout bill not only further erases the line between the Federal Reserve and the U.S. Treasury, it places BlackRock effectively in an overseer position for both.

Those lowly bureaucrats from both institutions who had attempted to turn BlackRock into a SIFI are now answering to Larry Fink. Clever.

In what is the most thorough critique of the BlackRock appointment to date, a March 27 letter from the Sunrise Movement to Federal Reserve Chair Jerome Powell noted: “By giving BlackRock full control of this debt buyout program, the Fed is further entwining the roles of government and private actors. In doing so, it makes BlackRock even more systemically important to the financial system. Yet BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions.” [7]

‘Stealth’ Bailouts

The 30 signers of that letter to Powell include Public Citizen, as well as many environmental organizations such as Greenpeace, the Indigenous Environmental Network, Amazon Watch, Stand.Earth, and the Rainforest Action Network. They rightly express concern about BlackRock’s many conflicts of interest and especially note: “…corporate bond-buying programs such as these may be stealth fossil fuel company bailouts if adequate climate safeguards are not applied. The Federal Reserve should not prop up industry destroying the climate and creating further risk to the financial system, and many of our organizations will be asking Congress to take legislative action to prevent this.” [8]

Just days later, on April 3, seven CEOs from Exxon Mobil, Chevron Corp., Continental Resources, Occidental Petroleum, Devon Energy, Phillips 66, and Energy Transfer had a private meeting with President Trump. Who knows what they asked for, or were promised?

The New York Times attempted to assure readers that BlackRock “won’t be making a mint off the Federal Reserve” and “will earn relatively modest fees” for helping the Fed “run a bond-buying program to steady markets unsettled by the pandemic.” [9] But that assurance largely misses the point: much more important is the “herding behavior” that a large asset manager like BlackRock is capable of, and about which various economists have expressed concern. With 70 offices in 30 countries, and a data-farm called Aladdin advising round the clock on that $20 trillion in investments for clients, the potential for BlackRock to shape the global economy to its liking is formidable. Add to that the fact that BlackRock is now also advising Canada’s central bank.

Here in Canada we’re waiting to see if the Trudeau government gives another bailout to the Alberta oil patch. The announcement – with possibly as much $15 billion pending – will likely come this week. With BlackRock a major shareholder is almost every oil company involved in the tar sands (and around the globe), it will be difficult for the government to explain such a bailout without looking like it’s taking direction from Larry Fink.

On the other hand, maybe this pandemic has moved everything to a “new normal” where there is no such thing as “bad optics,” only urgent, pragmatic action. Clever.

By the Way

The last time the financial press indulged in massive coverage of BlackRock was during the 2016 U.S. presidential campaign, when numerous financial pundits were exchanging gossip about Fink’s desire and potential to be Hillary Clinton’s Treasury Secretary. Of course, the result of the election changed all that. But now, with Larry Fink overseeing the virtual merger of the Fed and Treasury while advising Treasury’s Steve Mnuchin, his position might be even more powerful than any appointment Clinton would have made. Clever.

As Matt Taibbi observed way back in 2009 in the midst of the previous bailout, “By creating an urgent crisis that can only be solved by those fluent in a language too complex for ordinary people to understand, the Wall Street crowd has turned the vast majority of Americans into non-participants in their own political future. There is a reason it used to be a crime in the Confederate states to teach a slave to read: Literacy is power. In the age of CDS [credit-default swap] and CDO [collateralized-debt obligation], most of us are financial illiterates. By making an already too-complex economy even more complex, Wall Street has used the [2008] crisis to effect a historic, revolutionary change in our political system – transforming a democracy into a two-tiered state, one with plugged-in financial bureaucrats above and clueless customers below.” [10]

So keep your eyes on your pension fund and Social Security, my fellow serfs (or should I say: fellow slaves?). Larry Fink has long been committed to privatizing Social Security and this current crisis might just be the right opportunity. Of course, it will be called something innocuous or warm and fuzzy, like the CARES Act, and it will be greeted in the mainstream media as an urgent, pragmatic decision.

Footnotes:

[1] Andrew Gavin Marshall, “Exposing BlackRock: Who’s Afraid of Laurence Fink and His Overpowering Institution?” Occupy.com, December 23, 2015.

[2] Pam Martens and Russ Martens, “Icahn Called BlackRock ‘An Extremely Dangerous Company’; the Fed Has Chosen It to Manage Its Corporate Bond Bailout Programs,” wallstreetonparade.com, March 30, 2020.

[3] Matt Taibbi, “Bailing Out the Bailout,” Rolling Stone, March 31, 2020.

[4] Pam Martens, “Looking at 9/11 in the Context of the Wall Street Bailout of 2008,” Wall Street on Parade.com, September 8, 2016.

[5] Kevin Carmichael, “Why Bank of Canada needs BlackRock’s help,” Financial Post, March 27, 2020.

[6] Ryan Tracy and Sarah Krouse, “One Firm Getting What It Wants in Washington: BlackRock,” The Wall Street Journal, April 20, 2016.

[7] Sunrise Movement, “30 Groups Release Letter to Fed Raising Concerns Over Details of BlackRock Deal,” Common Dreams, March 27, 2020.

[8] Ibid., Letter to The Honorable Jerome Powell, March 27, 2020.

[9] Matthew Goldstein, “Fed Releases Details of BlackRock Deal for Virus Response,” The New York Times, March 27, 2020.

[10] Matt Taibbi, “How Wall Street Is Using the Bailout to Stage a Revolution,” Rolling Stone, April 2, 2009.

AIMCo to conduct review of volatility strategy linked to reported $3 billion loss by Barbara Shecter, April 24, 2020, Calgary Herald

The Alberta Investment Management Corporation is conducting a review of a volatility-based investment program, which news reports indicate cost the pension manager $3-billion amid market upheavals triggered by the coronavirus pandemic.

Jerrica Goodwin, spokesperson for the Treasury Board and Finance Alberta, told the Financial Post on Thursday that AIMCo will be doing a review and providing updates to the minister.

The “volatility-based investment program” isn’t a recent strategy and “began well before the current UPC government,” Goodwin told the Post, noting that the pension manager operates independently and at arm’s-length from government.

“We are facing unprecedented times and these are challenging market conditions for all investors,” she said. “It’s anticipated that all institutional investors will have some tough quarters due to the economic effects of the pandemic.”

She added that AIMCo, which had assets under management of almost $119 billion at the end of December, has a long track record of outperforming market benchmarks and is expected to continue to meet the long-term objectives of pension and endowment clients.

Dénes Németh, AIMCo’s director of corporate communications, said he could not comment on the volatility-based investment program or the suggested losses. But he called circumstances in March 2020 “exceptional,” as the “level of volatility that markets experienced … rose faster, and on a more sustained basis, than at any other time in history.”

Németh said the pension giant is invested across a diversified portfolio of asset classes and strategies and that, so far in 2020, “some have performed well, while others have not.”

He added that, as a long-term investor, AIMCo can “withstand, and not over-react to, short-term market fluctuations.” This, he said, can mitigate against having to “crystallize” losses or “underperformance” when it occurs.

The loss on this volatility strategy is money gone that is never coming back. It is a permanent loss of capital

Jim Keohane, who retired this month as chief executive of the Healthcare of Ontario Pension Plan, said AIMCo’s losses from stock market declines in the first quarter were probably far greater than the suggested $3 billion losses from the volatility strategy.

“The difference is that that is an unrealized loss and a lot of that would have come back in the recent market rally,” he said. “The loss on this volatility strategy is money gone that is never coming back. It is a permanent loss of capital.”

Keohane said he suspects AIMCo had a short position in volatility taken via swaps.

If this were the case, the pension fund would collect each day that volatility stayed below the level at which the transaction was made and pay out when volatility moved higher.

“The calculation is quite complicated, but an important aspect is that it is non linear — in other words as volatility goes up the loss per point increases,” Keohane said.

“Prior to the recent market decline volatility was trading around 10, and in the crisis it spiked to almost 90 which is the second-highest reading in history. It is still in the mid 40s so you will still be paying away significant amounts every day unless you close out the strategy.”

Keohane said the “opened-ended” risk of such a strategy has been described to him as “picking up dimes in front of a steamroller — most of the time you get your dime but occasionally you get run over.”

The slightly higher levels of volatility reached in 2008 should have been used as a “stress test,” Keohane said, but he added that what transpired was probably well outside risk models that would have been used as worst-case scenarios.

“The event that just occurred is the absolute worst outcome for a strategy like this,” he said. “The issue is that the loss is very high relative to what they could have ever made on the strategy.”

With few, if any, predicting the global economic hit from the pandemic, AIMCo is probably not alone in having investment strategies that aimed to profit from bets on volatility, according to another pension executive who spoke to the Post.

“I would say that most of the large Canadian pension plans have similar programs, of varying size and approach,” said Don Raymond, who was chief investment strategist the Canada Pension Plan Investment Board until 2014 and now has a similar role at the Qatar Investment Authority.

“Selling volatility is like selling home insurance,” he explained. “You take in premiums and every once in a while the house burns down, causing a loss.”

He said such strategies are “sensible for a long-term investor as they have a positive expected payoff, though the ride can be rough and they need to be sized appropriately so you are not forced out of the position early.”

Given recent market conditions, Raymond said a more apt analogy for market volatility might be “brushfires that caused many homes to burn down.”

Subject: And This is thje Type Of Public Body That Our federal Government Is Determined To Help—-God Help Us??

Date: Thu, 23 Apr 2020 11:22:49 -0600

From: Stewart Shields email hidden; JavaScript is required

To: bill morneau email hidden; JavaScript is required, chrystia freeland email hidden; JavaScript is required, email hidden; JavaScript is required, letters email hidden; JavaScript is required, email hidden; JavaScript is required

CC: email hidden; JavaScript is required, email hidden; JavaScript is required, email hidden; JavaScript is required, email hidden; JavaScript is required, Lacombe Ponoka email hidden; JavaScript is required, email hidden; JavaScript is required, Ministerial Unit email hidden; JavaScript is required, Public Interest Alberta email hidden; JavaScript is required

It may be true that AIMCO (The Governments Investment Board) can afford the loss of $4 billion dollars—–But It’s the folks who’s pension’s make-up the risked pool of cash that make up AIMCO’s pile of cash who cannot—- and should not have to Afford these type of losses without a change of personnel !! When will the manger who made reckless investments be replaced for a more moderate type of manager with a totally different strategy overseeing AIMCO’s massive funds?? Our Alberta teachers must react forcibly to joining forces with a UCP management group who without question will act in a manner approved by the Wild-Eyed UCP government?? Surely an investment of $4 billion cannot be undertaken by AIMCO without some approval of Kenney?? IF that is not the case the Alberta teachers must go to court to gain independence of their hard earned pension funds?? Or figure a way all of Alberta can get out from having a known criminal in control of their hard earned retirement funds!!

Many Albertans were simply waiting for a message containing conditions as described in the article below—realizing Kenney`s only experience with money management came while in the Harper government who ran Canada $160 billion in the hole while getting nothing done?

I will raise pure hell if Kenney attempts to put his greasy fingers on Canadian old Age Pension or any funds I have an interest in!!

We were all aware that Kenney was very determined to get funds belonging to the Alberta public into the hands of the Alberta foreign energy developers !!

Well we have already got introduced to how this is going to work –by Kenney stating AIMCO can afford the haemorrhage of public funds—instead of firing the AIMCO manager??

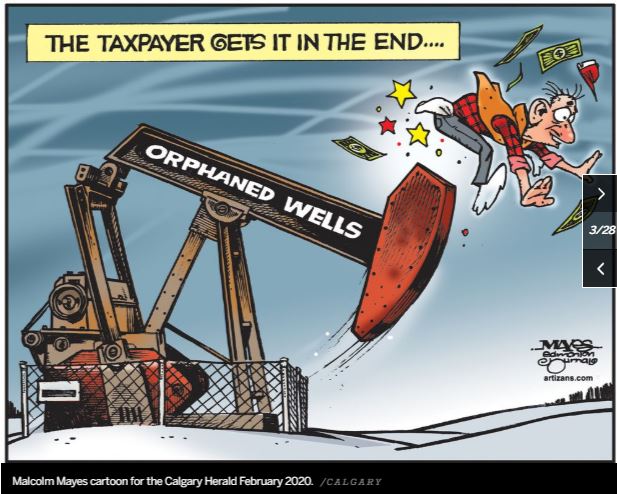

And the federal government will willingly offer 1.7 billion—so the federal public can clean up the idle wells Kenney’s industry playmates left behind them—while the hanging onto the 7 billion they had for capital projects that got cancelled??

Stewart Shields, Lacombe, Alberta

Alberta pension manager loses $4-billion on investment bet gone wrong by Andrew Willis and Jeffrey Jones, April 21, 2020, The Globe and Mail

Alberta’s government-owned money manager has lost more than $4-billion on what clients are calling a wrong-way bet against sharp swings in stock prices, dealing a heavy financial blow to a province already reeling from falling oil prices and the COVID-19 pandemic.

Alberta Investment Management Corp., known as AIMCo, suffered far larger losses than comparable funds after investing in contracts that pay off only if stock markets remain stable. It lost billions of dollars when the economic collapse wrought by COVID-19 sent the S&P 500 and other stock benchmarks on a roller coaster ride, putting it on the losing end of the trades, according to several senior pension plan officials and other sources who are familiar with the situation.

The Globe and Mail is not naming the people because they aren’t authorized to speak publicly about AIMCo’s investing strategies.

The Edmonton-based Crown corporation manages about $119-billion on behalf of 375,000 members of provincial public retirement programs as well as public accounts such as the province’s $18-billion Heritage Savings Trust Fund.

With investment decisions that affect pension beneficiaries as well as Alberta taxpayers, the loss raises questions about whether the strategy was too risky.

The sources said that AIMCo now acknowledges its executives were not fully aware of the risks they were taking.

A $4-billion loss would equate to more than a third of AIMCo’s 2019 net investment income of $11.5-billion.

AIMCo’s hit on volatility-based investment strategies came on top of a sharp drop in the value of its traditional equity, bond and real estate investments in March, when virtually every investor lost money. The average Canadian pension plan lost 8.7 per cent of its value in the first three months of this year, according to consulting firm Mercer. When it formally reports quarterly results to clients later this month, AIMCo is expected to be down far more than this.

AIMCo declined to discuss details of its investing strategies. However, its director of corporate communications, Denes Nemeth, said it has not breached any internal or external rules or regulations related to the risk it can take on as a fund manager acting on behalf of pensioners and government accounts.

“The level of volatility that markets experienced in March, 2020, the result of the COVID-19 pandemic, during which volatility rose faster, and on a more sustained basis than at any other time in history, is exceptional,” Mr. Nemeth said in an e-mail. “AIMCo acknowledges that it is not immune to the challenges, unique as they may be, that institutional investors around the world have experienced.”

AIMCo executives have kept clients apprised of the market conditions’ impact on investment performance, he said.

Markets were relatively placid in recent years, and clients said AIMCo made consistent 6-per-cent to 7-per-cent returns on the volatility strategy, which is meant to be a low-risk way of generating dependable results that are not linked to the performance of public market investments such as stocks or bonds.

AIMCo’s past returns on the strategy are now overshadowed by losses on the unprecedented moves in stock prices that played out in March, when volatility reached all-time highs, exceeding records set in the 1929 stock market crash.

AIMCo told clients in early April it is terminating the money-losing approach. However, it some of its contracts with institutions such as global investment banks will not expire until June.

The sources said AIMCo already booked about $2-billion in losses in March on this one strategy, and expects $2-billion or more in additional losses as the remainder of its contracts expire, although calmer markets could reduce that. AIMCo’s results are known in the industry because it reports to clients every three months, while most other plans disclose performance numbers once a year, or semi-annually.

Sheri Wright, vice-president of the Edmonton-based Local Authorities Pension Plan, known as LAPP, would not discuss specific investments, but said plan officials were briefed on the impact of the market meltdown in early April.

AIMCo invests $50-billion on behalf of LAPP’s 275,000 members, who include Alberta’s hospital workers and other current and retired government employees.

“We have heard from AIMCo, in a preliminary reporting, that the first-quarter report is likely to show significant losses as a result of the severe market volatility that characterized the first few months of 2020, in reaction to COVID-19,” Ms. Wright said.

“AIMCo is fully aware, and we communicate to them on a regular basis, that our risk tolerances are as much a reflection of our pension obligations as the need for positive investment gains,” she said.

Alberta regulations require LAPP to use AIMCo as its fund manager. The pension plan has flagged poor performance as a problem for many years, noting in its most recent report that “AIMCo has been short of LAPP’s value-added expectations for 46 consecutive quarters, or 11 years and 6 months.”

Other clients gave AIMCo qualified support. The fund manager oversees $150-million for the city of Medicine Hat, and city controller Dennis Egert said AIMCo provided a recent update on its performance. In an e-mail, Mr. Egert said: “We appreciate the unique COVID-19 impact on the financial markets, however, we also appreciate the nature and behaviours of the capital markets.”

Early this month, AIMCo reported a return of 10.6 per cent for its 30 pension-plan, endowment and government clients in 2019. It warned in its report that 2020 would be “unparalleled” because of the impact of COVID-19 and the oil-price crash on all asset values. AIMCo warned it was dealing with “a period of sudden and unprecedented volatility” in investment markets.

“Our team is responding decisively in an effort to protect our clients’ liquidity and assets in the near and medium term, while still identifying longer-term investment opportunities that will come out of these challenging market circumstances,” chief executive officer Kevin Uebelein said in a statement announcing the 2019 results.

Investment industry experts are warning pension plan members to brace for a shock when they see recent performance numbers, and focus on their long-term goals. Andrew Whale, a principal at Mercer, said in a recent report: “There is no doubt that funded positions are down and almost every defined-benefit plan will feel this economic and public health crisis, but we’re optimistic that plan sponsors can avoid a pension crisis with smart and strategic decision-making.”

AIMCo has been at the centre of controversy over the past year. Union leaders and Alberta’s opposition NDP opposed legislation passed by Premier Jason Kenney’s UCP government in late 2019 that brought teachers’ pensions under the AIMCo umbrella. The government said the move was aimed at saving taxpayer dollars.

The Alberta Teachers’ Association has argued that its members have been well served by the Alberta Teachers’ Retirement Fund, which has managed their pensions for decades and has modelled itself on the Ontario Teachers’ Pension Plan. The transition is not due to be completed until the end of 2021, so AIMCo’s loss does not affect Alberta’s teachers and retirees.

Alberta pension manager reportedly lost $4 billion on investment strategy sidelined by COVID-19, oil prices by Lisa Johnson, April 21, 2020, Calgary Herald ![]() Is the Herald on the war room payroll, trying to make Kenney, UCP and AIMCo look better after the Globe and Mail article ripped them to shreds? The market was heading for a major crash long before covid-19 and any one with any sense knew the oil and gas industry was dying long before the virus too, with intentionally polluting bankrupt corpses strewn about the world needing to be buried or burned. Things were “topsy turvey” for the oil and gas industry years before covid-19! And AIMCo and UCP damn well knew it!

Is the Herald on the war room payroll, trying to make Kenney, UCP and AIMCo look better after the Globe and Mail article ripped them to shreds? The market was heading for a major crash long before covid-19 and any one with any sense knew the oil and gas industry was dying long before the virus too, with intentionally polluting bankrupt corpses strewn about the world needing to be buried or burned. Things were “topsy turvey” for the oil and gas industry years before covid-19! And AIMCo and UCP damn well knew it!![]()

Alberta’s government-owned investment manager reportedly lost $4 billion in an investment strategy sidelined by the COVID-19 crisis and weak oil prices.

According to a report by the Globe and Mail, citing anonymous sources familiar with the situation at the Alberta Investment Management Corp., or AIMCo, the fund manager lost billions during the recent global economic collapse by betting on contracts that pay off only if stocks remain stable. AIMCo has since pulled the plug on volatile trading strategies, New-York based Institutional Investor reported Tuesday.

AIMCo controls $119 billion for 375,000 members of provincial public retirement programs and is responsible for the investments of 30 pension, endowment and government funds in Alberta, including the $18 billion Heritage Savings Trust Fund. The independent Crown corporation is set to take over the Alberta Teachers’ Retirement Fund (ATRF) in 2021 after changes made by the UCP government late last year.

In an emailed statement, Dénes Németh, director of corporate communication at AIMCo, said it would not comment on the performance of specific active investment strategies.

On Wednesday, Alberta government officials defended AIMCo’s investment record and transparency, and noted that institutional investors around the world have been experiencing difficult losses due to the pandemic.

“Things are so topsy turvy from day to day … it’s not surprising we would see investment funds of all scales and all places incurring losses right now,” ![]() Investment funds have been losing billions for years now! The losses are not because of the virus, they are because of industry’s own greed committing suicide and AIMCo and UCP being shitty money launderers.

Investment funds have been losing billions for years now! The losses are not because of the virus, they are because of industry’s own greed committing suicide and AIMCo and UCP being shitty money launderers.![]() said Premier Jason Kenney at the province’s COVID-19 update.

said Premier Jason Kenney at the province’s COVID-19 update.

Kenney also defended the possibility of pulling Albertan’s pensions out of the Canada Pension Plan (CPP) — one recommendation the province’s Fair Deal Panel was mandated to report on.

“That is not about investment strategy, it is about demography,” he said, noting that Alberta has a young population and should be able to operate a public pension plan at lower premiums than the CPP.

Jerrica Goodwin, spokeswoman for Finance Minister Travis Toews, said in an emailed statement the “volatility-based investment program” behind AIMCo’s recent loss is not a new program and began well before the current UCP government took power.

The loss sparked concern from Alberta’s NDP Opposition Leader Rachel Notley, who said that if management decisions at AIMCo exacerbated risk, the situation deserves more scrutiny.

“This should be a clear message to Jason Kenney and Travis Toews to stop all talk of forcing Albertans to put their CPP into AIMCo, and stop all talks of forcing teachers to put their pension money into AIMCo,” said Notley.

Teachers’ pensions not part of AIMCo portfolio — yet

AIMCo’s hit did not affect the Alberta teachers’ pensions that have been at the centre of controversy since late last year.

But on Wednesday, the Alberta Teachers’ Association (ATA) reiterated its calls for the Alberta government to reverse its decision to transfer teacher pensions to AIMCo.

The UCP government passed a bill in November to move investment control of roughly $18 billion in assets to AIMCo from the Alberta Teachers’ Retirement Fund (ATRF) by December 2021. At the time, public sector unions protested the move and called it political interference. Public sector nominees to the governing board would require approval through a government order in council.

“It is completely unacceptable that investment managers would make such a significant investment without fully understanding the risks. I am confident that ATRF would not have invested in such a risky venture,” said Jason Schilling, ATA president, in a news release.

Kenney said the transfer will save taxpayers money and “generate better returns,” while continuing to allow the teachers’ board to manage its investment strategy and level of risk under AIMCo’s execution. ![]() If you believe anything Kenney says or writes, you are a fool and deserve to lose everything he and his filthy UCP steal from you.

If you believe anything Kenney says or writes, you are a fool and deserve to lose everything he and his filthy UCP steal from you.![]()

The Local Authorities Pension Plan (LAPP), for which AIMCo manages a $50-billion fund, issued a statement Wednesday acknowledging AIMCo sustained “significant losses” and to reassure its 275,000 members, including hospital, city and school employees and retirees who pay into the fund, that the plan “is strong enough to sustain investment losses.”

Chris Brown, president and CEO of LAPP, said in a release the defined benefit pension plan is “not threatened by short-term market fluctuations.”

On April 8, AIMCo announced its returns for 2019, a total fund return of 10.6 per cent representing approximately $11.5 billion in net investment income. The annualized total fund returns over 10 years were 8.2 per cent. By comparison, the Ontario Teachers’ Pension Plan delivered a 10.4 per cent return in 2019, and 9.8 per cent annualized over 10 years.

AIMCo’s $3 Billion Volatility Trading Blunder, The Canadian fund pulled the plug on its volatility strategies following significant losses, sources say by Leanna Orr, April 21, 2020, Institutional Investor

The Alberta Investment Management Corp. — which manages pension assets, sovereign wealth, and other public money — lost billions of dollars on wrong-way volatility trades when markets crashed earlier this year, and then shut down the strategies, according to informed sources.

The now-defunct volatility-trading program cost pensioners and Albertans about $3 billion, the sources said. That’s on top of substantial, first-quarter losses to portfolio value that nearly all public funds are dealing with amid the coronavirus crisis.

“It’s not very hard to lose $3 billion selling volatility,” said one quantitative hedge fund manager who frequently trades with the likes of AIMCo. “You’re doing stuff that has a minus-infinity potential outcome.”

Another highly complex strategy — AIMCo’s derivative-based “portable alpha” overlays — may have exacerbated the bleeding, according to one of the sources.

AIMCo wouldn’t comment on these or any other strategies, but pointed to extraordinary challenges in markets this year.

“The level of volatility that markets experienced in March 2020, the result of the Covid-19 pandemic, during which volatility rose faster, and on a more sustained basis that at any other time in history, is exceptional,” communications director Dénes Németh told Institutional Investor in an emailed statement this week. “AIMCo acknowledges that it is not immune to the challenges, unique as they may be, that institutional investors around the world have experienced.”

Indeed, many retirement systems and nonprofits reaped years of steady returns by investing in asset managers that sold options or other forms of short-term risk insurance. But when markets blew out, a number of these funds blew up.

Only a handful of institutions run their own volatility-trading strategies in-house, and the vast majority of them are Canadian. AIMCo provides virtually no public details about the program, which a portfolio manager named David Triska takes credit for building at least in part, according to his LinkedIn profile.

Triska claims that he managed and developed “three equity volatility strategies across global developed and emerging markets” at AIMCo, using historical options data, volatility surface estimation, and methodology inspired by at least three types of stochastic volatility (Gatheral, Heston, and Bates), among many other items.

Canada boasts some of the world’s most sophisticated and best performing public investment funds, which essentially operate like Wall Street firms but siphon profits to ex-bus drivers and retired nurses.

AIMCo is not among that top tier, experts and data suggest.

For example, the Ontario Teachers’ Pension Plan delivered 9.8 percent annualized over the last decade, whereas AIMCo gained 8.2 percent — a gap of more than 1.5 percentage points per year.

Even within its own province, AIMCo has trailed the smaller Alberta Teachers’ Retirement Fund. AIMCo is slated to vacuum up ATRF’s C$18 billion (about $13 billion) or so in assets, despite teachers’ and fund leaders’ protracted opposition. Had this already happened, AIMCo’s wayward volatility trades would likely have hit educators’ pensions.

The Alberta Finance Minister’s office did not directly answer when asked if it would push ahead with the ATRF fold-in or consider pausing until the chaos clears.

“The transition of ATRF’s assets has not yet occurred and AIMCo operates with full operational and investment independence from the Government of Alberta,” a spokesperson for the provincial Treasury Board and Finance told II Tuesday. “AIMCo has a long track record of outperforming market benchmarks and providing great value to Albertans. ![]() Liar liars, pants on steal-from-pensioners fire!

Liar liars, pants on steal-from-pensioners fire!![]() We are facing unprecedented times and these are challenging market conditions for all investors. We are confident AIMCo will continue to meet the long-term investment objectives of their clients.”

We are facing unprecedented times and these are challenging market conditions for all investors. We are confident AIMCo will continue to meet the long-term investment objectives of their clients.”

The full extent of the first-quarter damage will come out in AIMCo’s annual public reporting. But in announcing its 2019 returns, the organization seemed set on controlling expectations.

“Our team is responding decisively in an effort to protect our clients’ liquidity and assets in the near- and medium-term, while still identifying longer-term investment opportunities that will come out of these challenging market circumstances,” said Kevin Uebelein, AIMCo’s chief executive officer, in an April 8 statement. “We know the impacts to their portfolios during these times of market uncertainty will be significant, and we are committed to accountability and full transparency to our clients as we navigate these conditions together.”

Refer also to:

Russell Gold@russellgold April 14, 2020

Holy moly, this quote.

Scott Sheffield, of Pioneer Natural Resources, to the Railroad Commission of Texas.

“No one wants to give us capital because we have all destroyed capital and created economic waste.”

Russell Gold@russellgold , 2020 Replying to @russellgold

Btw, the “us” is the oil industry, not $pxd

A few fun tweets:

Jeff Jones RetweetedSven Henrich@NorthmanTrader

BREAKING: WTI renamed WTF

NBT@NBT70398858 Replying to @FXMoronval and @NorthmanTrader

Finally. Now I know why people wanted toilet paper.

During Covid-19:

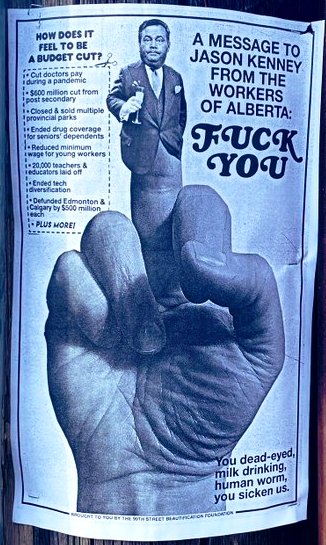

A message to Premier Jason Kenney from Alberta workers

Kenney’s 30 Million dollar Alberta War Room fartin’ up a storm o’ lies ‘n shit on Twitter.

Why Encana Corp. Is Just a Big Disappointment; Stock price tanked 80% in the last 10 years

Alberta senior to Jason Kenney: “Keep your criminal little fingers off my CPP pension!!”

Pension Pirates on a tear in Alberta! Where’s the RCMP?

BEFORE COVID-19!~

Shale Slaughter Continues; Wall Street turned off the tap on credit for drillers

And what of all the illegally frac’d drinking water aquifers and toxic potable community water supplies polluted by the oil and gas industry across North America, with regulators, politicians and courts enabling it?

And how many will die from covid-19 because of cumulative health complications caused by fossil fuel pollution, corporate greed, lobbying and massive deregulation under Trump, Fink, Harper, Notley, Clark, Horgan, Ford, Kenney, Wall et al?