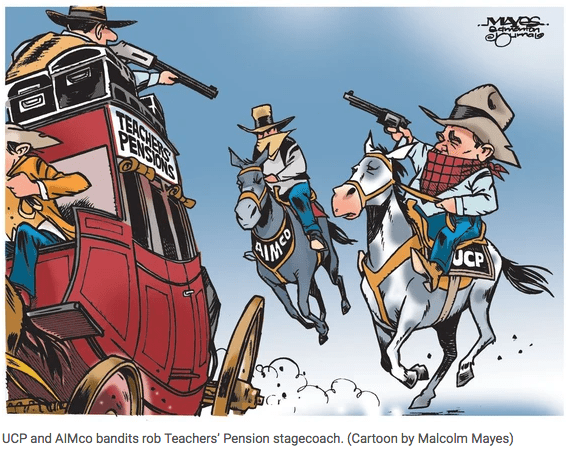

ATA Files Legal Challenge on Pensions Press Release by Alberta Teachers Association, March 12, 2021

A ministerial order on teacher pension management is unreasonable and should be declared invalid by the courts, argues a legal application submitted for filing by the Alberta Teachers’ Association this week.

Documents submitted with the Court of Queen’s Bench on March 10 outline how the terms and conditions imposed in Finance Minister Travis Toews’s order are inconsistent with the Teachers’ Pension Plans Act and how a duty of procedural fairness owed to the Association was breached. That order imposed terms and conditions to govern the relationship between the Alberta Teachers’ Retirement Fund (ATRF) and the Alberta Investment Management Corporation (AIMCo) after negotiations to try to reach an investment management agreement (IMA) were unsuccessful. ATRF has indicated that AIMco advised ATRF in mid-November 2020, that it was ceasing negotiations. The conclusion of an IMA was part of the transfer of investment management control imposed by 2019’s Bill 22.

An affidavit signed by ATA president Jason Schilling outlining the objections made by teachers and the lack of consultation around the entire transfer process was also submitted for filing with the courts.

“Teachers were very concerned that investment management for their pensions was required to be transferred from ATRF to AIMCo with no option by ATRF to select other investment managers,” reads the sworn affidavit from Schilling. “Teachers were also concerned that this decision was made without any consultation with the Association when teachers make more than half of the contributions to the fund. Pension benefits for services after 1991 are not guaranteed by the Government so teachers bear half the risk of any shortfalls or deficiencies.”

The application indicates that the government established a reasonable expectation for consultation before decisions were made about an IMA when it repeatedly made representations that the ATRF would retain control over the investment policy and pension funds. The ministerial order provided AIMCo with veto power over the ATRF’s investment policy.

In the application, the Association requests that the case be heard on an expedited timeline, as the transfer of pension asset management has already begun and must be completed by the end of 2021. The Association is also seeking an order from the courts prohibiting the transfer of additional assets until an IMA is negotiated between the ATRF and AIMCo or a valid ministerial order is enacted.

No date has been set yet for the matter to be heard.

Submitted Documents

Alberta Teachers’ Association, principal sue government over pension order, New law will require Alberta Teachers’ Retirement Fund to use AIMCo as investment manager by Janet French, Mar 13, 2021, CBC News

Alberta teachers’ battle over government changes to their pensions is headed for the courts.

The Alberta Teachers’ Association and an Edmonton school principal have filed a lawsuit against the provincial government about an order they say wrests more control of pension funds away from teachers.

The association, and Greg Meeker, who was president of the Alberta Teachers’ Retirement Fund (ATRF) for 10 years, claim a December ministerial order conflicts with the law. They say it also contradicts public statements by Finance Minister Travis Toews, who said current and retired teachers would retain control of how their pension fund is invested.

“[Teachers and the government] should both be interested in the best, cost-effective investment return possible,” Meeker said on Friday. “But that does not seem to be the case. And it seems to be that one of those two parties is making some arbitrary decisions about how that’s going to roll out for the next 40 or 50 years.”

None of the allegations have been proven in court.

At issue is control of the $19.3-billion teachers retirement fund, which has nearly 84,000 members.

In 2019, thousands of teachers were outraged when the United Conservative Party government passed a bill requiring the ATRF to use the Crown corporation Alberta Investment Management Corporation (AIMCo) to manage investment of the fund.

The government, which pays about half of teachers’ pension contributions, said the move would save investment management fees. Toews has said that ATRF would retain ownership of the fund and keep its ability to decide the strategy of how the billions of dollars should be invested.

The $19 billion is gradually being transferred to AIMCo’s control, and that transfer is supposed to be complete by the end of 2021. But to complete that transfer, the teachers’ pension fund board and AIMCo have to reach an investment management agreement.

When those talks stalled last fall, the government passed a ministerial order, which took effect in January. It allows AIMCo to veto the teachers’ fund investment directions in some cases, and says AIMCo will be the arbiter of any disputes between the parties.

In January, a government spokesperson said the order was intended to be temporary until AIMCo and the ATRF could reach an agreement. They said none of the changes affect the benefits paid to retired teachers.

The ATA and Meeker allege it contradicts the Teachers Pension Plan Act and public statements by Toews.

AIMCo’s decisions have been under additional scrutiny since a risky investment strategy cost its clients $2.1 billion last year. The shakeup prompted an external review and turnover of senior leaders.

Meeker said if AIMCo underperforms while investing public-sector pensions, younger teachers and the government will face rising contributions to prop up the plan. ![]() Nice money laundering plan? Steal from teachers and taxpayers to give to billions to losings oil, gas and frac companies?

Nice money laundering plan? Steal from teachers and taxpayers to give to billions to losings oil, gas and frac companies?![]()

“If we get solely betrothed with an investment manager that doesn’t perform as advertised, that could be a real problem for costs,” he said.

Toews’s press secretary, Charlotte Taillon, said Friday the government cannot comment on the legal action.

“We are confident that ATRF and AIMCo will be able to come to an agreement,” she said in an email. “Once the parties agree to a final investment management agreement the Ministerial Order will no longer be in effect.”

The ATA, which has publicly posted legal documents in the case, declined to comment on Friday.

Tweets in response:

Stephen Anderson@SAndersonshpk#HandsOffMyPension

Thank you @yomeeks for your tireless work standing up for us

Roma@Roma__AB Replying to @CBCEdmonton

Kenney hates public workers having pensions even though they are bargained for in good faith, contributions are also made by workers, and they are calculated into the total compensation package. He should have NO control over the investment. HANDS OFF. ![]() Hands off our Canada Pension Plan too! It’s bad enough the CPP Investment Board helped Encana/Ovintiv out by blowing a $Billion for a super shitty shale play.

Hands off our Canada Pension Plan too! It’s bad enough the CPP Investment Board helped Encana/Ovintiv out by blowing a $Billion for a super shitty shale play.![]()

Refer also to:

Canada Pension Plan intentionally making $Billion Bad investments in frac’ing?

Why did AIMCo announce $200 Million (bailout?) investment in “Quite leveraged” Calfrac?