Rating agency S&P has warned 13 oil and gas companies, including the some of the world’s biggest, that it may downgrade them within weeks because of increasing competition from renewable energy.

On notice of a possible downgrade are Australia’s Woodside Petroleum as well as multinationals Chevron, Exxon Mobil, Imperial Oil, Royal Dutch Shell, Shell Energy North America, Canadian Natural Resources, ConocoPhillips and French group Total.

S&P said it was also considering downgrading four large Chinese producers – China Petrochemical Corp, China Petroleum & Chemical Corp, China National Offshore Oil Corp and CNOOC.

The rating agency said it had increased its risk rating for the entire oil and gas sector from “intermediate” to “moderately high” because due to the move away from fossil fuels, poor profitability and volatile prices.

It said it also had a negative outlook for two other big oil and gas companies, British multinational BP and Canadian group Suncor, but did not plan to immediately reassess their credit ratings.

“In particular, we note significant challenges and uncertainties engendered by the energy transition, including market declines due to growth of renewables; pressures on profitability, specifically return on capital, as a result of high dollar capital investment levels over 2005-2015 and lower average oil and gas prices since 2014; and recent and potential oil and gas price volatility,” S&P said on Wednesday.

It said it did not plan to downgrade companies by more than one notch as a result of the risk to the industry as a whole.

“This said, we cannot exclude a combination of the industry risk revision and other material factors leading to a two-notch downgrade…” it said.

A two-notch downgrade would put Woodside at BBB-, which is one notch above a junk rating.

Woodside shares fell 3.25% on Wednesday morning.

A lower credit rating can make it harder or more expensive for companies to borrow money. In particular, many fund managers will not invest in companies with a junk rating.

S&P’s move came after the world’s biggest funds manager, BlackRock, said it might dump shares in big greenhouse gas emitters in support of limiting global heating to 1.5C by 2050. …

Refer also to:

2021 01 26: President European Investment Bank, Dr. Werner Hoyer: “Gas is over.” Oh, Oh! What’s gas frac’er Ovintiv/Encana gonna do? And, what’s Petro Pimp Jason Kenney gonna do? Fart bigger (after threatening USA with a tiny fart for wisely killing Keystone XL)?

2020 01 20: Why Encana Corp. Is Just a Big Disappointment; Stock price tanked 80% in the last 10 years

2020 01: Cenovus/Husky/Ovintiv/Encana, Chevron, Exxon et al deeply deserve this! CNBC’s Jim Cramer: “I’m done with fossil fuels … they’re just done. We’re starting to see divestment all over the world. … It’s going to be a parade that says, ‘Look, these are tobacco and we’re not going to own them.’ … Younger people don’t want to own them. The dividends are great…but you can tell that the world’s turned on them. It’s actually happening really quickly.”

Kenney’s $4.5 billion in corporate tax cuts obviously not enough to feed the greed.

2019: Encana fleeing Canada in Scheer desperation? Shares drop 9.2%! Illegal aquifer-frac’er, caprock buster, poisoning bully of families and briber/divider of communities running to USA, changing its spots to Ovintiv Inc. Erectile Dysfunction drug or cross between Ovaltine in vintage container and a vagina?

“Merriest fossil fuel stories” of 2019 show frac industry melting down. Roaring 20s speed into “tragedy on the horizon” where investments could “go to zero quickly.” Vital warning for AIMCo by Bank of England Governor Mark Carney: Pension funds could be hit by ‘worthless’ fossil fuels

“A Murderer’s Row: Maturities are coming year after year.” Bankruptcies rising in U.S. oil patch as Wall Street’s disaffection with frac’ers reverberates through industry. 26 producers file for bankruptcy so far in 2019; 28 filed in all of 2018. Bankruptcies expected to rise, “Debt levels are just too high and they’re going to have to take their medicine.”

Bankruptcy plan to let Cenovus/Husky “legally” escape clean-up, aided by taxpayer-funded courts? Cenovus (Encana spawn), buys Husky for $23.6 Billion, “including debt” (financed by Canada Pension Plan and AIMCo?); Will kill jobs Kenney promised would increase when he gave industry $Billions in tax breaks, mega corporate welfare, tax super holiday and citizen-financed propaganda (war room and Steve Allen’s witch hunt).

Canada Pension Plan intentionally making $Billion Bad investments in frac’ing?

Why commit to spend a billion to take on $billions in US Oilfield liabilities? Destroy the retirement of hardworking Canadians, burden us with US oilfield’s toxic legacy? Canada Pension Plan arm commits up to $1 billion to buy oil assets in U.S.

Canada Pension Plan (CPP) & Crestone Frac’ing Hanky Panky. More than 1,000 formal complaints made to state regulator against Crestone operations in Colorado (sneakily via Encana/Ovintiv)

2015 10 05: Does it get any more terrifying than this? Encana dumping frac water wars on Canadian pensioners? Encana sells troubled Colorado assets for nearly $1 Billion US to entity 95% owned by Canada Pension Plan Investment Board

2015 10 08: Who believes what Cenovus or Encana say? And, just how cruel are those companies to their workers? Encana offspring Cenovus apologizes: a lot too little, too late

Alberta picks yet another hanky panky “Dickhead.” Blackrock (lost $90 Billion in fossil fuel investments last 10 years) rule breaker Mark Wiseman to chair AIMCo (money-losing launderer of funds from pensioners to bankrupt frac firms).

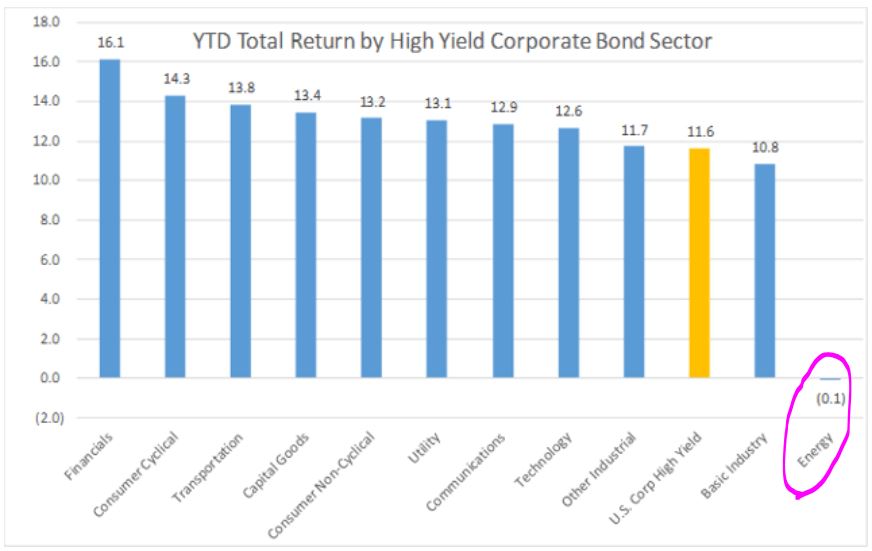

Energy: The Losing Sector in the Junk Bond Rally. This year, high yield corporate bond market produced best returns since 2016. Despite this strong performance, Energy sector, which makes up 11% of the HY bond universe, produced **negative returns.** Jason Kenney and AIMCo: Keep your grubby greedy mits off our pensions, including our CPP!~

Myth of American energy independence based on willful deception “Alice in Wonderland” forecasts by U.S. EIA. Best way to con investors into losing $Billions! The Permian is flat lining, most frac’d shale plays “don’t amount to a hill of beans.”

U.S. Shale Is Doomed No Matter What They Do: “More bankruptcies are all but certain as oil and gas borrowers must repay or refinance **several hundred billion dollars** of debt over the next six months”

Shale Slaughter Continues; Wall Street turned off the tap on credit for drillers

2017 02 17: BNN Interviews Alberta Oil Patch Consultant Brent Nimeck on Lexin and AER’s Orphan Wells: “This problem is 30 years in the making. … I would call it a Ponzi Scheme…. This is an orchestrated fraud from multiple angles: Industry, CAPP and the Alberta Energy Regulator have enabled this to happen. … Through our independent analysis and we’ve confirmed this at multiple sources within the energy regulator, the liabilities are over $300 billion. That’s what’s on the hook for Alberta taxpayers right now – $300 billion.”

Environmental causes of childhood cancers ‘grossly underestimated.’ In Canada, toxic chemicals used by oil and gas industry are exempt under CEPA (1999)

2015: As unconventional ponzi scheme implodes, Are Encana’s greedy law violations taking the company down?

2015: Art Berman: Shale Plays Have Years, Not Decades & The way of greed: Oil and gas companies face their creditors as Fracking Bubble Bursts (FUNNY!)

2014! Fracking in the Red & Junk Bonds Backing Fracking Facing $11.6 Billion Loss

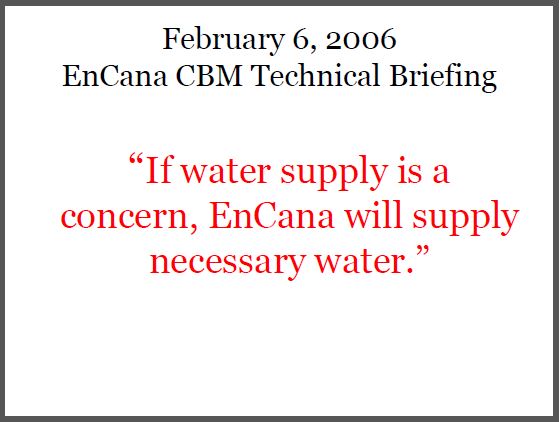

2014: Encana spends $3.1 Billion to enter Eagle Ford shale, but breaks 2006 written promise to provide necessary water to water well owners harmed by Encana’s ultra shallow fracing

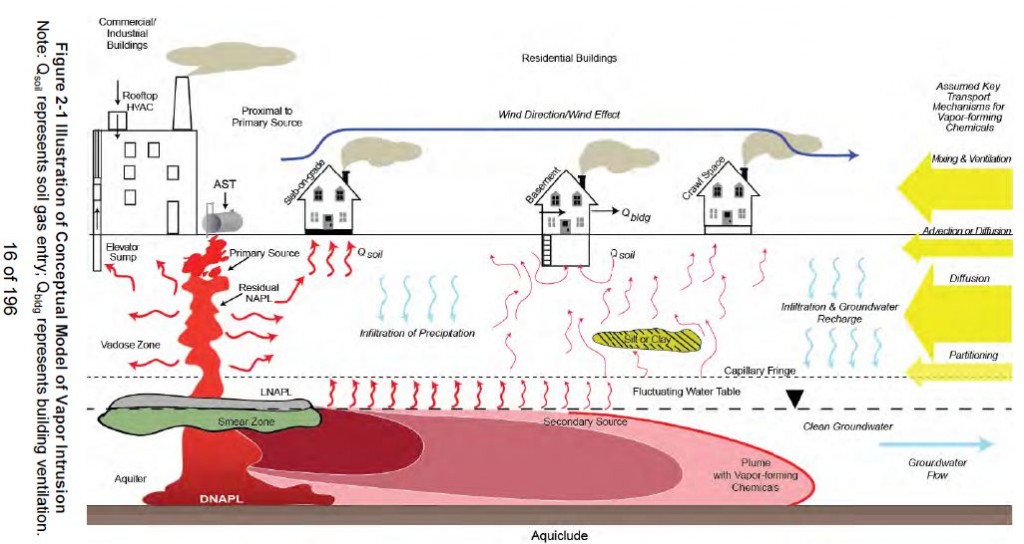

US EPA Office of Solid Waste and Emergency Response Final Guidance for Assessing and Mitigating the Vapor Intrusion Pathway from Substance Sources to Indoor Air (External Review Draft)

Why was a 2012 Health Canada Report, admitting significant health hazards and risks to groundwater and air from hydraulic fracturing, kept from the public?