Penn West plunges, New CEO puts joint ventures on the block to promote producer focus by Dan Healing, November 6, 2013, Calgary Herald

Stock in Penn West Petroleum Ltd. plunged as much as $2 per share or 17 per cent to $9.63 on Wednesday after it announced sweeping changes that will reduce short-term production levels. … “In the preceding phases of the company’s life cycle, we concentrated on resource capture and, later, on determining if new drilling and completions technology could economically revitalize the positions assembled in Penn West,” he said. “Now, to be successful, Penn West needs to shift to an economic returns and execution-focused model.” … “People are looking at this and saying, ‘I’ve got to wait two years before I see any improvement?’ They’re gone,” said Lever.

…

Penn West said it will continue to market its Duvernay play acreage in northwestern Alberta, along with other non-core assets, while directing most of its capital spending to the Cardium, Viking and Slave Point liquids-rich plays. Roberts unveiled a five-year plan to become “Canada’s leading conventional liquids producer,” with 2014 a year of transition. Penn West plans to spend about $4.7 billion through to 2018 on operated development, with the Cardium getting about half, the Slave Point absorbing $1.3 billion and the Viking receiving $620 million. Investment in the Cardium is to grow to $800 million per year by 2018 and in the Slave Point to $450 million per year by 2018, it said.

…

In August, Penn West laid off more than 300 head office and field staff, bringing cuts to total employee head count to 30 per cent since the fall of 2012. It said it had less than 1,600 full-time equivalents, down from 2,250. On Wednesday, a company chart indicated its head office workforce has been reduced from 1,153 as of Sept. 30, 2012, to 825 on the same date this year. [Emphasis added]

Encana leaves Eresman’s strategy behind by Deborah Yedlin, November 6, 2013, Calgary Herald

Cue Jim Morrison and the Doors’ “This is the end.” In the context of Encana’s bombshell announcement Tuesday, the “end” is the abandonment of a strategy articulated by former chief executive Randy Eresman in two parts. The first was splitting the company into two pieces – Encana and Cenovus – in 2009 without leaving Encana with any sort of hedge, other than a financial one, against a downdraft in natural gas prices. And while much of the focus has been on the challenges Encana has faced as a one-trick pony, it has to be said unlocking Cenovus as a publicly traded entity has resulted in tremendous value for shareholders of Encana who held on to the Cenovus shares distributed as part of that transaction.

The second tranche, articulated in March 2010, was the plan to double Encana’s natural gas production within five years – and spend $5 billion a year to get there. The strategy would force out the higher cost producers and result in Encana capturing a bigger share of the North American natural gas market. What Eresman – as well as his executive team and Encana’s board of directors – completely underestimated, however, was the ability of the rest of the pack to catch up, with the result being the glut of natural gas in North America that continues to depress prices on the continent. … In addition to slashing the dividend by 65 per cent, Encana will focus on five core areas and spin off its royalty assets into a separately traded public entity sometime next year. The importance of both these moves can’t be understated.

…

Seventy-five per cent of the company’s capital expenditure budget for 2014 will be directed at five plays; the remaining is maintenance capital for other assets, some of which will disappear as a result of an impending sale process. While it’s a bit curious that Encana has not specifically identified the assets to be sold – other than the Clearwater spinoff – given that this exercise isn’t about a balance sheet fix, the fact Encana’s shares closed up 90 cents on the day suggests the market likes what it heard. Undoubtedly the more interesting piece to Tuesday’s announcement was the creation of a separately traded entity with two million hectares and net daily production amounting to 374 million cubic feet of natural gas and 8,600 barrels of oil as of year-end 2012. … As part of the charter granted to the Canadian Pacific Railway, which included a total of 25 million acres, the company kept 9.6 million acres of oil and natural gas rights. Of this, 8.3 million acres were in Alberta. Another one million acres was in Saskatchewan, with 300,000 transferred to Pan-Canadian Petroleum in 1971.

When PanCanadian merged with Alberta Energy Company in 2002, those lands became part of Encana. And let’s remember that one of the reasons behind the creation of Encana was to establish a major oil and gas player in Canada that would be too big to be bought by a foreign player. Those lands have long presented a puzzle from a value maximization standpoint. As companies compete for capital within their organizations, based on the potential for returns on investment, many an analyst believed the asset potential of the freehold lands was not being optimized. With the creation of a separately traded entity, Encana is arguably going to get the better of two worlds. The first is that the value generated through the spinoff will be reflected in Encana’s stock price. According to preliminary number crunching, based on the $180,000 per flowing barrel that Freehold Royalty is trading at, it could be worth at least $1 to Encana’s share price. And because it intends to retain a majority ownership in this new company – at least for now – Encana not only establishes a value for the assets, but also is able to consolidate everything from an accounting perspective, which is positive from a credit ratings standpoint.

…

The one question some may have is whether a slimmer Encana means it is more vulnerable to becoming a takeover target. The short answer, referencing the Investment Canada Act, is it’s unlikely. Even though it’s not an oilsands producer, Encana is of a size that would not only trigger a review of a proposed acquisition, but likely a rejection by the federal government. [Emphasis added]

Encana cuts one in five jobs, slices dividend, New CEO Doug Suttles reveals smaller, more focused company by Dan Healing, November 5, 2013, Calgary Herald

CEO Doug Suttles continued to shrink Encana Corp. on Tuesday, announcing it would shed about 1,000 jobs, split off southern Alberta legacy freehold lands into a new publicly traded company and severely chop its payouts to investors.

…

Suttles said on a conference call with the media that the latest cuts of about 20 per cent would be from Encana’s staff of about 4,000 and core contractor force of about 900 as of Sept. 30 but exactly where and how many hasn’t been determined. Spokesman Jay Averill said about one-third of the staff in Plano will be offered jobs at the Denver office; Suttles, who was speaking from Plano on Tuesday, said there were about 400 staff there. Since splitting its oil assets off to form Cenovus Energy Inc. in late 2009, Encana has suffered dwindling returns because of low gas prices blamed on a glut of shale gas in North America. Its current output is about 90 per cent natural gas.

…

Suttles said those assets, which Pardy said produced about 12,000 barrels of oil equivalent per day in 2012, will be spun out through an initial public offering in mid-2014 into a separate company in which Encana will retain a majority ownership stake. Suttles said he believes the changes will allow the company will achieve a more than 10 per cent compound annual growth rate in cash flow per share through 2017. Encana identified the five plays it will continue to invest in as the Montney of northwest Alberta and northeast B.C.; the Alberta Duvernay, Colorado’s DJ Basin, the San Juan Basin of northern New Mexico; and the Tuscaloosa Marine Shale of Mississippi. It plans to spend $500 million to $600 million in the Montney in 2014 and $250 million to $350 million in the Duvernay, plus $700 million to $1 billion for the three U.S. plays. [Emphasis added]

Encana to slash jobs, spin off properties in sweeping overhaul by Bertrand Marotte, November 5, 2013, The Globe and Mail

Encana Corp. says it’s moving ahead with its new corporate strategy by slashing 20 per cent of its work force, focusing on five North American resource plays and spinning off royalty-producing properties into a separate company. The Calgary-based natural gas giant also cut its quarterly dividend to seven cents from 20 cents. “The current level is consistent with maintaining a strong balance sheet in a volatile commodity price environment and recognizes the attractive investment options within our portfolio,” Encana president and chief executive officer Doug Suttles said on Tuesday. Encana will invest about 75 per cent of its 2014 capital into five high-return oil and liquids-rich plays – Montney, Duvernay, DJ Basin, San Juan Basin and Tuscaloosa Marine Shale.

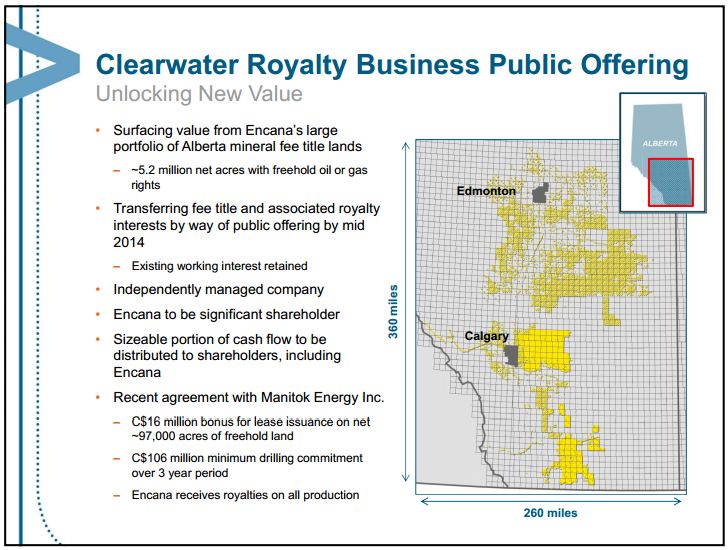

It also plans to transfer its so-called fee title land position and associated royalty interests across southern Alberta – about five million net acres where the company holds oil and gas rights and can collect royalties on production – into a new company through an initial public offering by 2014. Encana said it will retain a “significant” stake in the new company which will manage leasing activities in the Clearwater region.

As well, the company plans to sell assets, starting immediately. Encana shares initially fell in premarket trading but subsequently regained that lost ground ahead of the opening bell in New York. The sweeping changes are part of Mr. Suttles’ efforts to dramatically remake the company by shifting the focus to natural gas liquids such as butane and propane, some of which have proven more profitable than natural gas. A disciplined and focused growth strategy can help Encana attain an average of more than 10-per-cent compound annual growth rate in cash flow per share through 2017, the company said in a news release. Office locations will be consolidated in Calgary, and Denver, Colo. and the Plano, Texas, office will be closed. [Emphasis added]

Encana cutting workforce by 20 per cent, slashing dividend in new strategy by The Canadian Press, November 5, 2013, Calgary Herald

Canadian natural gas giant Encana Corp. says it will cut its workforce by 20 per cent, slash its dividend, close its office in Plano, Texas, and spin off a large portion of its Alberta assets into a new public company. Encana didn’t say how many jobs will be cut during the reorganization but said it would consolidate its office locations in Calgary and Denver. As of late 2012 it had about 650 corporate staff out of a total workforce of nearly 4,200 in Canada and the United States.

“In order to align our organization with our strategy, we have had to make a number of exceptionally difficult decisions,” Encana CEO Doug Suttles said in a statement. “The restructuring that is underway reflects our shift from funding about 30 different plays to focusing our resources on five key areas.”

“We will work as hard as we can to make these staffing decisions quickly and thoughtfully and we will treat everyone affected with respect as we work through this very difficult part of our transition.”

…

Encana also announced that its quarterly dividend will be cut to seven cents from 20 per share — a move that had widely been expected. “The dividend is an important component of total shareholder return,” said Suttles. “The current level is consistent with maintaining a strong balance sheet in a volatile commodity price environment and recognizes the attractive investment options within our portfolio.”

…

The company’s statement said about five million acres of Alberta lands and associated royalty interests, currently known as Encana’s Clearwater play, will be transferred to a new public company next year. Encana said it would retain a significant stake in the new company. Meanwhile, Encana will spend about three-quarters of next year’s capital budget on five resource plays that offer higher returns because they are rich in oil and natural gas liquids. They include the Montney play in northeastern British Columbia and the Duvernay play in Alberta. The others are the DJ Basin, San Juan Basin and Tuscaloosa Marine Shale. [Emphasis added]

Slide from Encana investor presentation Getting Back to Winning November 2013

Encana takes a new look at oil by Nathan Vanderklippe, January 13, 2011, The Globe and Mail

Encana split itself into two a little more a year ago, jettisoning most of its oil assets by carving out oil sands producer Cenovus Energy Inc. Although that strategy meant losing the benefits of diversification – and drew criticism from some quarters – Encana believed investors were better served with separate companies, each focused on a single commodity. … Even with such dramatic change afoot, Encana’s new openness toward crude is striking. In recent months, it has signed joint venture deals with a number of companies to explore for oil on more than 465,000 hectares in Alberta and Saskatchewan. “It does give us a lot of oil exposure,” Stacy Knull, an Encana vice-president in charge of its southern Alberta operations, said in an interview. “But we’re not scared of oil.” The joint ventures are a potentially major source of new revenue. They stem from a unique part of Encana’s land holdings.

The company owns more than three million hectares of “fee lands,” on which it holds subsurface rights. In those areas, which were originally granted to the Canadian Pacific Railway in the late 1800s, Encana pays no royalty to the Crown. Instead, it can charge royalties to other companies – a strategy it is now pursuing on lands that lie in some of Western Canada’s most prominent new oil plays, including the Viking, Cardium and Alberta Bakken. Encana has agreed to allow other companies to explore some of its lands in exchange for a royalty of anywhere between 30 and 38 per cent.

In the biggest deal, it gave Crescent Point Energy access to a 350,000-hectare swath along the Montana border in what is known as the Alberta Bakken; the play that has drawn immense attention in the past year, including from major companies such as Royal Dutch Shell PLC. By some estimates, the Alberta Bakken contains as much oil as Saskatchewan’s Bakken play, or roughly five million barrels in place per 260-hectare section. With about 10 to 20 per cent of that recoverable, the Encana lands could contain a massive pool. Under the terms of its joint ventures, a company such as Crescent Point has access to the Encana land for a three- to five-year period, and must drill one section of land to earn an interest in it. “They’d have to do a lot of drilling on that many sections to hold it all – and we encourage it because we make good royalties,” Mr. Knull said.

Encana also benefits by having someone else shoulder all the risk…. [Emphasis added]