Perhaps Chevron knows a huge fine and legal consequences are coming for this ungodly mess of theirs? McKittrick, California: One day after Chevron announced it had finished cleaning up months-long, nearly 1.4 million-gallon leak in Cymric Oil field, another leak started with a second larger one appearing the next day spilling about 84,0000 gallons of oily fluid into a stream bed. Chevron appeals state’s $2.7M fine

Or, Chevron doesn’t like the new frac and high-pressure steam injection ban in California (likely brought on by their mess, see links above)? California temporarily bans new frac’ing and high-pressure steam injection.

Or perhaps Chevron knows they’re in huge kah kah over this mess of theirs and it will spread money devouring kah kah for them everywhere? Shell, ExxonMobil, Chevron & BP Could Be Legally & Morally Liable for Climate Crisis in Philippines

Or perhaps Chevron is causing too many frac quakes and harms up at Fox Creek Alberta? Why are frac’d Albertans so easily bribed by law violators and polluters? Why don’t groups in Fox Creek say “No thank you Chevron, We’d Rather Skate in Hell Than Take Your Money”

Or perhaps the food millions have eaten, irrigated with Chevron’s waste? California farmers rely on Chevron’s wastewater to irrigate. Some refuse: “I would rather let my trees die” than use Chevron’s water

Or perhaps this deadly Chevron mess? “Abnormally dangerous and ultra hazardous activity.” Did TRC or Chevron’s fracing kill Robert David Taylor? What happened to California regulators’ vows to make steam injections safer? “Safer?” Why not make it “safe?”

And then there’s Ecuador: TRIPLE FRAUD ON HOT ICE? Chevron’s RICO Case Spectacularly Implodes as Corrupt Ex-Judge Admits to Making It Up in Exchange for Chevron Payoff

Or perhaps investors have made it clear they don’t like Chevron’s nasty ways? Chevron Sues Its Own Shareholders In Ecuador Compensation Battle

Or perhaps Chevron doesn’t like being told to stop injecting its toxic waste into protected drinking water aquifers and see the legal writing on the wall? California now says 2,500 wells dumping frac waste into protected aquifers, up from 532 in February. Regulators order oil drillers including Chevron Corp. and Linn Energy LLC to halt operations at 12 injection wells (two were issued cease and desist orders) because they may taint groundwater suitable for drinking and irrigation

Or, perhaps not enough deregulation? Chevron’s Lithuania Pullout: Legislation still not lax enough for frac giant, 3 or 4 years tax-free incentive also not enough

Or, perhaps Chevron is nervous about not being able to bribe harmed residents with yogurt? Romanian peasants’ revolt against hydraulic fracturing, Chevron tries to bribe with yoghurt

Chevron halts Romania shale work after using riot police to harm concerned citizens in Romania

Romania villagers and farmers block Chevron test drilling

Or, perhaps Chevron doesn’t like not being able to freely pollute at will? BP, Chevron Accused Of Illegally Dumping Toxic Radioactive Drilling Waste Into Louisiana Water

Or, perhaps Chevron doesn’t like not being to do the Hanky Panky with vital investigation data? Criminal investigation at Chevron refinery, Pollutants allegedly routed around monitoring devices

Or perhaps Chevron has killed too many workers? Chevron Workers Plead To Be Evacuated Before Deadly Blast How many dead workers on Chevron sites that we have not heard about?

Or, perhaps investors are pissed at Chevron, for lying to them about frac’ing being perfectly harmless? 2012: Chevron and Exxon Shareholders Send Strong Message Today About Need to Disclose Environmental and Financial Risks of ‘Fracking’

And then, of course, there’s reality across the board: 2019 10 16: Horrific. Terrible. Abysmal. The worst. Terms equity analysts are using to describe investors’ attitude toward energy stocks!

Chevron plans to leave Appalachia, following the footsteps of other giants by Pittsburgh Post-Gazette, Dec 11, 2019

California-based energy company Chevron Corp. is putting its Appalachian oil and gas business up for sale, the company reported this week.

It has about 400 employees in the unit and a regional office in Coraopolis.

Chevron controls about 890,000 acres in the Marcellus and Utica shales across Pennsylvania, West Virginia and Ohio.

The Appalachian shale operations contributed to more than half of a massive impairment charge that the company revealed for the fourth quarter. That charge, which writes down the value of assets on Chevron’s books, will be between $10 billion and $11 billion, the company disclosed Tuesday.

Chevron burst onto the scene in Appalachia in 2011 with a $4.3 billion acquisition of shale gas firm Atlas Energy Inc. Two years later, it paid $17 million for a stretch of land in Moon Township where the company planned to build a new regional headquarters.

In 2014, those plans were put on indefinite hold and never materialized. The following year, the energy giant cut more than 150 positions from its Appalachian division as natural gas prices slumped.

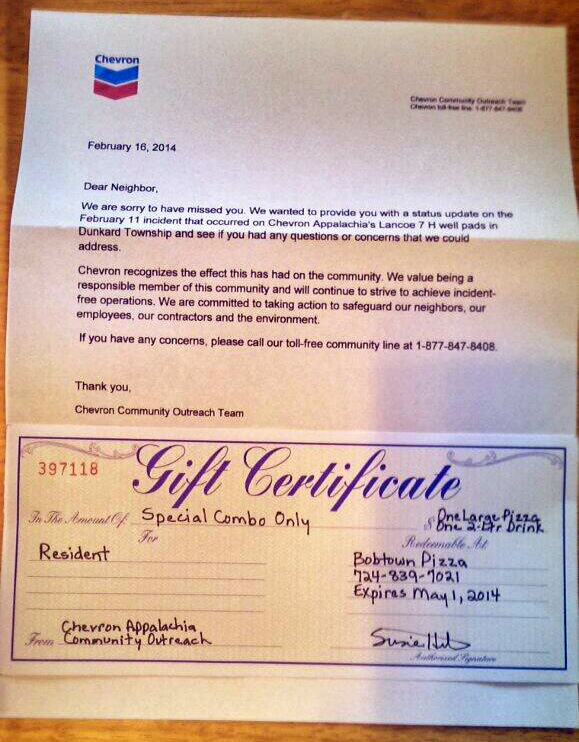

Still, Chevron maintained a high profile in the region, working to weave itself into its business and cultural networks. [And buying Pizza after deadly explosions!]

Some leave, others double down

In leaving the region, Chevron follows in the footsteps of other multinationals that tried out the Marcellus and Utica shale regions but moved on in favor of other projects around the globe.

Indian conglomerate Reliance Industries Ltd bought Pennsylvania Marcellus assets in 2010 only to sell them off for a third of the price in 2017.

Noble Energy Inc., a Texas-based firm that also has projects in West Africa and Israel, made a bet on Appalachia with its $3.4 billion joint venture with CNX Resources in 2011. Six years later, it sold its stake in the venture and left this region.

Royal Dutch Shell, the Dutch giant whose chemicals subsidiary is building a massive ethane cracker plant in Beaver County, shelled out $4.7 billion for Warrendale-based East Resources in 2010. For years now, its drilling activity in Pennsylvania has been pared down significantly after underwhelming results and asset sales.

Yet smaller oil and gas firms are instead going all in on Appalachian shales.

Southwestern Energy Co., which began as an oil and gas driller in Arkansas, sold the last of its assets there last year to focus on its Appalachian portfolio in Pennsylvania and West Virginia.

Texas-based Range Resources Corp., too, pulled back on its operations in Louisiana after its ill-fated 2016 acquisition and rededicated itself to its program in Appalachia.

As did Downtown-based EQT Corp. when its dalliance with geographic diversification resulted in a $2.3 billion impairment charge — meaning the Permian Basin assets in Texas that EQT bought in 2014 and its holdings in Kentucky’s Huron Shale were actually determined to be worth that much less than what the company had on the books.

The Marcellus Shale, in particular, has taken the mantle as the most productive natural gas play in the U.S., and one of the most cost-efficient.

Oil and gas price slump

Even so, the current price slump is a result of all that productivity — there is too much supply and not enough demand to soak it up. [Created by industry’s own ravanous greed]

So, with gas coming out of the ground faster than the U.S. can use it, gas producers are rushing to export their product abroad. Those closest to export terminals — most are on the Gulf Coast — have an advantage, according to Bloomberg Intelligence. Last month, Bloomberg analyst Vincent Piazza predicted that the Haynesville Shale in Oklahoma would see a resurgence because of that dynamic.

The low price of oil and gas — both global commodities at this point — means companies are looking to other aspects of their portfolios to set them apart, and those with more options can get picky.

“Good isn’t good enough,” Chevron’s CEO Michael Wirth said in an interview on CNBC’s show Squawk Box this week, explaining the massive write-down of the company’s Appalachian assets.

“The assets in the Northeastern U.S. simply don’t compete as well for our investment dollar as others do,” he said, adding, “some of our assets may work better for others.”

Chevron’s possible exit from Kitimat LNG project dents Canada’s aspirations of building LNG hub, Chevron’s comments have dented some of the optimism in the Canadian natural gas sector by Geoffrey Morgan & Reuters, Dec 11, 2019, Calgary Herald

Chevron Corp. is considering putting its entire stake in the proposed liquid natural gas project in British Columbia on the block, in a blow to Canada’s aspirations to build a robust LNG industry.

“Although Kitimat LNG is a globally competitive LNG project, the strength of Chevron Corporation’s global portfolio of investment opportunities is such that the Kitimat LNG Project will not be funded by Chevron and may be of higher value to another company,” the company said on Tuesday.

The San Ramon, California-based company said its Canadian unit will look for buyers for its 50 per cent interest in the Kitimat LNG Project, but set no timeline to conclude the process. Chevron’s other Canadian projects are not part of the sale.

The company said it would continue to work closely with its joint venture partner Woodside Petroleum Ltd., which owns the other half of the company, and First Nations partners during the process.

Chevron’s comments have dented some of the optimism in the Canadian natural gas sector, which had cheered the construction of the $40-billion, Royal Dutch Shell Plc-led LNG Canada project and the prospect of Pacific Oil and Gas Ltd.’s smaller Woodfibre LNG project.

“It would have been nice to see LNG facilities come on stream shortly after (Shell’s) LNG Canada, but the comments that Chevron made yesterday may be tempering this type of enthusiasm,” Raymond James analyst Jeremy McCrea said, adding the comments were surprising given how Chevron had been advancing the Kitimat LNG project.

“To see them potentially take the writedown on their gas reserves and make the comments they did is a bit of a reversal from what we’ve seen from them,” he said, adding the company might be “taking a pause” given the outlook for global LNG prices.

Asked whether there was an obvious buyer for the Chevron’s stake in the project, which it co-owns with Woodside, McCrea said “nobody comes to mind,” but noted that groups like Rockies LNG have been actively looking to build a project.

Rockies LNG, a consortium of British Columbia and Alberta natural gas producers, did not respond to a request for comment.

The LNG project, which Chevron had committed to operate, features upstream resource assets in the Liard and Horn River Basins in northeast B.C., a 471-kilometre Pacific Trail Pipeline, and a natural gas liquefaction facility at Bish Cove near Kitimat.

The proposed project envisions three LNG trains with a combined capacity of 18 million tonnes per annum powered by hydroelectricity from BC Hydro. [Site C dam that’s harming so many?]

The move to sell the Kitimat project came as Chevron took an axe to its balance sheet Tuesday and wrote down the value of its assets by $10 billion to $11 billion this quarter, related to a deepwater Gulf of Mexico project and shale gas in Appalachia.

The company said it will hold its 2020 global spending program flat at US$20 billion.

“With capital discipline and a conservative outlook comes the responsibility to make the tough choices necessary to deliver higher cash returns to our shareholders over the long term,” Chief Executive Michael Wirth said.

Wirth is preparing sweeping changes that would cut costs and streamline operations with expectations of lower-for-longer commodity prices.

Morgan Stanley said it expects natural gas prices to worsen next year, amid oversupply.

“To solve this glut, we see increasing risk of U.S. LNG export capacity shut-ins next summer,” the Wall Street bank said in a note to clients on Wednesday. “We are cutting our 2020 Henry Hub price forecast from US$2.50/MMBtu to US$2.25/MMBtu, though maintain long-term estimate of US$2.50/MMBtu.”

Experts Warn Chevron’s $11 Billion Write-Down Portends ‘Greater Troubles to Come’ for Fossil Fuel Industry, “Business as usual, even efficient business as usual is wholly insufficient in a market that is, and must, fundamentally change” by Andrea Germanos, Dec 11, 2019, commondreams

“Two words: stranded assets.”

That was the reaction Wednesday from sustainability professional Jessica Davis after oil giant Chevron announced that it was writing down at least $10 billion and as much as $11 billion in assets.

Reuters reported:

Chevron said it expected write-downs this quarter related to a deepwater Gulf of Mexico project, which needs higher oil prices to churn a profit, and shale gas in Appalachia, which has suffered from low natural gas prices. It is considering selling its stake in Appalachian shale and the proposed Kitmat LNG project in Canada.

“Oil companies have struggled to reap the profits of old and are falling out of favor with investors amid fears that electric vehicles and renewable energy, along with government regulations to address a warming planet, will constrain their futures,” the Wall Street Journal added.

The news comes just a week after Spanish energy giant Repsol announced a $5.3 billion write-down of its assets. The company also pledged to be carbon neutral by 2050 and set a goal of “become a leading international player in renewable energies.” That move, according to Bloomberg, “throws down the gauntlet to competitors as large oil companies face mounting investor pressure to clean up their act.”

Shareholder advocacy group As You Sow said fossil fuel companies should act swiftly on that front.

“Chevron’s announcement demonstrates that companies must proactively address changing energy markets. Companies that fail to plan for a net-zero world will inevitably get caught—and investors will pay the price in unplanned write-downs and an economy battered by massive climate impacts,” said As You Sow president Danielle Fugere.

Lila Holzman, Fugere’s colleague and the group’s energy program manager, added that Chevron’s write-down “is a signal of much greater troubles to come in the oil and gas industry. Energy companies must start demonstrating now how they are planning to fully align with the Paris agreement to proactively adapt to the transition.”

“Business as usual, even efficient business as usual,” said Fugere, “is wholly insufficient in a market that is, and must, fundamentally change.”

One of the comments:

“How Did You Go Bankrupt ?”

“Two Ways. Gradually, and then suddenly .”

Ernest Hemingway

The Chevrons of the world use write off accounting as a profit tool as the write off reduces net income and in turn taxes not paid. A similar scheme is in play when a corporation relocates their production to a third world slave shop.

Fracking is another matter. All that will be left by this moronic scheme is poison holes in the ground, poison water forever and rusting machinery. When you are losing billions per year, propped up by massive tax payer subsidies and criminal politicians (from day one it has been a rolling bailout) bankruptcy is the tool … but hey we are ‘energy’ independent.

Refer also to:

2014: The Chevron Frac Guarantee: Our well won’t explode…or your pizza is free!

2012: The Natural Gas ‘Ponzi Scheme’

One of the first people to raise questions about shale gas’s potential was Arthur Berman, a former Amoco geologist who, at the time, was a long-time contributing editor for an industry magazine called World Oil. But when Berman raised important questions about the ways the shale gas industry calculated their reserves, his column was cancelled by the magazine — amidst pressure from shale gas companies like Petrohawk. Mr. Berman resigned in protest, and within a few days, his editor, Perry Fischer, was fired.

The industry denied that it was responsible — “It is doubtful that his termination was a direct result of comments made by Petrohawk,” the company’s Investor Relations Vice President Joan Dunlap told a Houston Chronicle reporter at the time – but those involved had something different to say. “Let me be clear: The decision to pull Art’s column was due to pressure from these two companies,” Fischer later wrote. Despite this, Arthur Berman was undeterred.

… It’s worth noting that Art Berman’s analysis is looking highly prescient these days. Official government estimates for shale gas have been slashed significantly. And the most basic element of his thesis – that caution is in order because it’s too early to know for sure how much and how long fracked wells will produce — has even been echoed by an unexpected source: former CEO of ExxonMobil Lee Raymond.