Rural municipalities call for end to oil industry tax break, Municipalities say makes no sense to maintain tax breaks when industry thriving by Paul Cowley, Jan 18, 2024, Red Deer Advocate

Rural municipal leaders say it is time to restore a tax break put in place when the energy industry was struggling with plunging world oil prices.

Alberta Municipal Affairs Minister Ric McIver told municipal leaders in a letter following that convention that a three-year tax holiday on new wells and pipelines will be lifted as planned after the 2024 tax year.

However, a well equipment tax dropped at the same time will not be coming back.

“I feel like we’re still catering to the oil industry and the last couple of years have been pretty good to them and they’re still riding on the backs of our ratepayers,” said Lacombe County Reeve Barb Shepherd.

Well equipment tax revenue is plowed directly into the county’s road programs, she said.

“To me that’s the support for the infrastructure that is needed while those guys are driving their heavy equipment up and down our roads,” she said.

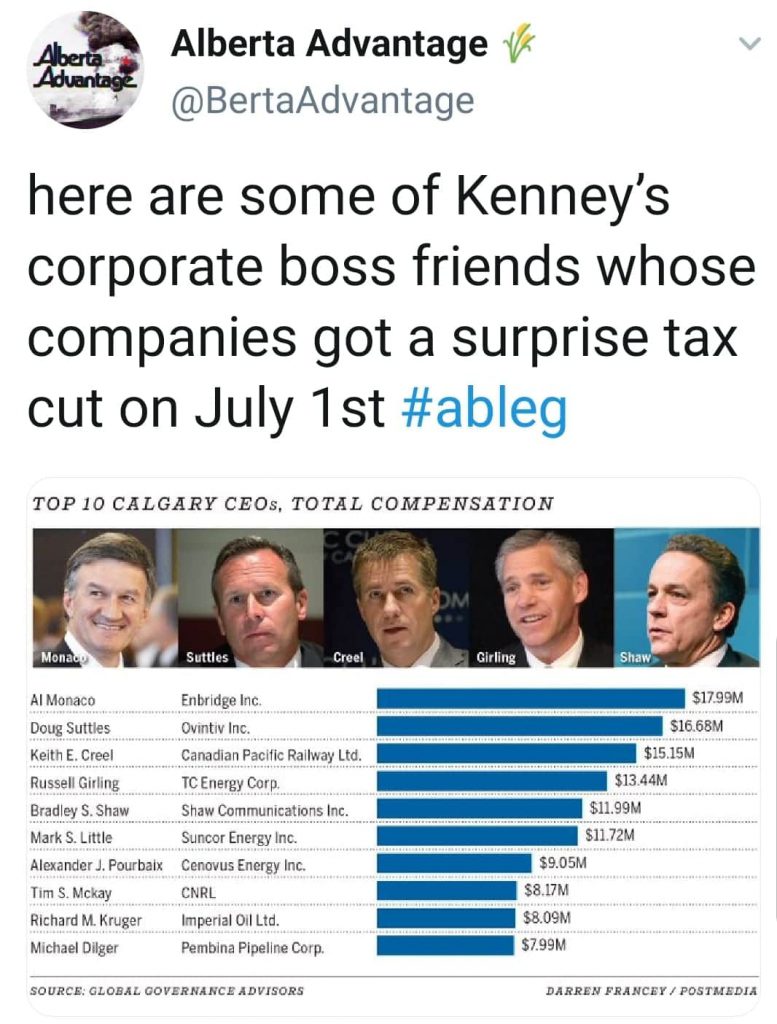

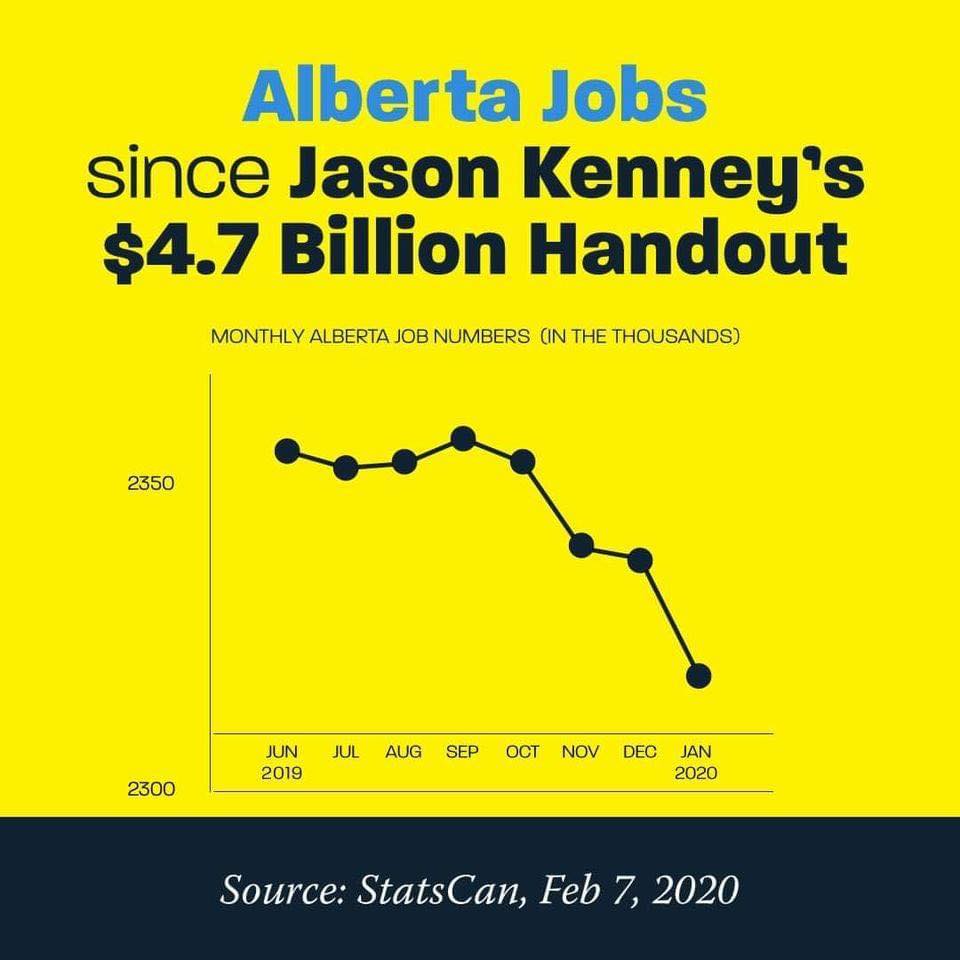

“They’re not going to reinstate that and I’m not sure why.”![]() Alberta is a cowardly corrupt pushover when it comes to the oil and gas industry. It’s welfare on steroids but only for the rich and polluting companies, many foreign owned.

Alberta is a cowardly corrupt pushover when it comes to the oil and gas industry. It’s welfare on steroids but only for the rich and polluting companies, many foreign owned.![]()

In Lacombe County, the tax generated on average $25,000 per well.

“We’re not talking about chump change here. For some municipalities, it will probably be in the magnitude of several hundred thousand dollars.![]() UCP and municipalities force struggling farmers and residents to pay the damages to roads and bridges caused by billion dollar profit-raping oil and gas companies. It’s beyond insane, yet typical in Alberta.

UCP and municipalities force struggling farmers and residents to pay the damages to roads and bridges caused by billion dollar profit-raping oil and gas companies. It’s beyond insane, yet typical in Alberta.![]()

Municipalities have also been awaiting a promised assessment review of oil and gas properties but there has been nothing so far.

A 35 per cent reduction on shallow wells and pipelines introduced in 2019 is also continuing as is are depreciation adjustments for lower-producing wells that result in lower tax bills.![]() Industry’s lies of riches for decades from frac’d wells are become clear:

Industry’s lies of riches for decades from frac’d wells are become clear:

2024: Art Berman: Beginning of the End for the Permian (and Bakken and Eagle Ford …)

I expect frac’ers will bankrupt many municipalities and likely bankrupt rich Alberta too, as the province gets frac’d dry and burns up in heat and wildfire extremes.![]()

“These two measures were intended as a bridge to the implementation of new assessment models and will therefore be extended until the Assessment Model Review is completed and the regulated assessment models for wells are updated,” McIver says in his letter to Lacombe County.

Rural Municipalities of Alberta chair Paul McLauchlin said he has brought the issue up numerous times with government.

“It’s actually really disappointing. Really, it’s using municipal tax to incentivize drilling, which makes sense when you have a low oil and gas price.

“But the problem we have with it is when you have a high oil and gas price you’re actually leaving money on the table because wells don’t need to be incentivized when the price is high.

“The intent of that tax is to assist in the upkeep, care and attention of roads that are in the service of the drilling activities.”

![]() Before Encana’s frac invasion in my community, the highway through it was newly paved. Within the first year of Encana’s invasion, the highway was ruined and gravel roads riddled with potholes and spread with toxic waste.

Before Encana’s frac invasion in my community, the highway through it was newly paved. Within the first year of Encana’s invasion, the highway was ruined and gravel roads riddled with potholes and spread with toxic waste.![]()

Photo by FrackingCanada

Highway damages by frac’ers near Didsbury, Alberta

McLauchlin said he has told various government ministers that continuing the tax break amounts to incentivizing an industry already incentivized by high commodity prices.

“That does not make sense. It’s just not recognizing that commodity prices drive the industry.”

He has so far not received a convincing answer as to why some tax breaks remain in place.

“I think there is an extremely powerful oil and gas lobby that has the ear of government and somehow has convinced this government taxes are a bad thing.![]() While taxes for the little guy keep going up up up to pay for rich Americans and companies getting a free ride in Alberta.

While taxes for the little guy keep going up up up to pay for rich Americans and companies getting a free ride in Alberta.![]()

“(However) taxes pay for the infrastructure that helps the oil and gas industry.”

McLauchlin said rural municipalities are happy to do their share and forgo some tax revenues when the province’s premiere industry is struggling. But that is not the case now.

Mountain View County forgives outstanding oil, gas property taxes, Bankrupt companies’ oilfield properties in Mountain View County have been offered for sale for a number of years and remain unsold by Dan Singleton, Jan 18, 2024, Mountain View Today

Council has forgiven outstanding taxes totalling more than $39,000 owed by five bankrupt oil and gas companies.

“The five companies owning the nine listed property tax rolls have been insolvent and in receivership,” said Mountain View County’s chief administrative officer Jeff Holmes at the Jan. 10 council meeting. “Those companies have gone through the bankruptcy process and there is no hope of recovering any of those amounts from them.

“The oilfield properties have been offered for sale for a number of years and remain unsold. Decommissioning and remediation is yet to be completed by the Orphan Well Association for the accounts still receiving annual tax levies.

“The outstanding levies are all of the accounts back to at least 2018 and are all deemed to be uncollectible.”

The five companies involved are Houston Oil and Gas Ltd., Manitok Energy Inc., Scollard Energy Ltd, Trident Exploration Corp., and Trident Limited Partnership.

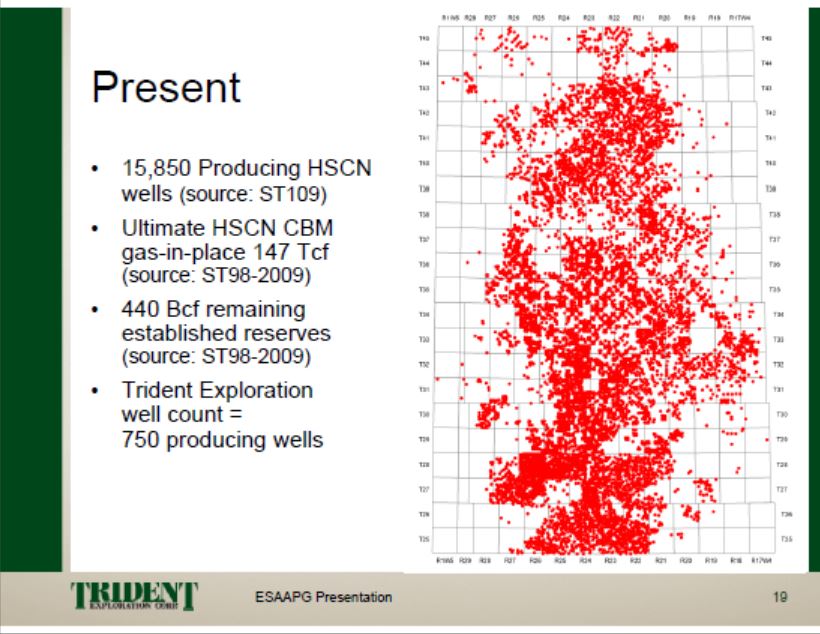

![]() Bankruptcy is an intentional tool used often by oil and gas and frac companies, enabled by our courts, for the rich to take the money and run, leaving the citizenry paying for the mess and damages left behind. Trident frac’d the shit out of many Alberta counties. Slide below is from a Trident presentation boasting of carpet bombing rural Alberta for profit. The only way to prevent this rape and pillage avoiding clean up via bankruptcy, slick name changes and or leaving the country by oil and gas companies is to demand sufficient bonds (minimum $100,000.00 per well) paid up front, to cover unpaid bills such as taxes, and damages to infrastructure, aquifers, public health, and landowners. But, Alberta politicians, no matter what stripe – whether UCP or NDP – are too cowardly and corrupt to manage the industry responsibly.

Bankruptcy is an intentional tool used often by oil and gas and frac companies, enabled by our courts, for the rich to take the money and run, leaving the citizenry paying for the mess and damages left behind. Trident frac’d the shit out of many Alberta counties. Slide below is from a Trident presentation boasting of carpet bombing rural Alberta for profit. The only way to prevent this rape and pillage avoiding clean up via bankruptcy, slick name changes and or leaving the country by oil and gas companies is to demand sufficient bonds (minimum $100,000.00 per well) paid up front, to cover unpaid bills such as taxes, and damages to infrastructure, aquifers, public health, and landowners. But, Alberta politicians, no matter what stripe – whether UCP or NDP – are too cowardly and corrupt to manage the industry responsibly.![]()

“The allowance for doubtful accounts and taxes receivable would be reduced by the same amount, $39,150.64.”

As far as budget implications, he said, “The nine listed property tax rolls have been recognized in allowance for bad debt. By writing off these accounts, with a December 31, 2023 effective date, it would be recognized as a bad debt expense in the 2023 fiscal year.

Council also passed a motion approving having a number of other outstanding oil and gas accounts included in planned county applications under provincial education requisition (PERC) and designated industrial requisition credit (DIRC) programs.

PERC provides an opportunity to recover funds previously submitted to the province for the education requisition, while DIRC provides the same opportunity for designated industrial property requisition.

The companies involved are Hard Rock Resources Ltd., Houston Oil & Gas Ltd., Manitok Energy Ltd., Odaat Oil Corp., Sailing Energy Ltd., Scollard Energy Ltd., Shanpet Resources Ltd., Silver Blaze Energy Ltd., and Tallahassee Exploration Inc.

“These are companies that are still in operation but have not paid their education requisitions for 2023, so we are able to make application to the province to get that money back and then in the future is that education tax is paid then we have to do a reconciliation with the province and turn it over to them,” said Holmes.

Coun. Peggy Johnson asked whether there is any expectation that the companies will “come through with their education tax.”

Holmes replied, “Certainly there is some chance, some possibility![]() But it ain’t gonna happen. Why the hell would companies pay when there is no punishment for not paying their bills, taxes or for damages they repeatedly cause, especially when judges repeatedly let them walk via bankruptcy?

But it ain’t gonna happen. Why the hell would companies pay when there is no punishment for not paying their bills, taxes or for damages they repeatedly cause, especially when judges repeatedly let them walk via bankruptcy?![]() , and that is why we are not asking council to formally write-off any other tax amounts owed by any of those companies.”

, and that is why we are not asking council to formally write-off any other tax amounts owed by any of those companies.”

Coun. Greg Harris asked, “What is the process for us for these companies, at what point do we notify AER (Alberta Energy Regulator) and monitor what they are doing and if they are applying for other licences?”![]() AER will do nothing but enable the thefts, damages and bad practices by oil, gas, bitumen, coal and frac companies, while giving companies Alberta’s water and actively harming the harmed, violating our charter rights trying to shame us silent. Rob Renner, when he was Environment minister, told frac’ers when they expressed worry to him there was not enough water in Alberta for all that frac’ers wanted to frac, they could have all Alberta’s water.

AER will do nothing but enable the thefts, damages and bad practices by oil, gas, bitumen, coal and frac companies, while giving companies Alberta’s water and actively harming the harmed, violating our charter rights trying to shame us silent. Rob Renner, when he was Environment minister, told frac’ers when they expressed worry to him there was not enough water in Alberta for all that frac’ers wanted to frac, they could have all Alberta’s water.![]()

Holmes replied, “The new process is a quarterly update that we provide to the AER and Municipal Affairs and we list the companies with outstanding amounts and then in exchange the changes to the legislation indicate that the AER is not supposed to grant any new licences to those companies until their debts are paid.”![]() Pffft. AER is allergic to responsibly regulating industry in Alberta. It’s a self regulator that efficiently deregulates while publicly lying, promising the opposite.

Pffft. AER is allergic to responsibly regulating industry in Alberta. It’s a self regulator that efficiently deregulates while publicly lying, promising the opposite.![]()

Coun. Jennifer Lutz said, “My new concern would be that I hope they (AER) are looking at who they are giving licenses to in the first place, that it is not just recycled, we will start a new company with the same folks, because I think that process is something they could look at next.”

![]() The companies and games they play are always recycled:

The companies and games they play are always recycled:

1) companies lie, a lot, promise the world and declare they will make us all rich;

2) companies rape and pillage and lie more, and make more promises, while donating a few pennies here and there and host a few beef on a bun lunches to feed the greed;

3) company CEOs and upper management run with the profits, refuse to pay taxes, refuse to repair damages, refuse to pay rent to landowners (or dramatically reduce payments, violating contracts), promise more promises, tell more lies, become VPs at the AER;

4) companies file for bankruptcy, judges happily enable the walk from clean up like they enable crimes by pedophiles and rapists;

5) companies change company name (dumping huge plays on little bit companies with zero funds and little or no ability to clean up or fix damages), same staff, same field workers, same field offices, same phone numbers, same internet IPs, same postal addresses, same rape and pillage continues under new name, happily made legal by authorities, until;

6) next bankruptcy and next bankruptcy and next bankruptcy, etc.

Rinse and repeat, repeatedly.![]()

Deputy reeve Dwayne Fulton chaired the Jan. 10 council meeting, with reeve Angela Aalbers not in attendance.

Colette B. Jan 18, 2024:

Hmmm I wonder if they forgive regular folks for unpaid taxes???

![]()

Refer also to:

2020:

etc.

etc.

etc.