I expect Encana/Ovintiv will win if the company appeals to Trump’s supremely oily republican religious court of the USA.![]()

North Dakota high court backs state in oil company dispute by James MacPherson, Sept 2, 2022, AP News

BISMARCK, N.D. (AP) — North Dakota’s Supreme Court has reversed a lower court decision that sided with a Houston-based energy company over disputed oil and natural gas royalties, a decision that could eventually bring millions of dollars to the state’s public schools and colleges.

The case stems from a lawsuit Newfield Exploration filed against the state after the Department of Trust Lands conducted an audit in 2016 that claimed the company was underpaying royalties to the agency that manages several state trust funds, including one that benefits public schools.

Northwest District Court Judge Robin Schmidt’s ruled last year that the state’s claim of a breach of contract could not be proven because the state failed to provide “any contract or lease … that allows this court to meaningfully review the contract obligations and whether a breach has occurred.”

In a unanimous ruling Thursday, the high court’s justices said the lower court should have focused on the state’s position that the company underpaid royalties from its drilling operations, and not whether the state could prove a breach of contract from its leases.

The case was sent back to the lower court to determine, in part, the amount of unpaid royalties.

State Land Commissioner Joseph Heringer estimated that Newfield owes between $6 million and $8 million.

Newfield, which is owned by Denver-based Ovintiv, did not immediately respond to messages left Friday seeking comment.

Heringer, an attorney, called the high court ruling precedent-setting and said it might help settle about 20 similar cases with energy companies that may have “tens of millions” in unpaid royalites.

“I think it helps or provides clarity from a legal perspective,” he said. “My hope is that it’ll help all of these outstanding claims out there come to resolution.”

Herringer said his agency has already succeeded in reaching financial settlements with several other companies.

The royalty disputes are centered around post-production costs, which are expenses associated with gas preparation before it is sold. Companies sought to deduct those costs from royalties owed to the state

Ron Ness, president of the North Dakota Petroleum Council, doesn’t believe the high court’s ruling will impact other cases of alleged unpaid or underpaid royalties.

“It’s not going to have a precedent-setting impact on the other companies because they all have a unique situation,” he said.![]() Pfffft, who believes oil and gas lobby (aka propaganda) groups? I don’t.

Pfffft, who believes oil and gas lobby (aka propaganda) groups? I don’t.![]()

![]() Refer also to:

Refer also to:

Where did Ovintiv Mid-Continent Inc come from?

Cory v. Newfield Expl. Mid-Con, Inc. Opinion, April 12,2020

… Newfield Exploration Company merged with a wholly owned subsidiary of Encana Corporation, which is based in Canada. … After removal, Encana Corporation was reorganized. … The result was that Newfield Exploration Mid-Continent Inc. became known as Ovintiv Mid-Continent Inc. and Newfield Exploration Company became known as Ovintiv Exploration Inc. Ovintiv Mid-Continent Inc. is wholly owned by Ovintiv Exploration Inc., which in turn is wholly owned by Ovintiv USA Inc., which in turn is wholly owned by Ovintiv Inc. … The current status is: (1) the presumed real party in interest, Ovintiv Mid-Continent Inc., is the successor of named Defendant Newfield Exploration Mid-Continent Inc. and, like its predecessor, is incorporated in Delaware and has its principal place of business in Texas…; and (2) Defendant’s ultimate parent, Ovintiv Inc., was incorporated in Delaware and now has its principal place of business in Colorado…. ![]() What a tangled mess. Looks like changing names has not improved Encana’s frac practices or financial ones.

What a tangled mess. Looks like changing names has not improved Encana’s frac practices or financial ones.![]()

2021: Encana/Cenovus/Ovintiv’s birth canal

2012: Chesapeake, Encana antitrust case deepens

2010: EnCana Corporation facing criminal charges

2010: US Congress Investigating EnCana’s hydraulic fracturing practices asking about all allegations of water contamination caused by their fracing

![]() Ernst requested the company’s response to Congress. Encana lawyer Jayana Flower refused, claiming the investigation had nothing to do with the community-wide drinking water contamination at Rosebud, including Ernst’s drinking water (after Encana broke the law and hydraulically fractured into the aquifer that supplies Ernst’s water well)

Ernst requested the company’s response to Congress. Encana lawyer Jayana Flower refused, claiming the investigation had nothing to do with the community-wide drinking water contamination at Rosebud, including Ernst’s drinking water (after Encana broke the law and hydraulically fractured into the aquifer that supplies Ernst’s water well)![]()

The 2010 Congress letter to companies, including Encana

2007: EnCana to cut $1-billion if royalties rise

2007: EnCana faces California gas price-fixing trial

2007: Suffield Files Reveal Disturbing Story of Environmental Degradation, Non-compliance by Energy Companies and Industry Giant EnCana In a Wildlife Protected Area no less.

2004: Under Gwyn Morgan’s leadership: Alleged Violations of the rules and regulations of the Colorado Oil and Gas Conservation Commission (COGCC) by EnCana Oil & Gas (USA) Inc.Cause No. 1V, Order No. 1V-276 before the Oil and Gas Conservation Commission of the State of Colorado

The COGCC staff hand-delivered a Notice of Alleged Violation (“NOAV”) to EnCana on April 23, 2004. …The NOAV cited Rule 209., failure to prevent the contamination of fresh water by gas, Rule 301., failure to notify the Director when public health or safety is in jeopardy, Rule 317.i., failure to pump cement 200’ above the top of the shallowest producing horizon, Rule 324A., impacts to water quality and Rule 906.b.(3), failure to report a release to the Director.

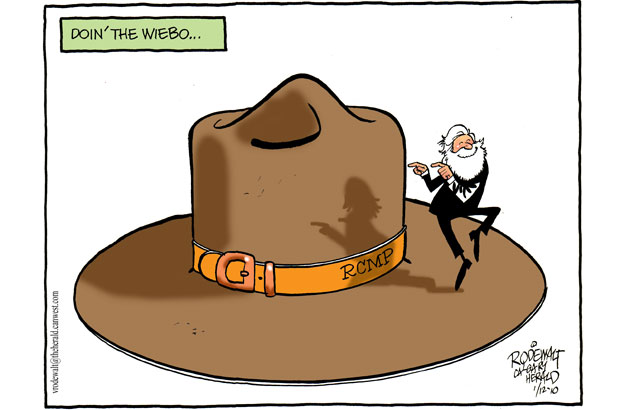

1999: Alberta Energy Corporation, became Encana, CEO Gwyn Morgan defends company conspiring with RCMP for staged bombing of a gas well

1975-2002 Gwyn Morgan at Alberta Energy Corp (2002 it merged with Pan Canadian to become EnCana, then, Encana)