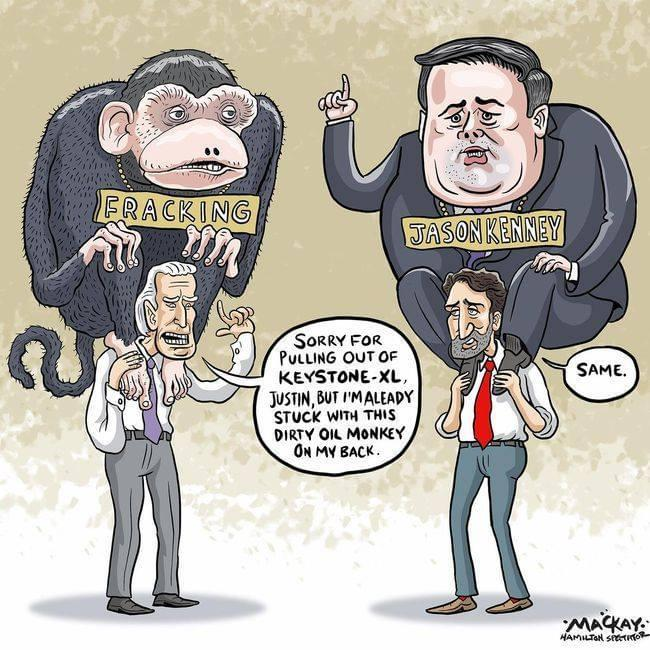

Image by FrackingCanada

Exxon: Historic annual loss, $20 billion cut in shale value by Jennifer Hiller and Shariq Khan, Feb 2, 2021, Reuters

Exxon Mobil Corp on Tuesday posted a historic annual loss…and the company reduced the value of shale gas properties by more than $20 billion.

Exxon last year slashed spending on new projects by nearly a third, outlined plans to cut up to 15% of its workforce while adding $21 billion to its debt to cover spending and restructuring.

… The company reported a net annual loss of $22.4 billion for 2020, on the writedown and losses in oil production and refining, compared with a full-year profit of $14.34 billion in 2019.

Exxon declined to comment if it has ever had an annual loss, but the company churned out profits since Exxon merged with Mobil in 1999 and through the 1980s oil bust.

… Other oil majors posted losses for the year as pandemic-related travel restrictions cut fuel demand and triggered huge writedowns. Rivals BP Plc and Chevron Corp posted annual losses.

Royal Dutch Shell Plc reports financial results Thursday.

… Exploration and production, Exxon’s largest business, lost $18.5 billion in the fourth quarter on the natural gas asset impairments, compared with a profit of $6.1 billion the year prior.

… The writedown lays bare the size of the miscalculation that the company made in 2010 when it paid $30 billion for U.S. shale oil and gas producer XTO Energy.

… On Monday, Exxon said it would invest $3 billion on lower emission solutions through 2025 and that it has created a business that will focus on commercializing its carbon capture technology. ![]() which is as polluting, if not more so, than oil and gas, and can be deadly.

which is as polluting, if not more so, than oil and gas, and can be deadly.![]()

How to spot the tricks Big Oil uses to subvert action on climate change, Three ways fossil fuel companies try to trick the public by Jariel Arvin, Feb 1, 2021, Vox

… Many such detractors use common oil industry talking points in their arguments — talking points that have been developed in collaboration with PR firms and lobbyists to undercut clean energy policies and prolong dependence on fossil fuels.

A 2019 report by researchers at George Mason, Harvard University, and the University of Bristol describes how the fossil fuel industry deliberately misled the public by funding climate denial research and campaigns, all while knowing for decades that human-induced climate change exists.

Aware of the science but afraid of the impacts it might have on their returns, oil executives funded opposition research that “attacked consensus and exaggerated the uncertainties” on the science of climate change for many years, with the goal of undermining support for climate action.

Their messaging has worked for so long because Big Oil has become really good at stretching the truth.

“What’s really important to keep in mind is that part of the reason that oil and gas propaganda is so effective is that there is always a grain of truth to it,” said Genevieve Guenther, the founder of End Climate Silence,an organization that works to promote accurate media coverage of the climate crisis.

“I call it ‘sort of true,’ where there’s something about the messaging that’s true, but that grain of truth gets developed into a whole tangle of lies that obscure the real story,” she said.

… Which is why it’s more important than ever to be aware of the tools oil and gas companies use to cloud the issue.

My conversation with Guenther, edited for length and clarity, is below. …

Jariel Arvin

So what are the talking points the oil industry uses to try to convince the public in these PR blitzes?

Genevieve Guenther

People can recognize fossil fuel industry talking points by thinking about what they’re designed to do. In general, fossil fuel talking points are designed to do three things: make people believe that climate action will hurt them, and hurt their pocketbooks in particular; make people think we need fossil fuels; and try to convince us that climate change isn’t such a big deal.

Jariel Arvin

How do they make people believe that taking climate action is going to hurt them financially?

Genevieve Guenther

Right now, they’re really hammering the point that climate action is going to hurt jobs and the economy. So, for instance, Sen. Ted Cruz released a press statement saying that by rejoining the Paris climate accord, Biden is showing that “he’s more interested in the views of the citizens of Paris than in the jobs of the citizens of Pittsburgh.”

Jariel Arvin

Yeah, and we also saw Rep. Lauren Boebert make a similar statement saying she works for “the people of Pueblo, not the people of Paris,” and that the Paris agreement would put “blue-collar jobs at risk.”

Genevieve Guenther

Yeah, exactly. So Cruz is arguing that Democrats plan to destroy the jobs they don’t like, including thousands of manufacturing jobs. This is completely false, because building out clean energy infrastructure is going to create millions of manufacturing jobs in this country which can’t be outsourced.

And whatever fossil fuel jobs have been lost in the past year happened a) on Trump’s watch, and b) due to market forces that have absolutely nothing to do with any explicit climate policy passed by any administration.

Jariel Arvin

So if the claim is untrue, how has the idea that taking action on climate change will cause millions of job losses become so pervasive?

Genevieve Guenther

There’s a mythology in this country of the coal miner and the oil and gas worker as the kind of exemplary masculine figure who acts as the backbone of America.

Jariel Arvin

Do you think there’s any truth to that?

Genevieve Guenther

It is true that if we phase out the fossil fuel industry there are going to be people, and indeed whole communities, that will need to find their livelihood in different industries. That is absolutely true.

But two things about that: Number one, you can design policies so that those people don’t suffer, and number two, you can put incentives in place so that the new jobs are created in the geographical regions that are already depopulated and suffering economically, because the fossil fuel industry is not actually prosperous enough anymore to sustain a vibrant economy in those regions to begin with.

So you can set up both: policies to ease the transition and policies to incentivize new investment so that the economy ends up more vibrant in these locations than it was before. Nothing is inevitable. The transition can be managed.

Jariel Arvin

Okay, so what’s the second talking point oil and gas uses?

Genevieve Guenther

The second thing oil and gas companies will do is try to make people believe that we need fossil fuels, and that oil and gas companies should stay in business.

One I’ve seen a lot lately raises people’s national security fears with the message that we need to extract oil to maintain our “energy independence,” as if domestically produced fossil energy alone were powering America’s homes and businesses.

The truth is that, according to the US Energy Information Agency, in 2019 (the latest year for which full data is available) the US imported 9.14 million barrels of petroleum a day — half a million more than we exported. It’s clean, safe energy sources like wind and solar that are sure to be domestically produced, not oil and methane gas.

Jariel Arvin

So they act as if US independence will be lost without fossil fuels, while in reality America still depends on other countries to get its oil and gas. Got it. What else?

Genevieve Guenther

Another talking point designed to make us believe that we need fossil fuels is the message that we cannot halt global warming without “innovation.” This is a tricky one, because you’ll often hear energy researchers talk about the innovations we’ll want to develop in order to enable continued aviation and industrial shipping.

But saying that new technologies will help us is different from saying that we need them, which implies that the world cannot stop using fossil fuels now. So politicians in the pockets of the oil and gas producers will proclaim that they support “innovation,” and fossil fuel companies will place ads touting the money they’re spending on research and development— but the money they actually do spend is orders of magnitude smaller than their PR budgets, not to mention their budgets for exploring and developing new fossil fuel reserves.

Jariel Arvin

What’s the third big talking point?

Genevieve Guenther

The third thing Big Oil will try to do is to make people believe that climate change is not such a big deal. Either they call people trying to communicate the dangers of global warming “alarmists” or they simply don’t talk about the climate crisis at all.

In their campaign of silence they’re aided by the vast majority of the broadcast news media, which mostly proceeds as if the crisis didn’t exist and won’t even mention the words “climate change” when they report on floods, fires, and hurricanes in which there are scientifically established links to global warming.

It’s weird to think of silence as messaging, but sometimes what you don’t say is as important as what you do.

Jariel Arvin

Okay, so we now have the three points the fossil fuel industry often uses: Convince people climate action will hurt their pocketbooks, suggest that we need fossil fuels, and downplay the climate emergency. How do climate scientists, activists, and the media counter that narrative?

Genevieve Guenther

We’ve got to keep climate change in the foreground of people’s attention. We’ve got to be clear about why we’re making this energy transition — it’s not just because it’s a new way to create jobs, and it’s not just because we like clean air and water.

It’s because if we don’t do it, we might actually destroy civilization.

We’re not going to change up everything unless we have to, and guess what? We have to. This is what an existential threat means. …

Bank Clients in Sweden Face New Climate Hurdle to Get Credit by Hanna Hoikkala and Frances Schwartzkopff, Feb 1, 2021, Bloomberg

A growing number of Swedish banks will start turning clients away if their businesses aren’t clean enough to justify new loans.

Swedbank AB, Sweden’s biggest mortgage bank, just became the latest in the country to limit lending based on climate criteria.

The Stockholm-based bank won’t provide fresh credit for new oil and gas projects. Nor will it provide funds to enable production in the Arctic.

Jens Henriksson, Swedbank’s chief executive officer, said the goal is to “give advice” to clients to avoid arriving at a stalemate that shuts them off altogether. The bank remains open to lending “to those who want to transform into a carbon dioxide-neutral world,” he said in an interview.

Swedbank is now planning to engage in “intense discussions” with its customers, Henriksson said. A similar model was launched at SEB AB late last year. The bank, which brought the world its first green bond more than a decade ago, said in November it will start setting ultimatums for corporate clients and withhold credit from the worst polluters.

The development comes amid criticism that banks aren’t doing enough within their core lending operations to address climate change. Most in the industry have made saving the environment a clear strategy in their asset management units, but continue to provide credit to companies that hurt the climate.

Dirty Loans

Since signing the Paris agreement, the loan departments of 10 leading Nordic banks provided almost $70 billion in credit to companies and projects in coal, oil and gas, according to a report published on Monday. Meanwhile, the same banks tend to have large asset management units that advertise their climate credentials far and wide.

At Nordea Bank Abp, the biggest in the Nordic region, deputy head of sustainability, Ylva Hannestad, says that “exclusion in itself from Nordea does not solve the problem.” Only if a company shows no desire to improve, would exclusion be “strongly considered,” she said. At the same time, Nordea’s asset management unit is closing its climate fund to new investors after assets under management soared amid insatiable demand for sustainable ventures.

Jakob Konig, project leader at the Stockholm-based organization that compiled the report, called Swedbank’s new policy ”a positive step.” But he also said it’s “not what we were hoping for” in terms of scope. Swedbank’s plan “leaves a lot of loopholes where the bank can continue to finance some of the most climate-damaging activities, if not directly then indirectly,” he said.

Meanwhile, there’s plenty of evidence that climate change is moving faster than first feared. A report published on Tuesday shows global warming is causing oceans to rise quicker than even the most pessimistic forecasts, putting greater pressure on economies to rein in carbon emissions.

Swedbank has pledged to stop financing projects looking for new oil and gas fields, if companies don’t have a plan for complying with the Paris Agreement. It also wants to stop financing extraction from the Arctic and from shale and tar sands.

The step is in part symbolic. Oil and gas aren’t a big part of Swedbank’s balance sheet. But “it sends an important message,” Henriksson said.

Incentives

Banks in Europe can play a big role in the shift to carbon neutrality because businesses still get roughly two-thirds of their financing from lenders. In the U.S., capital markets do most of the financing. That potentially leaves banks in Europe with less of a financial incentive.

Konig says banks may be less inclined to stop lending to polluters because it means they’ll “directly lose income.” Meanwhile, divesting from a portfolio “is mainly a smaller administrative cost.”

He says it’s “likely” that more Nordic banks will develop stricter policies for their lending. “But I fear they will not be as strict as we have seen within asset management, where some have completely divested from the sector.”

Banks have been under pressure to reveal — and clean up — what’s on their loan books. Almost four years ago, a climate-related financial disclosure task force laid out a global framework so that risks could be properly priced in and capital correctly allocated.

“The strongest incentive is clearly public pressure,” Konig said. Because lending is covered by bank secrecy regulations, “as soon as this comes to light, people react really strongly.”

Refer also to:

Down down down they go. Why? Because of increasing competition from renewable energy.

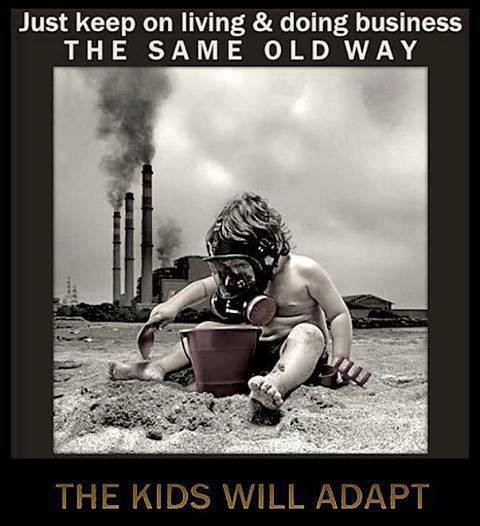

Dirty oil monkeys on their backs