Jason Scott@JasonOnTheDrums:

…

This is AFTER

- A record oil production year

- Record profits

- Municipalities we’re forced to lay off Albertans and cut key services to make up for the lost revenue.

Smith is doing NOTHING

Who does Smith represent?

![]() Smith and the UCP/PC/CPC’s being servants to the rich and raping companies while on our dime was obvious decades ago. Albertans are addicted to lies, secrets, and stupidity (believing what cons tell them instead of verifying with reality and thinking for themselves); again and again, they vote in cons that abuse us, our resources and province, and earth’s livability.

Smith and the UCP/PC/CPC’s being servants to the rich and raping companies while on our dime was obvious decades ago. Albertans are addicted to lies, secrets, and stupidity (believing what cons tell them instead of verifying with reality and thinking for themselves); again and again, they vote in cons that abuse us, our resources and province, and earth’s livability.![]()

Will Ratliffe@ratliw:

This is absolutely something that the UCP could make happen immediately if they actually cared. The likely argument that it would push marginal companies over the line is total bullshit – if you are not paying taxes, you are not doing enviro or decom work either.

Alberta energy watchdog must make firms pay property taxes by Paul McLauchlin, Mar 18, 2024, Edmonton Journal

For the past six years, the Rural Municipalities of Alberta (RMA) has collected data from members related to unpaid property taxes from the oil and gas industry. This survey has become an annual RMA tradition because unpaid tax amounts increase each year. The most recent survey results show a total unpaid amount of over $250 million, with $43 million of that incurred in the 2023 tax year.

The RMA’s 69 member municipalities represent 85 per cent of Alberta’s land base, with members touching all four borders. These municipalities support the oil and gas industry through the management of over 75 per cent of roads and 60 per cent of bridges in the province, many of which exist only to provide industry with access to natural resources.

As some oil and gas companies continue to ignore their obligation to pay property taxes, we at the RMA want all Albertans to understand this issue and why it matters. The reality is that non-payment of taxes by some oil and gas companies is not only unfair to all other property taxpayers in the province, but also an indicator that companies are unable or unwilling to meet other regulatory or environmental requirements.

The Alberta Energy Regulator (AER) has the ability to deem non-payment of property taxes as a high-risk practice and take action against companies ignoring their obligations. Instead, the AER has looked the other way, mainly because it is a symptom of a larger issue that the AER has refused to deal with: zombie oil and gas companies.![]() And, because the courts ruled the AER (oil and gas industry’s self regulator) has no duty of care to any Albertan, is legally immune, and, can piss on any law in Canada, including our constitution.

And, because the courts ruled the AER (oil and gas industry’s self regulator) has no duty of care to any Albertan, is legally immune, and, can piss on any law in Canada, including our constitution.![]()

Zombie companies have a few frightening characteristics. Firstly, they often live on the margins of solvency. The AER’s liability management rating (LMR) is a ratio of assets over liabilities that the regulator is supposed to use to determine the financial health of a company and its level of risk in meeting its reclamation obligations.

The problem with the LMR is two-fold: Zombies can buy themselves an LMR increase by putting down a deposit that is only a marginal amount of their liability, and even when they don’t, the AER typically takes little action even as zombie companies operate with no ability to address their liabilities.![]() It’s all intentional, and enabled by gov’t after gov’t. Our judges and politicians lie when they arrogantly proclaim that no one is above the law. In Canada, rapists, dirty politicians, industry and AER are above the law, that’s obvious. That’s why companies freely pollute our air, land and water, and abuse us so often and nastily.

It’s all intentional, and enabled by gov’t after gov’t. Our judges and politicians lie when they arrogantly proclaim that no one is above the law. In Canada, rapists, dirty politicians, industry and AER are above the law, that’s obvious. That’s why companies freely pollute our air, land and water, and abuse us so often and nastily.![]()

While information on the identities and ownership structures of zombie companies is limited, approximately 70 per cent of the largest oil and gas companies operating in Alberta are foreign-owned. While these large companies reliably pay property taxes, extending this proportion of foreign ownership to zombie companies suggests that not only are taxes and surface leases not being paid, but much of the revenue that should be directed to this purpose are being funnelled to zombie company owners and shareholders located outside of Canada. The LMR system provides little incentive or requirement for zombies to reinvest profits in meeting their tax or liability obligations.

On its website, the AER states that “acquiring and holding a licence or approval for energy development in Alberta is a privilege, not a right” and that the regulator has wide latitude to deem a company as posing an “unreasonable risk” and take enforcement action in such cases.![]() Pffft. In Alberta, never believe words or promises, believe actions and lack of actions (like not paying taxes and other bills, and refusing to clean up, decade after decade after decade, and illegally frac’ing community drinking water aquifers, not reporting toxic leaks into groundwater, etc.).

Pffft. In Alberta, never believe words or promises, believe actions and lack of actions (like not paying taxes and other bills, and refusing to clean up, decade after decade after decade, and illegally frac’ing community drinking water aquifers, not reporting toxic leaks into groundwater, etc.).![]()

The AER’s Directive 067 states that, to determine this risk, the AER “may consider … outstanding debts owed for municipal taxes [or] surface lease payments.” The crucial word here is “may.”![]() Just one of many of industry’s/AER’s special escape hatch words; they’re everywhere.

Just one of many of industry’s/AER’s special escape hatch words; they’re everywhere.![]()

Our ask of the AER is simple. Move from “may” to “shall” and require oil and gas companies to take the same responsibility for property tax payments as every other property owner in Alberta. ![]() Never going to happen. Alberta is too stupid and arrogant, greedy and spoiled. Just wait until the water runs out, and the gov’t and AER give all the water to industry, and make the rest of us drink and bathe in dirt.

Never going to happen. Alberta is too stupid and arrogant, greedy and spoiled. Just wait until the water runs out, and the gov’t and AER give all the water to industry, and make the rest of us drink and bathe in dirt.![]() This simple wording change will ensure that zombies will no longer ignore the rules, and much like Daryl from Walking Dead, will wipe zombies off the land.

This simple wording change will ensure that zombies will no longer ignore the rules, and much like Daryl from Walking Dead, will wipe zombies off the land.

We estimate that if surface lease payments and municipal tax requirements were enforced today, 200 companies would walk away leaving 18,000 wells and $3 billion or more in liabilities with the Orphan Well Association.

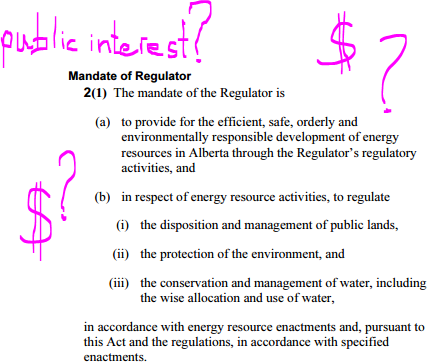

As scary as this is, these numbers will only increase if the AER continues to do nothing. Enough is enough. When will the AER regulate in the public interest? We need a regulator, not a cheerleader.

![]() With REDA, the Alberta gov’t removed public interest from AER’s mandate over a decade ago:

With REDA, the Alberta gov’t removed public interest from AER’s mandate over a decade ago:

AER is not a regulator, it’s industry’s self regulating servant. As with Canada’s self-regulators of judges and lawyers, these self serving agencies serve themselves and theirs, not the rest of us.![]()

Paul McLauchlin is president of the Rural Municipalities of Alberta.

Dwayne Wladyka:

I am originally from a very large farm in eastern Alberta. These rural people in Alberta should stop voting for these Conservative governments that aren’t a Conservative government in any way, shape, or form, because they don’t look after your well being. This has been happening since the early 1990s. They left you with problems accessing proper healthcare, left you with an very large infrastructure debt, that is now $30 billion, or even more, left oil companies off the hook to remediate their messes, leaving Albertans with a mammoth bill of $260 billion to deal with this, forsake collecting property taxes from the oil companies companies in Alberta, which lost Alberta hundreds of millions of dollars, and made municipal property taxes go up, want to pursue open pit coal mining in the Rockies of Alberta, which will contaminate the water, and so on. Peter Lougheed was never like this.

People are wondering why municipalities in Alberta must charge increased municipal property taxes. This is why.

Carol Goodfellow:

Excellent article. . Albertans have RMAs backs. Pc and UPC have kicked the can down the road for decades.

AER has always been in the pockets of big oil along with the AB Govt.

Alan K. Spiller:

Lougheed certainly did care about the well being of all Albertans but that all changed under Ralph Klein and it’s been that way ever since with these Reformers.

We estimate that Albertans have been cheated out of around $975 billion and we look at what Alaska and Norway have accomplished with their oil wealth and we think that we are right.

It’s no secret that on average Albertans pay one of the highest property taxes in Canada and it’s all because these Reformers are helping the rich steal our oil and tax wealth as you have suggested.

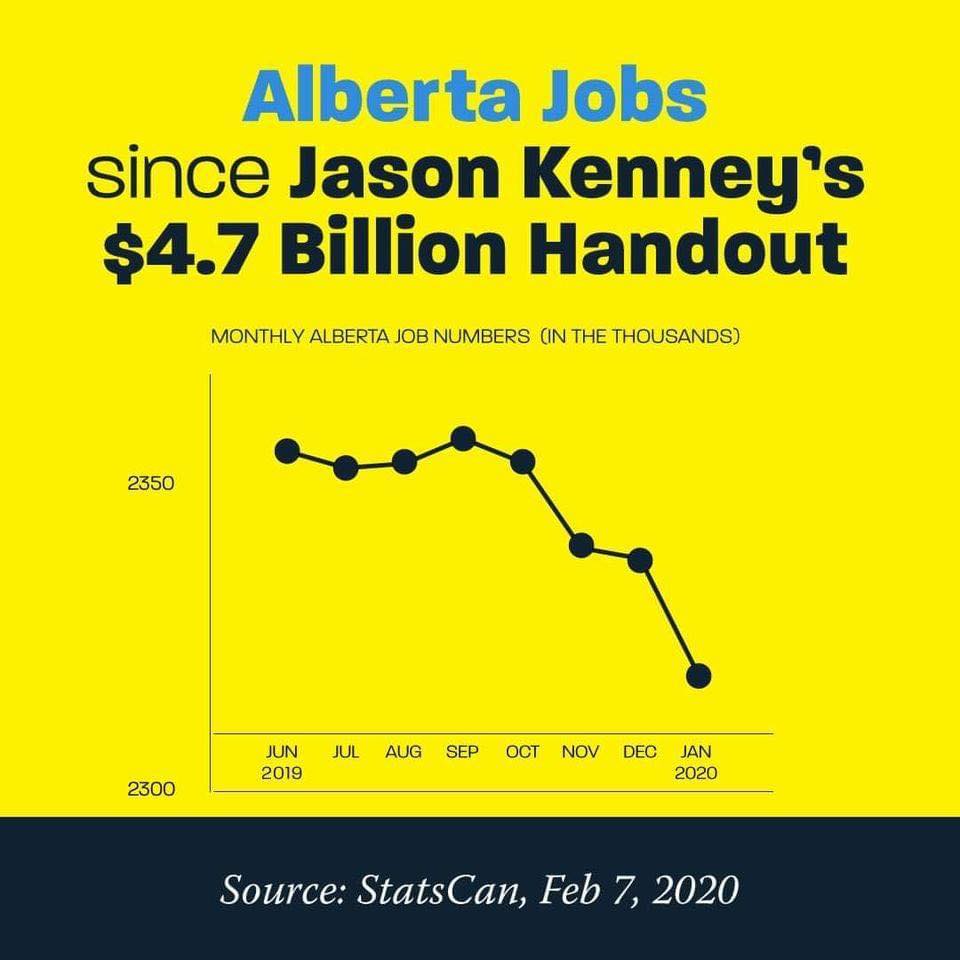

Klein deliberately slashed Lougheed’s oil royalties down from 35% of oil production to 3% and corporate taxes from 16% to 10% , Notley increased them to 12% and Jason Kenney cut them back down to 8%.. This article shows how upset Lougheed was:

“Royalties Down 32% Billions in Federal Revenues Lost”

Lee Neville:

Hey – Rural Municipalities Association – time to take the gloves off.

And from the UCP,,,,,,, wait for it…….nothing. Zip. Crickets!

Sunshine List Time!

Publish the names of the delinquent companies, the tax amounts defaulted on and the names of the corporate principles.

No more Mr. Nice Guy!

***

Jenny Yeremiy@JennyYeremiy:

Now rinse and repeat for the billions in liability clean up and restoration.

Refer also to: