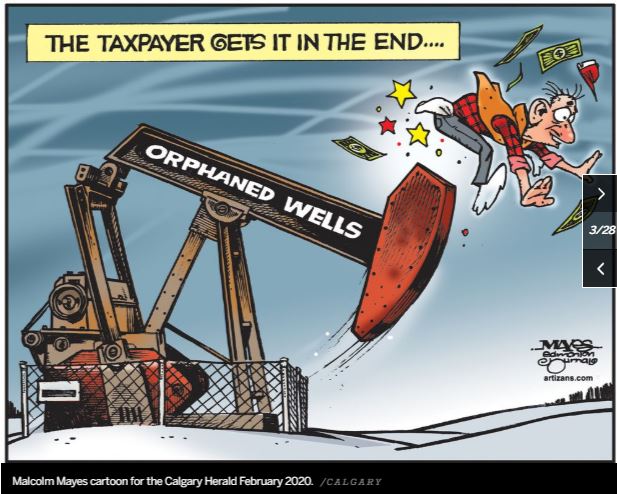

Are any oil and gas companies planning to pay to clean up after their multi-billion dollar profit-raping of North America?

It appears not and seems intentional with self-regulators like OGC and AER enabling the rip offs.

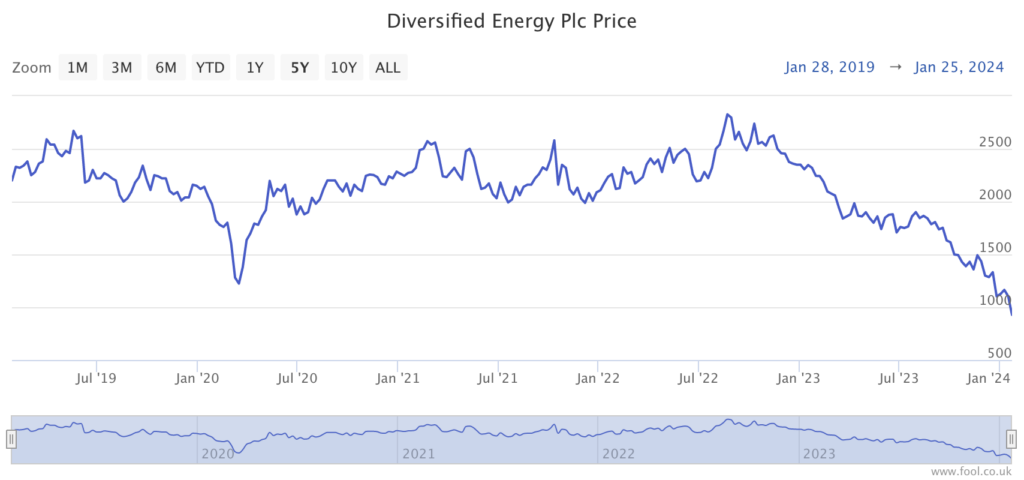

Diversified Energy tumbles as Snowcap says dividend cut looks imminent by Jan 25, 2024, Share Cast

Diversified Energy tumbled on Tuesday after Snowcap Research said the company may not have enough funds to cover the cost of plugging its inactive wells and that a dividend cut looks imminent.

London-based activist investor Snowcap, which is short the stock, said in a 39-page note that Diversified’s own reported production rates appear to indicate decline rates well in excess of the headline decline rates claimed by the company.

It also said the company’s self-reported “discretionary cash flows” are calculated using what it believes to be “a flawed and misleading methodology”.

“By our adjusted calculation, discretionary cash flows in the last 12 months were just $3m (versus dividends of $162m),” Snowcap said, adding that a dividend cut looks imminent.

Snowcap said Diversified has marked down its asset retirement liabilities (AROs) by delaying well retirement as far out as 2095. It noted that the company says it can fund these long-dated costs based on its own 50-year cash flow projections.

“But these projections are highly sensitive to changes in DEC’s long term assumptions, which appear to be overly optimistic,” Snowcap said.

“Based on our own modelling using marginally more conservative assumptions than the company, we estimate that DEC’s retirement costs may exceed the cash flows from its business as early as 2036, and that even with no future dividend payments to shareholders, DEC’s cumulative cash flows may be insufficient to cover its ARO (asset retirement liabilities),” it said.

Snowcap also pointed out that a recent study using satellite measurements to estimate the methane emissions intensity of 25 oil & gas companies found that Diversified’s methane emission intensity was as much as 16 times higher than the company reports and “substantially above” the threshold for methane fees under new IRA rules due to start in 2024.

Diversified is the largest owner of oil and natural gas wells in the US, with 10% of the national total at 78,000.

Shares in the company ended down 13% on Tuesday at 839.08p.

@baroninvestment Jan 23, 2024:

Anyone wondering (again!) why Diversified Energy just did another vertical drop? Here’s why:

*DIVERSIFIED ENERGY TARGETED BY SHORT-SELLER SNOWCAP IN REPORT

*SNOWCAP SAYS DIVERSIFIED ‘DIVIDEND CUT LOOKS IMMINENT’

…

Brent Crude +1.4% YTD.

Ftse350 oil and gas sector:

BP -4.58%

Shell -8.11%

Tullow -21.89%

Enquest -16.45%

Diversified Energy -12.6%

Ithaca -3.61%

Bloomberg Technology@technology Jan 24, 2024:

Diversified Energy, the largest owner of US oil and natural gas wells, is being targeted by a short seller claiming the company may not have enough money to meet obligations to plug inactive wells

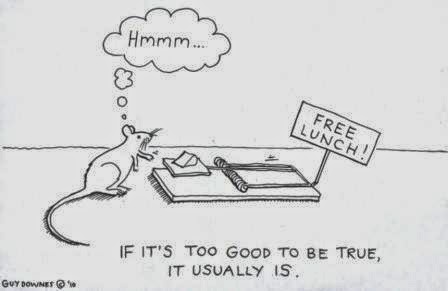

Dividend yield over 30%, shares down 60%: is Diversified Energy too risky? With a tanking share price, Diversified Energy’s dividend yield is ridiculously high. But I am holding firm with my investment because a dual US-listing may offer a return to stability by Guarav Sharma, The Motley Fool, Jan 24, 2024

For a while, Diversified Energy Company (LSE: DEC) seemed like a stable bet for investors. Its journey – from an AIM-listed minnow in 2017 to a FTSE 250 stock with a dividend yield of 10-12% by 2020 – was spectacular.

However, of late, things have become muddled. Diversified Energy’s share price has steadily declined, media headlines have been unkind, and its business is being questioned by Democrats on the US Congress’ Energy and Commerce Committee.

That business is one of buying ageing natural gas and oil wells with a low-decline profile.

Diversified Energy follows this by hedging their expected production for several years out and keeping shareholders happy with high-yield quarterly dividends.

…

…

Refer also to:

Do you expect/hope industry will clean up after its profit-raping of Alberta? Pfffft!