Pierre Picklehead and his anti-reality, anti-science CPC Con Klan, and the provincial con klans like Danielle Smith and her UCP/TBA evangelicals, blame only and always Trudeau for inflation. Liars.

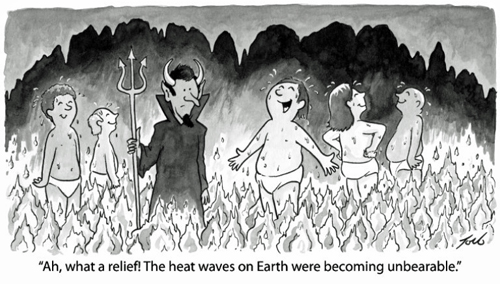

***

David Roberts@drvolts:

Interesting new paper from a UK think tank argues that much modern inflation is driven by fossil fuels (“fossilflation”) & climate change (“climateflation”) & that conventional tools of monetary policy are counterproductive in that circumstance.

“Increasing interest rates fails to address the core drivers of rising energy and food prices, disproportionately hampers investment in capital-intensive green projects, and reduces government’s fiscal space.”

Patrick Reynolds@pv_reynolds:

Yes! And renewables are structurally de-flationary, or rather dis-inflationary, as is the whole energy transition: no constant shovelling of the dirty stuff into the furnace only for it to disappear inefficiently and poisonously.

Inflation as an Ecological Phenomenon by David Barmes (Grantham Research Institute), Jordi Schrӧder Bosch (Positive Money EU), February 2024

Executive Summary

Climate change, environmental degradation, and global energy markets are all sources of price instability, with important implications for inflation forecasting and macroeconomic policy. Central banks will have to deepen their understanding of these drivers of inflation and adapt their policymaking accordingly, recognising that achieving environmental targets is necessary to avoid persistent environment-related macroeconomic instability. While primary responsibility for the transition to a sustainable economy lies with fiscal, industrial, and environmental authorities, new approaches to monetary policy and improved inflation forecasting should support these efforts.

Energy’s relevance to price stability is widely acknowledged, as fossil fuel prices driving inflation (‘fossilflation’) is a longstanding phenomenon, most recently triggered by Russia’s invasion of Ukraine. The inflationary effects of climate change (‘climateflation’) and environmental degradation in a modern context are comparatively novel though increasingly pronounced. Climateflation, which is global in nature yet borne disproportionately by lower income households and countries, occurs primarily through reductions in agricultural activity and damage to crop yields. As environmental disruptions intensify, they will play an increasingly significant role in driving price instability.

In this context, orthodox monetary policy is counterproductive to achieving price stability, as well as governments’ economic, social and environmental objectives. Increasing interest rates fails to address the core drivers of rising energy and food prices, disproportionately hampers investment in capital-intensive green projects, and reduces government’s fiscal space. Instead, central banks should factor environmental considerations into the conduct of monetary policy and explore greater macroeconomic policy coordination with fiscal and industrial authorities. New international monetary arrangements will also be necessary to secure price stability and a just transition

…

- Fossilflation: Fossil fuels as drivers of inflation

Throughout 2022 and 2023, high headline inflation figures across the globe were

driven primarily by high energy prices, which were already inflated in late 2021 and

exacerbated following Russia’s invasion of Ukraine. High global energy prices have

an immediate direct impact on headline inflation figures as energy goods feature

substantially in inflation indices, and contribute to inflation indirectly over time as the vast majority of goods and services require energy throughout the production and transportation process.

…

2. Climateflation: Climate change as a driver of inflation

While research on climateflation is relatively nascent, there is an emerging consensus

that extreme weather events and rising temperatures cause negative supply-shocks that place upward pressure on inflation, primarily through their impact on food prices. However, the ultimate effect on inflation depends on several variables, including the type and severity of the shock. Looking ahead, climateflation is likely to become an increasingly common and severe phenomenon, given that intense extreme weather events and relatively higher temperatures have a disproportionately high impact on inflation.

2.1. Impacts on food prices

There is a growing evidence base that the impacts of climate change increase food prices, which should come as no surprise given that agriculture is negatively impacted by extreme weather events and high temperatures. Single-country studies have found that extreme weather events and shocks have resulted in higher food prices in China, Thailand, Peru, Germany, and the UK. Cross-country studies also show that temperature shocks and precipitation shocks have already put upward pressure on food prices.

…

3. The uneven burden of climateflation

Climateflation can have pernicious effects on inequality through multiple mechanisms.

First, it risks exacerbating intra-country inequality as low income households spend

a bigger proportion of their income on food.![]() And have poor access to birth control, if any, resulting in more hungry mouths to feed.

And have poor access to birth control, if any, resulting in more hungry mouths to feed.![]()

…

Conclusion

Intensifying climate change and environmental degradation will become an

increasingly significant source of price volatility. Central banks will have to pay

increasing attention to these dynamics and adapt their forecasting methods, policy tools and operating frameworks accordingly. In the face of fossilflation and climateflation, interest rate hikes are ineffectual and counterproductive. Greater macroeconomic policy coordination and new international monetary arrangements will be necessary to stabilise prices while facilitating new socially and ecologically responsible investments on a global scale. Furthermore, the growing threat that climate change and environmental degradation pose to price stability strengthens justifications for greening monetary policy in support of a transition.

The scaling-up of renewable energy will ultimately have a stabilising effect on prices, yet the transition to a sustainable economy could have its own adverse implications for price stability, which require further investigation and will need to be anticipated and managed by policymakers. While challenging, the latter will be more feasible than attempting to maintain price stability in the context of recurring, persistent, and escalating supply and demand shocks that will result from intensifying climate change and ecological degradation if governments fail to meet globally agreed upon environmental targets.

***

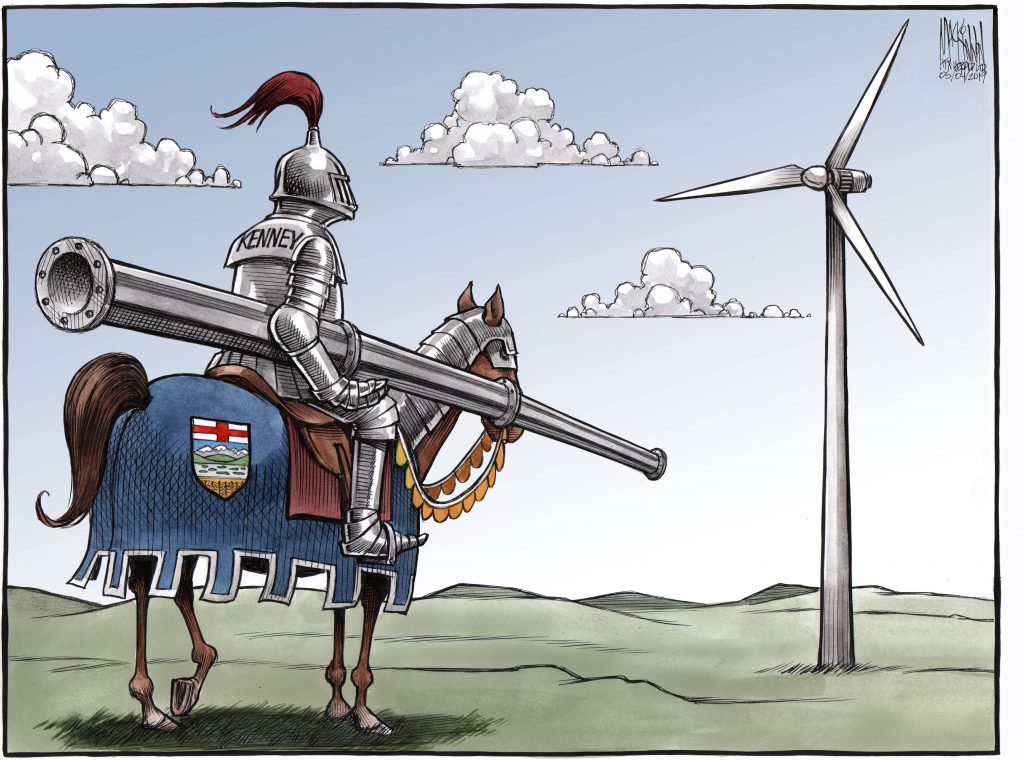

![]() Meanwhile, in Caveman Canada, Danielle Smith’s TBA UCP Evangelical Party bans renewable energy seemingly to bring on Armageddon which they think will zip only them and theirs and Zionists, up to special spas in heaven, and:

Meanwhile, in Caveman Canada, Danielle Smith’s TBA UCP Evangelical Party bans renewable energy seemingly to bring on Armageddon which they think will zip only them and theirs and Zionists, up to special spas in heaven, and:![]()

Jonathan Wilkinson@JonathanWNV:

For months, @CPC_HQ have been blocking the development of renewable energy and the creation of tens of thousands of jobs for Atlantic Canada.

And now we know why – Pierre Poilievre’s Conservatives don’t believe in climate change.

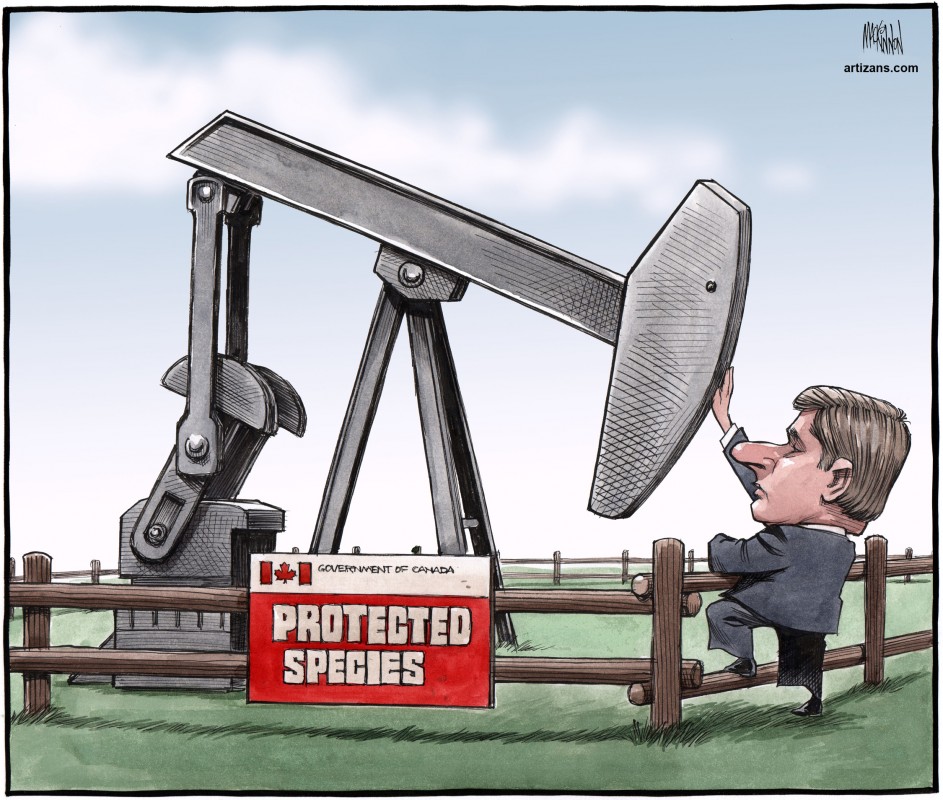

![]() Neither does IDU’s Steve Harper, who pulls Pierre Picklehead’s, Danielle Smith’s and Scott Moe’s pro polluter strings. And, when they get all the LNG plants paid for by the citizenry (too expensive for any greedy old gas company to pay for themselves) and built for their rich polluting buddies, most Canadians will not be able to afford frac’d unnatural gas to heat their homes, and will freeze in the dark because con provinces are serving their polluting rich buddies even more by using frac gas for electricity generation. So stupid.

Neither does IDU’s Steve Harper, who pulls Pierre Picklehead’s, Danielle Smith’s and Scott Moe’s pro polluter strings. And, when they get all the LNG plants paid for by the citizenry (too expensive for any greedy old gas company to pay for themselves) and built for their rich polluting buddies, most Canadians will not be able to afford frac’d unnatural gas to heat their homes, and will freeze in the dark because con provinces are serving their polluting rich buddies even more by using frac gas for electricity generation. So stupid.![]()

![]() Ches Crosbie in clip above speaking arrogantly with much snark is a lawyer/politician. The more I hear lawyers talk, the more I wonder how they ever graduated from law school. Did Daddies buy them their degrees?

Ches Crosbie in clip above speaking arrogantly with much snark is a lawyer/politician. The more I hear lawyers talk, the more I wonder how they ever graduated from law school. Did Daddies buy them their degrees?![]()