Alberta Energy Regulator tries to stem tide of orphan wells, It just got harder to buy oil and gas assets in Alberta by Tracy Johnson, June 21, 2016, CBC News

With little fanfare, the Alberta Energy Regulator has tightened up the rules for buying oil and gas assets.

From now on, a company looking to buy oil and gas wells in Alberta will need a liability management ratio (LMR) of 2.0 or higher. That means the value of a company’s producing wells must be twice that of the cost of abandoning and reclaiming the wells at the end of their life.

Bankrupt energy firms add to Alberta’s abandoned well problems

Creditors get priority over environment in Redwater Energy insolvency: judge

It is a double of the existing ratio of 1:1 and means that more than 70 per cent of the companies licensed in Alberta can no longer buy oil and gas wells without paying a deposit to the regulator.

This is a direct reaction to the Redwater Energy court decision last month that ruled energy companies have to pay back their secured lenders before paying to clean up old wells in the case of a bankruptcy.

The AER is very concerned about a possible flood of old wells into the Orphan Well Fund. In the bulletin dated June 20, the AER said the rule changes were intended to “minimize the risk to Albertans.”

Carolyn Wright, an energy lawyer for Burnet Duckworth and Palmer (BDP), said she is concerned that the rule will have the opposite effect during a time when many energy companies are scrambling simply to survive.

“Those parties that were looking for opportunities to keep themselves alive and afloat. It’s gone away now and those parties are typically left with no option but to fold up their tents,” said Wright.

In a note to clients on Tuesday, BDP said the rule change would have “a chilling effect on the rise in transaction activity in a province that is struggling to get back on its feet following a two-year long rut in commodity prices.”

Change concerns industry

AER spokesman Ryan Bartlett said companies can improve their LMR by cleaning up old wellsites, posting security or revamping their proposed well transactions.

The regulator acknowledged its regulations may “inconvenience some stakeholders” but pointed out it wants to work with industry and the province to develop broader permanent regulatory measures.

Gary Leach, the head of Explorers and Producers of Alberta — which represents junior energy companies, said that he is concerned about the rule change.

He says he also understands that the regulator is trying to strike a balance that protects the Orphan Well Fund, but still preserves a functioning marketplace for purchase and sale of oil and gas assets.

“When there’s not enough money to go around, and that’s the quintessential point in an insolvency, someone else gets stuck with the bill, said Leach.

“So what we have here is interim measures by the AER to provide some stability and guidelines on who they will permit to acquire assets while the issues that erupted from the Redwater decision are sorted out.”

Before the Redwater case was decided, the AER had priority in the case of a bankruptcy. Any producing assets that had value had to pay for the cleanup of inactive wells.

But the Redwater decision cut the link between a company’s “good wells” and its “bad wells,” allowing the good ones to be sold off and the bad ones to be passed onto the Orphan Well Association.

New rule may not go far enough

On the flip side of this issue, Barry Robinson has long been sounding the alarm about the growing number of abandoned and inactive wells in Alberta.

He’s happy that the AER is tightening up the rules, but thinks the regulator should go further.

“These are reasonable as an interim measure,” said Robinson.

“However, in the long run, the LMR is still fundamentally flawed in how it calculates deemed assets and deemed liabilities. I still think that the long-term solution is regulated timelines [for cleanup of old wells] and full security.”

Alberta looks at different ways of making sure companies clean up old wells, The AER warns that it could go after directors and executives to ensure proper reclamation by Tracy Johnson, June 20, 2016, CBC News

As Alberta struggles with its abandoned well problem, the province’s energy regulator is looking at different ways to ensure the inventory of old wells doesn’t get much larger.

Earlier this spring, the Alberta Energy Regulator released a bulletin reminding the directors and most senior executives of energy companies they can be personally responsible for well clean-up if their company goes bankrupt.

The timing of that release probably wasn’t a coincidence. There are nearly 150,000 scattered across the province, some that have been dormant for 60 years or more. While the problem has been going on for as long as there has been energy development in Alberta, a recent court decision changed the game.

In the case of Redwater Energy, the Alberta Court of Queen’s Bench ruled that when an energy company goes bankrupt, lenders need to be paid back before wells are cleaned up. With more companies facing insolvency, there’s concern on the part of landowners and regulators that the abandoned well problem in Alberta is about to get worse.

The AER bulletin in April was was not a new rule, but rather a well-timed prompt, said David Bish, a partner with law firm Torys.

Bankrupt energy firms add to Alberta’s abandoned well problems

Creditors get priority over environment in Redwater Energy insolvency: judge

“There’s that reminder to everyone that it can still look to directors and officers,” said Bish. “And it has a variety of tools that it can deploy to do that.”

Directors and officers includes the board of directors of a company, as well as the top executives, such as the chief executive officer and chief financial officer.

The AER has long had the ability to formally name, or blacklist an officer or director of an energy company, under the Oil and Gas Conservation Act, but it has only done so in cases of malfeasance, said Ryan Zahara, a partner with Blakes, Cassels and Graydon in Calgary.

“Certain of the parties they’ve taken that step against have been viewed as egregious offenders,” said Zahara.

Environmental protection orders are an option

The AER also has the ability to use an environmental protection order to impose personal liability.

EPOs have been used in Ontario. In the case of Northstar Aerospace, a court found that directors and officers were personally responsible for the clean-up of a contaminated site because the contamination happened under their watch. Those directors were told to pay $15 million.

The question being asked in the energy industry is whether that will happen here, given that the recent run of insolvent companies is connected to the two-year long drop in energy prices. [Companies are required to clean up and plan for clean up. The polluter is supposed to pay, not the tax payer. But, greed has driven the lack of clean up over decades enabled by lack of enforcement by the AER and its kin (ERCB, EUB and ERCB before it was EUB)]

“How do you punish someone for basically a market downturn? A specific individual, when they may have been compliant with the rules,” said Zahara. [Emphasis added]

Alberta looks at different ways of making sure companies clean up old wells, The AER warns that it could go after directors and executives to ensure proper reclamation by Tracy Johnson, June 20, 2016, CBC News

As Alberta struggles with its abandoned well problem, the province’s energy regulator is looking at different ways to ensure the inventory of old wells doesn’t get much larger.

Earlier this spring, the Alberta Energy Regulator released a bulletin reminding the directors and most senior executives of energy companies they can be personally responsible for well clean-up if their company goes bankrupt.

The timing of that release probably wasn’t a coincidence. There are nearly 150,000 scattered across the province, some that have been dormant for 60 years or more. While the problem has been going on for as long as there has been energy development in Alberta, a recent court decision changed the game.

In the case of Redwater Energy, the Alberta Court of Queen’s Bench ruled that when an energy company goes bankrupt, lenders need to be paid back before wells are cleaned up. With more companies facing insolvency, there’s concern on the part of landowners and regulators that the abandoned well problem in Alberta is about to get worse.

The AER bulletin in April was was not a new rule, but rather a well-timed prompt, said David Bish, a partner with law firm Torys.

Bankrupt energy firms add to Alberta’s abandoned well problems

Creditors get priority over environment in Redwater Energy insolvency: judge

“There’s that reminder to everyone that it can still look to directors and officers,” said Bish. “And it has a variety of tools that it can deploy to do that.”

Directors and officers includes the board of directors of a company, as well as the top executives, such as the chief executive officer and chief financial officer.

The AER has long had the ability to formally name, or blacklist an officer or director of an energy company, under the Oil and Gas Conservation Act, but it has only done so in cases of malfeasance, said Ryan Zahara, a partner with Blakes, Cassels and Graydon in Calgary.

“Certain of the parties they’ve taken that step against have been viewed as egregious offenders,” said Zahara.

Environmental protection orders are an option

The AER also has the ability to use an environmental protection order to impose personal liability.

EPOs have been used in Ontario. In the case of Northstar Aerospace, a court found that directors and officers were personally responsible for the clean-up of a contaminated site because the contamination happened under their watch. Those directors were told to pay $15 million.

The question being asked in the energy industry is whether that will happen here, given that the recent run of insolvent companies is connected to the two-year long drop in energy prices.

“How do you punish someone for basically a market downturn? A specific individual, when they may have been compliant with the rules,” said Zahara.

Alberta toughens regulations to cope with court ruling on orphan wells by Dan Healing, June 20, 2016, Edmonton Journal

CALGARY – The Alberta Energy Regulator is making it tougher to transfer oil and gas well licences in view of a recent court ruling that allowed the buyer of a bankrupt company’s assets to avoid acquiring wells with high environmental liabilities.

In an announcement, the AER said licence transfer applications will now be considered “non-routine” under its temporary new measures.

It added that it will refuse to approve the transfer of AER licences, approvals and permits if the transaction results in the buyer’s asset value falling below two times the cost of its environmental liabilities. Currently, companies are only required to maintain an equal amount of assets and liabilities.

AER spokesman Ryan Bartlett said 219 or 28 per cent of the 788 companies registered as licensees with the AER have a liability management ratio or LMR above the newly required 2.0. He said companies can improve their LMR by cleaning up old wellsites, posting security or revamping their proposed well transactions.

The regulator acknowledged its regulations may “inconvenience some stakeholders” but pointed out it wants to work with industry and the province to develop broader permanent regulatory measures.

“They are attempting to put a higher hurdle rate for acquirers of assets. That will have an impact and this is of deep concern to us,” said Gary Leach, president of the Explorers and Producers Association of Canada.

He said the new rules will reduce the number of potential buyers for assets his members are trying to sell.

But he added the rules may be necessary to avoid increasing liabilities for the Alberta orphan well fund, an industry financed pool of money that is used to clean up well sites for owners who can’t or won’t do it themselves.

“This case has shaken up what was the old order and until there’s a new order in place, whether it’s through legislative fixes or what, what we’re seeing is the regulator trying to stabilize the situation,” said Leach.

He called on the regulator to use flexibility in interpreting new regulations.

The Alberta Court of Queen’s Bench ruled in May in the case of bankrupt producer Redwater Energy that the rights of lenders to be paid back ranks above the right of the provincial regulator to require the reclamation of oil and gas wells.

The regulator has launched an appeal of the decision because it could encourage more companies to enter receivership and bankruptcy to avoid obligations to clean up around oil and gas wells. [Was that the plan, including by the AER?]

The lawsuit has been closely watched as a precedent-setting case as more bankruptcies loom in the oil and gas industry in the face of chronically low prices. [Emphasis added]

[Refer also to:

2012 06 04: Danger Below? New Properties Hide Abandoned Oil And Gas Wells

2006 Ernst’s explosive water after Encana illegally fractured the aquifers that supply drinking water to the community of Rosebud’s citizen and municipal wells:

2007 09 24: Taxpayers Pick up Portion of $22,000 EUB Spy Bill without Explanation

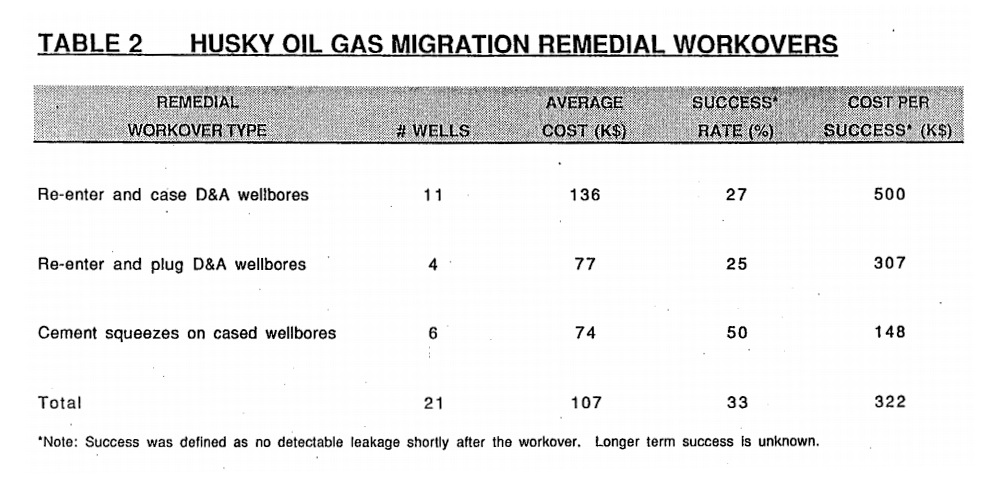

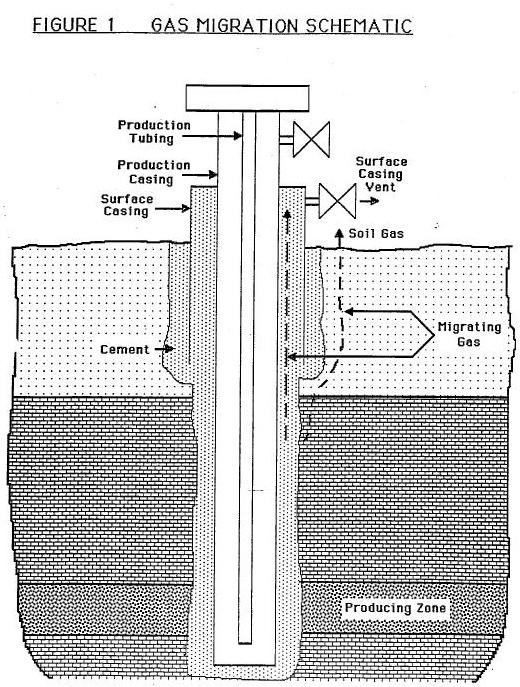

1993: Husky Oil’s Gas Migration Research Effort – An Update: Big Problem; Impossible to Completely Fix

A slick devious plan? Devised decades ago, when the dangerous, water and air contaminating problem became expensively apparent?