Junex Says Horizontal in Quebec’s Forillon Formation Delivering Historic Results by Charlie Passut, September 21, 2016, Natural Gas Intel

Junex Inc., a junior oil and natural gas explorer based in Quebec City, said a horizontal oil well drilled two years ago into the Forillon formation in eastern Quebec continues to deliver strong results during a mandatory testing period, with cumulative production representing the largest oil recovery in the province’s history.

[Historic results? Appears the results are getting worse over time (refer below). And why is Junex now reporting cumulative production results, when it previously reported daily results on their Galt wells?]

Junex said since the Galt No. 4 was completed in November 2014, cumulative production totaled about 14,100 bbl. [How many days production, averaging how many barrels per day?]

During a recent 23-day period, when the company was deliberately attempting to keep production under 100 b/d, the well yielded 1,618 bbl of light sweet crude without a pump. [62 barrels per day]

“To the best of our knowledge, the 23-day period is the longest period of continuous natural oil flow ever seen in a well drilled in Quebec,” said Junex CEO Peter Dorrins. “The production testing of this well has been the principal focus of our efforts at Galt because it is a key element as to the future development of the Galt light oil accumulation.

“The improved understanding of this well’s performance, when integrated with other information such as the 3D seismic data we acquired last year, has influenced the selection of the optimal locations for future wells on the Galt Oil property.”

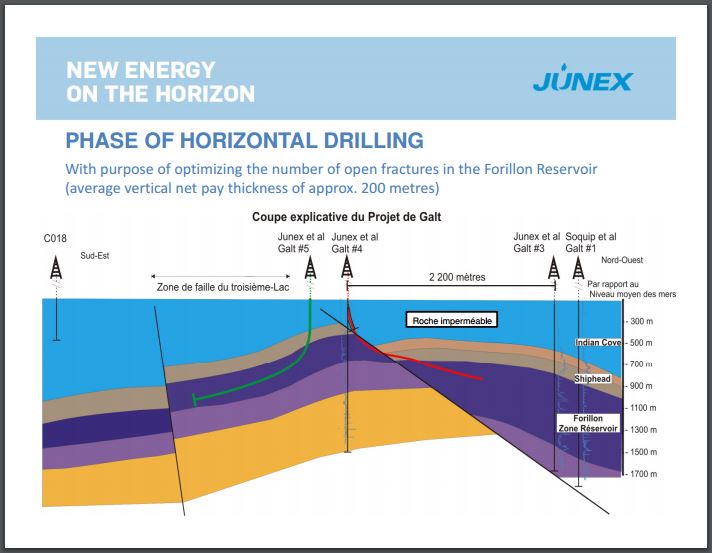

The Quebec provincial government granted Junex a permit to drill the Galt No. 4 well in 2014 (see Shale Daily, July 3, 2014). The well, in a sparsely populated area about 20 kilometers (12.4 miles) from the town of Gaspe, is Junex’s first horizontal well from an existing vertical wellbore. The vertical wellbore was first drilled in 2012 to target the Forillon Formation.

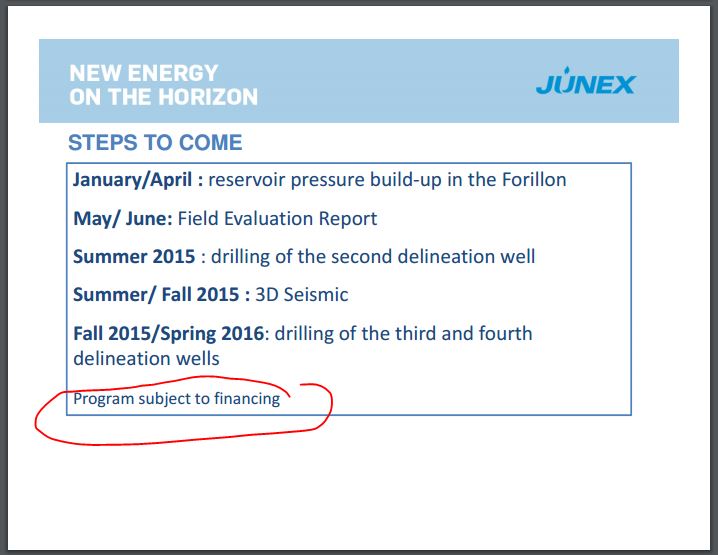

Junex said a testing program mandated by the provincial government would continue until late November. During that time, the well is to produce at various controlled production rates over different portions of the horizontal wellbore targeting the Forillon formation.

“This production has been and will be through unassisted natural flow and/or by using the pump,” the company said. “Similarly, production testing operations may be temporarily suspended during this time to perform downhole well operations, including but not limited to the retrieval and replacement of downhole pressure gauges in the well.”

Junex completed a second well, Galt No. 5, last June. According to Dorrins, that well was shut in to record the buildup of formation pressure in the reservoir.

“[This] data will provide important details as to the reservoir characteristics in this well, including the potential productivity of this horizontal wellbore,” Dorrins said, adding that the Galt No. 5 “remains shut in for pressure buildup, which will also continue for some time. Once the shut-in period is ended, the downhole pressure gauges will be retrieved and the data analyzed. This will be the basis for determining the next steps for the Galt No. 5 well.”

According to its website, Junex holds exploration rights to almost five million net acres in Quebec. It has about 1.44 million acres in the sedimentary basin of the St. Lawrence Lowlands; 1.67 million acres in the Utica Shale; 1.65 million acres in the Gaspe Peninsula; 1.78 million acres in the province’s portion of the Appalachian Basin, and about 233,000 acres on Anticosti Island.

Junex also forged a partnership (25% working interest) in early 2012 with undisclosed partners for about 2,219 gross acres in Schleicher County, TX, in the Permian Basin. The acreage is operated by Telesis Operating Co.

Quebec has moved slowly on shale development and hydraulic fracturing (fracking) as the provincial government’s position on the issue changes with each new regime.

In 2011, when the Liberal party was in power and Jean Charest served as premier, the Quebec government launched a two-year study of shale gas development and allowed fracking only for exploration purposes (see Shale Daily, March 10, 2011). But the Parti Quebecois (PQ), which came to power in 2012, had campaigned on a promise to shut down shale development and a moratorium was enacted in early 2013 (see Shale Daily, Feb. 8, 2013).

Despite the moratorium, PQ leaders in February 2014 created two joint ventures between the government and four oil and gas producers to drill wells on and offshore Anticosti Island at the outlet of the Saint Lawrence River in the Gulf of Saint Lawrence across from Gaspesie (see Shale Daily, Feb. 21, 2014).

The Liberals returned to power after elections in April 2014, this time with Philippe Couillard as premier. Since then speculation has grown that the province may allow fracking in other parts of the province, although Couillard has been on record as saying he opposes the practice in environmentally sensitive areas (see Shale Daily, April 8, 2014).

[Reality Check:

The Bureau des audiences publique sur l’environnement, BAPE, determined there is scant evidence to support the oil and gas lobby’s claim that hydraulic fracturing, more commonly known as “fracking,” would be advantageous for Quebec.

…

The fracking projects in Quebec are concentrated in the St. Lawrence Lowlands between Montreal and Quebec City, home to 2.1 million people and the province’s best arable land.

The report found that fracking could have “major impacts” on nearby communities, from polluting the air to increasing traffic and noise. Even with “rigorous attenuation measures,” fracking would still cause a “range of annoyances” for residents hundreds of metres from a work site, the BAPE said.

For example, the process can release acrid odours that are strong enough to cause complaints 600 metres from the fracking platform, the environmental review said. It said the work could also generate enough noise to disturb people living up to four kilometres away.

“The activities of the industry could engender consequences for the quality of the environment, particularly on the quality of surface and underground water,” the document said.

…

Even if gas prices bounced back, “it hasn’t been shown that the financial advantages for Quebec would be sufficiently important to compensate for the costs and externalities for society and the environment,” the report said.

The BAPE found that shale gas development could increase Quebec’s greenhouse gas emissions by three to 23.2 per cent.

Each horizontal well could require up to 4,000 round trips by truck, increasing the risks of accidents and speeding up the deterioration of roads, the report added.

End Reality Check]

Work has since started on the first of three horizontal exploration wells planned by Anticosti Hydrocarbons LP, a consortium of Petrolia Inc., Corridor Resources Inc. and Investissement Quebec (see Shale Daily, July 1).

Quebec Prepares to Drill, Frack Its Utica Shale by Gordon Jaremko, July 1, 2016, Natural Gas Intel

After being excluded from Quebec for six years by a drilling moratorium, natural gas suppliers saw June mark a turning point toward access to French Canadian cousins of shale formations in the northeastern United States.

The signs of change included approval of the first fracking wells, a start on liquefied natural gas (LNG) deliveries to remote consumers, government participation in both ventures, and a new energy policy that dials down official eco-disdain for fossil fuels.

Junex Inc., a Quebec City-based startup petroleum firm, described the breakthroughs as foreshadowing a bright future for its pre-moratorium accumulation of 944 square kilometers (364 square miles) of shale formation exploration permits.

Work is beginning on the first of three horizontal drilling and hydraulic fracturing exploration wells planned by Anticosti Hydrocarbons LP, a consortium of Petrolia Inc., Corridor Resources Inc. and Investissement Quebec.

The drilling will test a formation described as a northern counterpart to the gas, liquid byproducts and tight oil geological zone known as the Utica Shale in the United States. The exploration sites will provide Quebec with a gentle introduction to fracking, far from public view and popular resistance on remote Anticosti Island in the Gulf of Saint Lawrence.

Investissement Quebec, a provincial agency set up to support industry startups with all forms of finance including part-ownership, is also a partner in tanker truck deliveries that Gaz Metro LNG began in June to locations off the gas pipeline grid.

As a subsidiary of province-wide distributor Gaz Metropolitain Inc., the LNG specialist has started up by supplying a diamond mine known as Stornoway Renard, in the Otish Mountains about 1,040 kilometres (655 miles) of northern bush away from Montreal.

Investissement Quebec is putting about C$42 million (US$32 million) into the drilling and C$50 million (US$39 million) into the LNG program. The commitments are large by Quebec standards as a “have-not” recipient of Canadian “equalization,” an income redistribution scheme that taps federal corporate and personal taxes to raise per-capita revenues to the national average of all the provinces.

Provincial Energy Minister Pierre Arcand called Gaz Metro LNG’s inaugural deliveries “a landmark project for Quebec.” He wrapped the new operation in a green cloak by adopting the international environmental movement’s view of gas as at best a stand-in until zero-emission sources entirely replace carbon-based fuels with renewable energy sources.

Arcand’s formal statement was studded with words chosen carefully for a jurisdiction that boasts being Canada’s cleanest energy consumer and exporter to the United States as a result of mammoth northern power dam-building by provincial government-owned Hydro Quebec.

“Natural gas is a profitable transition energy that will play an important role during the next few decades in supporting the economic development and competitiveness of our companies, particularly those in Northern Plan territory,” said the Quebec minister.

The Northern Plan is a long-range development program, enshrined in legislation, for the thinly populated majority of 1,542,056-square-kilometer (595,381-square-mile) Quebec, which is 2.2 times the size of 696,241-square-kilometer (268,589-square-mile) Texas.

As in the case of Hydro Quebec’s electricity generation and transmission network, public planning and participation in industrial development are hallmarks of the grand design. Investissement Quebec is also a participant in the Stornoway diamond mine, for instance.

As a companion to the Northern Plan, the new provincial energy policy unveiled this spring emphasizes central planning and hybrid enterprises, especially in priority fields such as development of renewable sources.

As a plus for the Canadian gas and oil sector, which is used to a high degree of regulation by U.S. standards, the policy includes creation of an agency resembling the Alberta Energy Regulator (AER) for coordinated engineering, economic and environmental approvals of projects. Although the intricate web of rules, inspectors and approval procedures at times annoys companies, the [completely legally immune even for Charter violations, acts in bad faith and gross negligence, no duty of care] AER is dedicated to rendering projects publicly acceptable [Translation: Bribe, lie to and con families and communities into believing they have rights, while quietly decimating those rights, to make them accept the impacts then bully and abuse harmed families and communities into silence after the impacts begin, and engage in fraud to cover-up air, land and water pollution] rather than to stopping development.

Gas ranks second only to hydroelectric development in the new Quebec energy policy. The agenda’s top priorities include: “Ensure natural gas supply at competitive prices to enhance the profitability of mines, reduce greenhouse gas emissions, attract new investments and supply liquefied natural gas in the North.”

Current Quebec industrial proposals include two LNG export terminal projects at potential tanker port sites along the St. Lawrence River. Both rely on supplies from the U.S. and western Canada but do not rule out eventually using Quebec production if it becomes available.

With exploration and field trials of fracking only beginning, knowledge of Quebec shale remains largely in the realm of geological theories about in-place resources that do not predict the eventual size of supplies within economic reach.

[Reality Check for Jaremko’s statement that frac trials started in Quebec in 2016:

2014 01 11: Gaspé, Quebec passes water law to stop oil drilling near its wells and homes

2013 05 19: Protection of water and drilling: the regulation would not apply for Gaspé

2011 12 24: Groundwater contaminated with shale gas found in Quebec

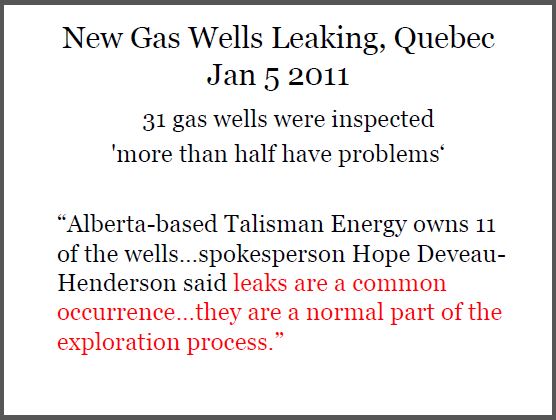

2011 09 18: Leaking Energy wells in Quebec keep on leaking

Late 2010: Six years ago, new shale gas wells in Quebec were found to be leaking. The leaks were ordered repaired by the regulator, companies tried and all failed.

End Quebec frac’ing start reality check for Jaremko]

A preliminary estimate by the Canadian Energy Research Institute says fracking known bits of Quebec’s Utica and similar Macasty formations could yield early output of one billion cubic feet of gas and 60,000 barrels of oil per day. But the figures are rated as speculative and liable to grow or shrink depending on drilling results, commodity prices and policy developments.

The new Quebec policy pledges to create a permanent task force on industrial energy supply that includes the provincial government’s energy, economic development, science and Hydro-Quebec departments.

“Natural gas is a transition energy that is profitable for Quebec and will play a key role in the coming decades in supporting economic development and the competitiveness abroad of Quebec companies,” says the policy. “The government therefore intends to ensure that Québec households and businesses have reliable, secure, stable access to natural gas throughout the territory where demand and economic profitability warrant it.” [Emphasis added]

Alberta Industry Working the PR Side of Fracking by Gordon Jaremko, May 30, 2014

After completing 8,900 horizontal hydraulically fractured wells since the end of 2007, Alberta industry leaders are searching for a community-relations formula that will be as effective as the drilling technology. [Brute force and ignorance?]

Strategy discussions Thursday among business and government officials included a startling demonstration that fracking — now used by nearly three-quarters of Alberta wells outside the oilsands — no longer flies under the public radar.

A group of property owners paid admission fees to a conference staged by Petroleum Technology Alliance Canada (PTAC), to pepper senior corporate and regulatory officials with questions in the main dining hall of the Calgary Petroleum Club.

The emerging peacekeeping formula takes cues from increasingly annoyed landowners such as Nielle Hawkwood. The rangeland around her family’s generations-old Ironwood Ranches, deep in scenic foothills of the Rocky Mountains, has become studded with 110 wells and more are being drilled at a brisk pace, she said in an interview.

Under traditional regulations, wells are approved one at a time. Only nearby landowners, liable to experience “direct and adverse” effects, are notified and have rights to demand formal reviews and hearings. [Demand yes, get reviews and hearings, not so much, rarely if at all, in industry’s typical frac’ing “brute force and ignorant” fact]

Across Alberta and in northern British Columbia (BC), hydraulic fracturing for liquids-rich shale gas and tight oil sets a new pattern, known in the industry as resource plays. Companies buy up large spreads of drilling rights and exploit them with repeatable wells described as more like factory assembly lines than traditional resource exploration.

“We get suspicious if there’s no disclosure,” Hawkwood said, in calling for better notice of all aspects of the programs such as their total planned areas, well numbers, contents of the fracking fluids, risks of spills and waste management programs.

“The rural grapevine is high and wide.” Out on the Alberta range, residents from longtime ranching families to a growing population of ex-urbanites believes they are seeing deterioration of water, air, livestock health and wildlife populations.

Bob Willard, a senior policy adviser with the Alberta Energy Regulator (AER, formerly the Energy Resources Conservation Board or ERCB), told engineers, earth scientists and corporate executives to take such warnings seriously if they want to keep their ability to operate briskly in Canada’s chief gas- and oil-producing jurisdiction.

“We have to appreciate the community,” Willard said. Appreciation, he explained, means accepting that negative or skeptical perceptions of industry — right or wrong, or easily disproved [and proved!] at scientific or technical level — are a reality that affects activity application and approval processes.

The industry needs to see the big community relations, environmental and political picture, Willard said. Companies can no longer afford old habits: “Landmen hiding behind minimum requirements [for public notice] of the regulator is part of the problem.”

The AER is gradually replacing old minimal requirements rooted in the bygone gas and oil exploration era with a new regime known as play-based regulation. [With significant deregulation and dramatically reduced consultation and notification requirements to keep industry’s “brute force and ignorance” abusing as many Alberta families and communities as possible, with zero accountability]

The emerging regulations strongly encourage [“encouragements” and “suggestions” and “best practices” and “promises” are not legally binding or mandatory or enforceable not matter how strong Bob Curran and other enabling and proven liars at the AER emphasize them] or require early disclosure of exploitation plans for large shale or tight geological formations, up to the scale of regional drilling plays. The AER has twin goals of maintaining straightforward, efficient regulatory [translation of “efficient” = massive deregulation with huge benefits and increased profit taking for industry, only harm for communities and families impacted] proceedings for industry and keeping the peace in Alberta communities.

Disclosure of industry practices in projects as they proceed from their cradles to their graves is also an element of the new regime, made possible by widened authority over environmental approvals and policing under a regulatory overhaul that created the enlarged AER from the ERCB last year. [AER was “enlarged” only because industry was given all of Alberta’s fresh water and rights to it via AER swallowing Alberta Environment and it’s previous task of protecting fresh groundwater for Albertans, with the AER then appointed Ex Encana VP Gerard Protti as Chair]

Initial mandatory performance monitoring of horizontal hydraulic fracturing wells is generating detailed public reports on industry behavior concentrated on water use, liquids storage, and fluid waste management, said AER environmental data specialist Michael Bevan. [But, those ‘public” reports and chemical details are conveniently kept from the public]

Full data on use of chemicals including fracking fluid recipes is being collected, and a public reporting system is expected to follow [THAT HASN”T HAPPENED YET!] when the records can be verified as clear and accurate, eliminating frequent murky spots such as variable spellings or brand names for materials. [AER and industry still spell checking their toxic chemicals injected? Ernst has been trying since 2004 to get the complete toxic chemical brews injected under her community, with zero success so far]

Less formal improvements are also spreading across Alberta’s often professionally reserved industry and regulatory officer class, with help from veterans of the oil and gas sector in the United States.

Community picnics work, said Susan Stuver, a researcher from the Texas A&M University Institute of Renewable Natural Resources.

[Food bribery to silence objections? Synergy Alberta: bribery and silencing experts]

Friendly barbecues with landowners work wonders at spreading proper perspective on the industry that otherwise only appears, for instance, in annual 200-page reports by the Texas Water Development Board that nobody reads, said Stuver. She urged industry to respond to criticisms posted in online internet forums by increasing direct, personal contacts in communities where it works: “The people driving the social media train are not going to change,” she said. [Emphasis added]

[Refer also to:

“The well reacted well beyond our expectations and achieved a constant flow of 316 barrels of oil per day, which is significantly more than the 161 barrels of oil per day published in our January 27 press release”, said Junex president and CEO Peter Dorrins.

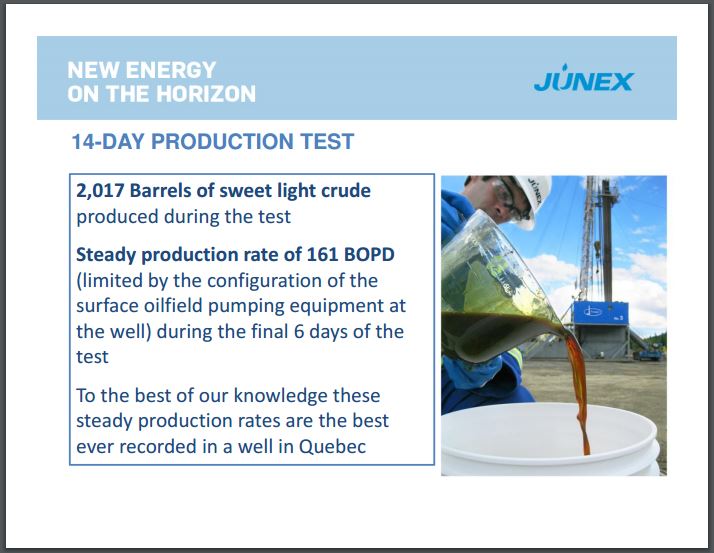

2015 01 27: Junex Production Tests Oil at 161 Barrels per Day in its Galt No. 4 Horizontal Well

Junex Production Tests Oil at 161 Barrels per Day in its Galt No. 4 Horizontal Well

“To the best of our knowledge, this production rate of 161 barrels of oil per day is the highest oil production rate seen so far in Quebec and, based on our calculations, translates into a commercial oil production rate even at today’s oil price. Because this production rate is currently constrained by surface equipment configuration limitations, we recognize that our well is likely capable of being produced at a higher production rate though it is premature to affirm what this rate could be. The completion of the next phase of well shut-in with measurement of the pressure build-up and possible future production testing should clarify this.” stated Mr. Peter Dorrins, Junex’s President & Chief Executive Officer.

2005: Junex Galt No. 3 well, frac’d, tests at 232 barrels per day:

Junex milestone on Quebec well Quebec-based Junex and partner Gestion Bernard Lemaire are close to completing the first commercial oil well in the Canadian province’s history. Last week, Schlumberger concluded a fracturing programme on the Galt-3 well located in the Gaspe region, about 800 kilometres east of Quebec City and near the Gulf of St Lawrence.

The C$2.5 million ($2 million) well was the third drilled by Junex with Lemaire.

All were drilled to a depth of 2500 metres into a Devonian limestone formation.

Galt-1 is producing about 1 million cubic feet per day the only natural gas producer in the province. The nearby Galt-2 well was dry.

The Galt-3 well test-flowed 232 barrels per day of light crude as well as the 434 barrels of fluids injected in order to stimulate the formation. Associated natural gas was also present, but not measured, the company said.

“This is the first time a massive stimulation work has been performed on an oil well located in Gaspe and the results of this work have permitted a significant improvement in the oil productivity of the formation,” said Junex president Jean-Yves Lavoie.

“The preliminary results lead us to believe that Galt-3 could become the first oil well to be put into commercial production in the history of Quebec.”

The company expects to drill up to five more shallow wells in the region in the next year with another partner, Petrolia, in an attempt to attract the investment attention of a major.

Calgary-based Questerre Energy currently holds more than 700,000 acres of exploration acreage in the St Lawrence Lowlands. [Emphasis added]

MONTREAL, June 28 /CNW Telbec/ – Junex (JNX: TSX VENTURE) and its partner Gestion Bernard Lemaire are proud to announce that Schlumberger Canada Inc. has successfully completed the massive stimulation work on the Galt No. 3 well, located approximately 20 kilometres west of Gaspé. “The preliminary results lead us to believe that the Galt No. 3 well could become the first oil well to be put into commercial production in the history of Quebec” has indicated Mr. Jean-Yves Lavoie, P. Eng., President of Junex, who was present to supervise the work.

During the next few days, Junex will proceed with the installation of a bottom-hole pump equipped with a pressure gauge and will perform a prolonged production test at the Galt No. 3 well. The results of this test should be known in a few weeks and will allow us to determine the production capacity of the well.

Performed in an intermittent basis between June 24 and 27, the self cleaning of the well has permitted the production of 232 barrels of crude oil of an excellent quality (48 degrees API) in addition to recuperating all 434 barrels of fluids injected in order to stimulate the formation. Gases associated with the oil have also been produced but their quantity has not been measured. Once the cleaning of the formation was completed, the well continued to generate hydrocarbons all day long without any presence of water or other fluid.

“This is the first time a massive stimulation work has been performed on a well located in Gaspésie and the results of this work have permitted a significant improvement in the oil productivity of the formation. All the preliminary data collected at this time seem to confirm the validity of our geological concept, notably the presence of HTD in this well. The results are very promising and they allow us to believe in a commercial oil production at the same time that they demonstrated the fact that the Gaspesian oil system is working” concluded Mr. Lavoie, P. Eng., President of Junex.

The fracturation work have been targeted on the interest zone, located at approximately 2,230 metres deep where an important lost in circulation had been observed during the drilling. [Emphasis added]

How’s Galt No. 3 well looking a decade later? Why doesn’t Junex mention they frac’d it?

2014 07 31: Junex Tests 180 Barrels of Oil per Day at its Galt No. 3 Well

QUEBEC CITY, QUEBEC–(Marketwired – July 31, 2014) – Junex Inc. (TSX VENTURE:JNX) (“Junex” or the “Company”) is pleased to announce that it has recovered 180 barrels of oil over a 24-hour period (or an “initial rate” of 180 barrels of oil per day) from a production test at its Galt No. 3 well. This well is on Junex’s Galt Oil Property that is situated approximately 20 kilometers from the town of Gaspé in eastern Quebec.

Mr. Peter Dorrins, Junex’s President & Chief Executive Officer, remarked: “The Galt No. 3 vertical well was tested to harvest more information about the Forillon reservoir as part of finalizing the test design for the upcoming Junex Galt No. 4 Horizontal well. While not being a stabilized rate that would typically be much lower, we believe that this initial production rate in our Galt No. 3 well, which has been shut-in since 2011, nonetheless provides an indication as to the potential of the naturally-fractured Forillon reservoir on our Galt Oil Property.”

Mr. Dorrins continued: “It is of note that the Galt No. 4 Horizontal well is designed to intersect a larger number of open, near-vertical fractures than the number of fractures encountered in the Galt No. 3 vertical well. Geological data indicates that the oil is produced from the natural fractures and we are hopeful that an increased number of open fractures, if encountered during drilling, could translate into a higher production rate in the Galt No. 4 Horizontal well. We foresee starting drilling operations at this location in the coming weeks.”

The Junex Galt No. 4 Horizontal well, the first in a series of horizontal wells planned for the next phase of the project, will be drilled from the existing Junex Galt No. 4 vertical wellbore towards the Galt No. 3 well in the Forillon Formation.

Originally drilled in 2003, the Galt No. 3 vertical well is located on the same structure as and approximately 2.5 kilometers from the Junex Galt No. 4 vertical well. The Junex Galt No. 4 vertical well, drilled in 2012, confirmed the presence of a 997 meter-thick oil column in the combined Forillon and Indian Point formations (see September 25, 2012 press release), the impact of which was a 27% increase in the total Oil Initially-in-Place (“OIIP”) resource volumes for the Galt Oil Property (see March 27, 2013 press release).

Junex holds 70% interest in the 16,645 acre-sized Galt Oil Property and 100% interest in the 36,816 acre-sized permit adjacent to the Galt Oil Property. The adjacent 100% Junex acreage has not yet been independently evaluated for its resource potential.